-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Inertia and Uncertainty

We find ourselves at something of an odd juncture in crypto markets right now wherein a lot seems to be crossing the headlines, and yet simultaneously, there often feels like little of real meaning to say. Everything is simultaneously in a moment of existential decision-making, and in total inertia and statis.

Executive Summary

-

Persistent regulatory uncertainty lingers in the US, with Coinbase’s lawsuit the latest piece in a very large puzzle.

-

The expectation at this point should no longer be on clarity from the US, but on a landing spot for existing and new projects stuck in limbo.

-

The race is now on among more open jurisdictions as to finding a landing spot for innovative crypto businesses.

Regulatory inertia

We find ourselves at something of an odd juncture in crypto markets right now wherein a lot seems to be crossing the headlines, and yet simultaneously, there often feels like little of real meaning to say. Everything is simultaneously in a moment of existential decision-making, and in total inertia and statis.

The broad narrative is clear: we are beginning to see a realignment of sorts. The headline quote to start this week was Chamath Palihapitiya – long-time American frontier VC who has a reputation as a crypto bull and advocate, albeit not always deserved – declaring that “crypto is dead in America” on the All-In podcast, and doubling down by stating that “the United States authorities have firmly pointed their guns at crypto”. The statement is, of course, broadly true. The Silvergate and Signature shutdowns made it clear beyond a shadow of a doubt that crypto companies in the US needed to, if not pack their bags, at least make sure that their travel documents were in order going forward.

We should, however, be clear as to what we’re talking about in that regard. The concerns here are not the concerns of 2017-8, which can broadly be described as a threat of rollback – that is, a total ban, or for regulated activities becoming retrospectively illegal. Bitcoin’s commodity status is essentially beyond reproach at this point, and while there have been murmurs, the same is likely to be true of Ethereum, and the same is likely to be true of most other base assets (particularly given the struggles of the SEC to prove violations and securities status in the ongoing case against Ripple).

This may lead one to think that the problem is the uncertainty for protocols and for new systems being built on top of crypto. Certainly, this is part of the issue. The push to build onshore in the US as an implied certificate of authenticity in the 2020 to 2022 period now hangs heavy over founders and builders, because of glimpses of expectations of territoriality (as seen in the CFTC Binance case) that go far beyond anything that we saw with and against even the most heinous of actors in the 2018 market.

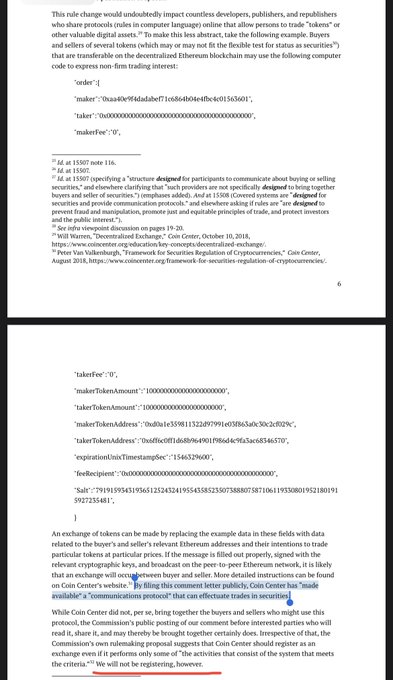

This may come, and indeed, most expectations are that this will come at some point in coming months. One of the more amusing notes from the last week was pro-crypto DC lobby group Coin Center publishing a basic snippet of smart contract code allowing for the trade of on-chain assets (and hence, ‘securities’) in a public comment letter to the SEC, a move echoing similar tactics from campaigners defending encryption in the 1990s (e.g. the so-called ‘RSA shirt’)

As clever as such moves are, they do highlight an underlying concern about what’s in the near future for many major DeFi protocols. This comes in the spite of there having been very few actual enforcement attempts against said protocols to date; the Mirror Protocol subpoena in November 2021 is by far the most prominent such case, and that proceeded as quickly as it did explicitly because Mirror had dove head-first into the tokenised stocks trap, i.e. the tokenisation of US securities – a specific area which had always been the equivalent of poking an alligator in the eye with a very short stick indeed.

However, for now, little has come to light in terms of even the explicit threat of regulatory enforcement. Who has been the target? Exchanges, upon exchanges, upon exchanges. Binance is now embroiled in multiple cases with the SEC and CFTC. Bittrex, a long-time second-rung exchange within the space, was charged by the SEC on the 17th April for the usual litany of being an ‘unregistered exchange, broker, and clearing agency’. Coinbase has not yet faced charges but did receive a Wells Notice from the SEC on 23rd March over its staking program, and announced a lawsuit on Tuesday against the SEC in a purported attempt to clarify rules around it.

The problem isn’t illegalisation or anything of the kind – instead, it’s that US regulators are acting throughout in a way that does everything short of attempting to put the proverbial toothpaste back in the tube, by strangling banking relations and restricting on- and off-ramps from crypto, with the effort more than anything being aimed at restricting the total potential growth of what remains a very early-stage industry in most respects. The crypto industry has at this point scaled past the point where being a reasonably effective payment processor, and very effective store of value, is enough for it to justify the multiples it largely trades on across the board; as in 2018, regulators are trying to ‘pop the bubble’ by limiting its future potential.

So, we have a growth industry where the growth in the market with the most overall funding (if not necessarily the most customers) is on pause. In the long term, while there is a decent case for saying that this may be a limiter on upside 10 or 20 years down the line, this probably doesn’t matter; the industry will find a hub, or hubs, away from the US. The cause of the current inertia is not that there’s nowhere to go, but rather that there’s not a clear flight-to spot. Most jurisdictions outside of the US and China, even those that one might not traditionally expect, have been indicating an openness to crypto, including in the EU.

However, all landing spots have their positives and negatives, and for many in the industry, there is an element of ‘once bitten, twice shy’. It is easy to forget, but the US becoming central to crypto was only really a trend from around 2019 on, having been stronger in China and East Asia more generally prior; when companies and individuals moved over to US-centric incorporation and business models, it was essentially with an implicit buy-in into that very Silicon Valley mentality of not seeking permission and dealing with any issues after the fact.

Some firms and businesses are returning to the eternal wild west that comprises most of the Caribbean and certain Asian jurisdictions – Bermuda has suddenly become the hot new spot for derivatives businesses for example, e.g. the Coinbase announcement earlier in the month and the sale of the LedgerX derivatives platform by the FTX holding group – but most are looking for greater certainty and greater assurances before they leave the US. The lack of a focal point in that regard has been felt at all levels over the last couple of months; recall that by far the most sustained push we’ve seen so far this year was in early January, and was largely motivated by rumours of a renewed enthusiasm for crypto in China specifically. The key going forward, in our view, is not to look to what US regulators do – because there will be more and more actions, and there will likely be almost no clarity until at least 2025 on anything that matters – but to regulators in places like Germany, Hong Kong, Singapore, Switzerland, Japan, the UK, and the UAE. It seems like there is something of a race on now to hammer out frameworks for crypto businesses, and while it won’t be winner-takes-all, the first jurisdictions to market in late 2023 and 2024 may end up being the ones to capture the next generation of innovative crypto firms.