Cutting-Edge Technology for Institutional Digital Asset Liquidity

Enigma powers leading institutions globally through

best-in-class trading technology and services.

Available 24/7, connect with Enigma’s OTC trading desk for bespoke quotes, human execution, and a personalized trading experience via voice and chat.

Access Enigma X and EXTP platforms and benefit from front-to-back digital-asset trading, curated news and insights via dedicated web-based portals.

Leverage Enigma’s FIX, REST, and Websocket APIs to execute trading strategies, integrate deep liquidity pools, and stream live market data in a low-latency environment.

Enigma has been offering clients best-in-class technology and services as a Digital Assets provider since 2017. Find out more.

Join a dynamic team dedicated to providing cutting-edge solutions in the fast-evolving world of Digital Assets. Check Enigma’s current job openings.

Stay up-to-date with Enigma’s latest developments, press releases, and media coverage.

Enigma powers leading institutions globally through

best-in-class trading technology and services.

Why Enigma?

Clients face only one, full-service registered counterparty. Enigma’s in-house algorithms tap into liquidity pools and exchanges around the globe, providing deep and harmonized liquidity whilst managing market impact and ensuring best execution.

Access Enigma’s trading services using the user-friendly web applications, API services, or OTC desk, with real humans available to provide around the clock trade and tech support to clients.

Reputation and reliability are a top priority for Enigma, mitigating counterparty risk with rigorous KYC and AML due diligence processes.

Leading Infrastructure Partners

Safeguard your digital assets when trading with Enigma via access to a network of highly-secured custodians. Enigma protects client funds with multi-layer technology that leverages enterprise-grade MPC and multi-sig custody methods for peace of mind.

Enigma has developed a settlement network consisting of the world’s leading digital-asset friendly banking institutions, ensuring that clients can transact safely and efficiently on the widest range of fiat currencies available in the market.

With meticulous KYC/AML screenings for all clients, combined with stringent blockchain wallet analysis to detect and prevent financial crime, Enigma retains a tight focus on compliance and security to allow clients to transact and interact securely with us.

Services

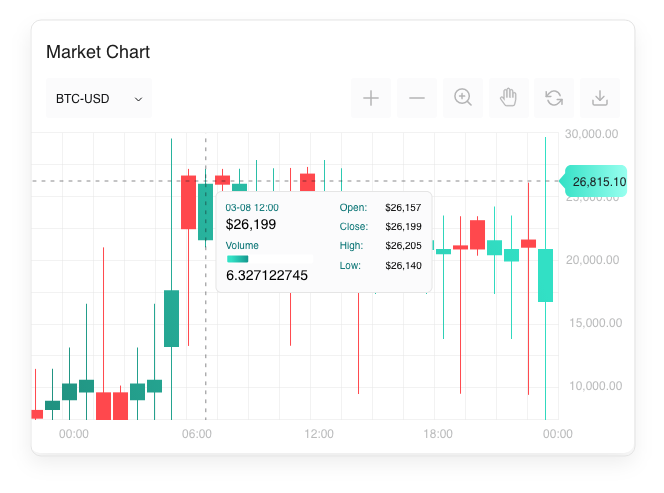

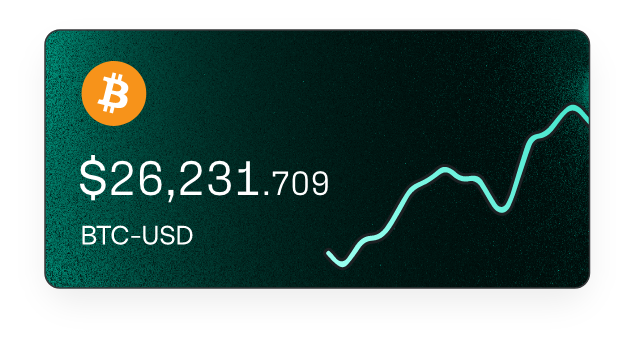

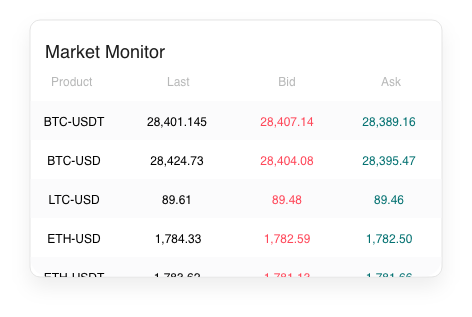

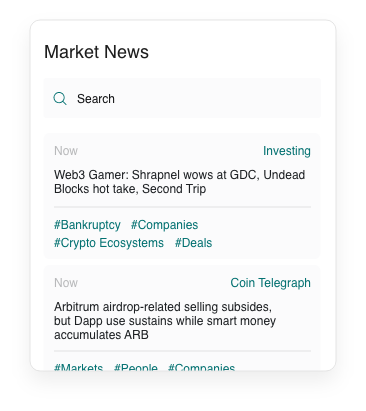

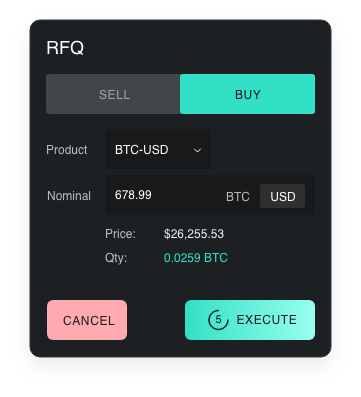

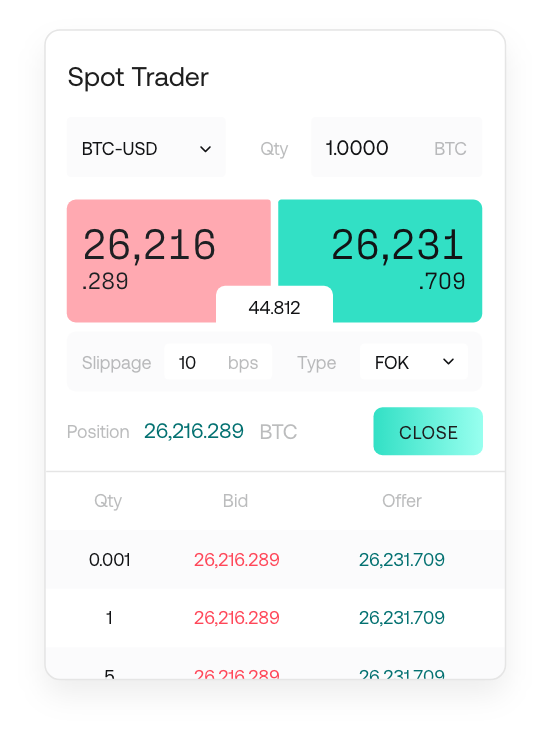

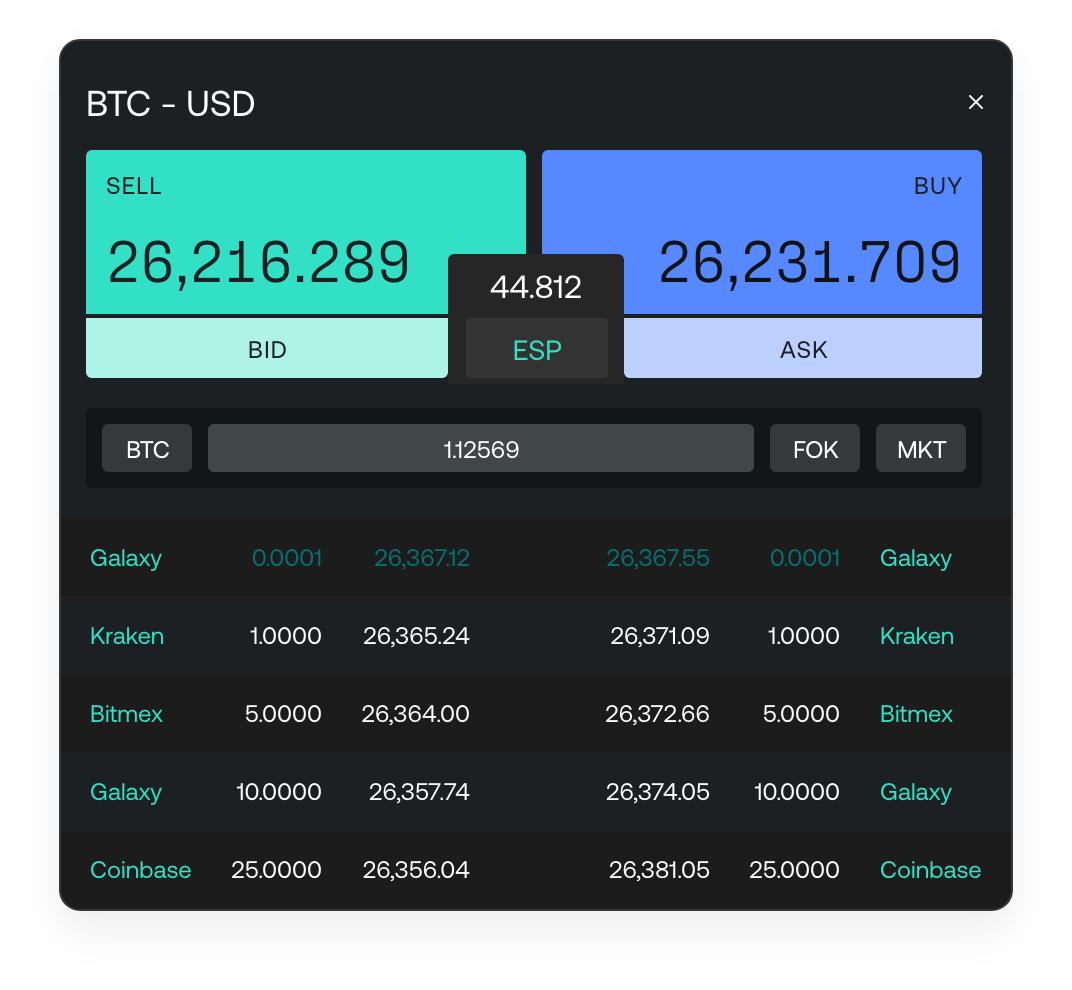

Enigma X is a full-service trading terminal, offering spot trading on all major pairs, an holistic overview of client positions with real-time monitoring and advanced charting, live price data across markets, global volumes, an industry curated news flow, and Enigma’s fundamental research reports.

Building on the spot trading capabilities of Enigma X, EXTP elevates client trading strategies with complex trade structuring flexibility, multi-venue integration, a range of execution algorithms and proprietary low-latency trading infrastructure to suit client needs.

Created in 2017 as a subsidiary of the Makor Group, a leading cross-asset brokerage group, Enigma is among the world’s first institutional-grade providers of digital-assets liquidity, bridging the gap between traditional finance and blockchain.

An error has occurred, please try again later.

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.