-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Unlocks, FDV, and cliff-edges

Unlocks are in focus this week, with a significant portion of contributor and early investor tokens going out to OP investors, as well as the second in a number of community unlocks for SUI. We also outline a brief history of unlocks in crypto, and how in general they should be perceived.

Executive Summary

-

Unlocks are in focus this week, with a significant portion of contributor and early investor tokens going out to OP investors, as well as the second in a number of community unlocks for SUI.

-

We outline a brief history of unlocks in crypto, and how in general they should be perceived.

-

Our view: Unlocks are overrated as supply-side difference makers, but can tell us a lot about the perception and momentum of a token for the long term.

This upcoming week will see significant unlocks on OP and SUI, and for sake of ease, we will frontload this piece by giving our view on both:

OP (Optimism): Unlock will consist of 9% of total supply (currently around 50% is theoretically circulating, but a large portion of that is in the ecosystem fund and hence not in active circulation), going to core contributors and investors; further linear unlocking will follow over the next 3 years. The Bedrock mainnet upgrade to Optimism will take place on 6th June as something of an attempted hedge against it. Price has already dropped around 13% in the days leading into the unlock; we would tend to expect to see a bounce within the next couple of days, mean reversion between the two going into the upgrade itself, and we continue to think in general that OP will outperform in coming months.

SUI: This has been misreported in places; the second monthly unlock of tokens from a number of launchpads (i.e. public ICOs) will take place on June 3rd, which will represent less than 1% of total supply and around 15% of circulating supply. As a supply-side event, this is probably a non-issue; the problem here is that the Sui ecosystem is in an abysmal state and any and all attention drawn to it as it stands is likely to be negative. We hence tend to maintain a negative outlook here on all time frames even allowing for any possible squeeze.

With that out of the way, it seems worth discussing what unlocks mean in crypto and why they matter. It is difficult to pinpoint exactly when people in crypto started caring about token unlocks, but if we had to try to pin it down, we would suggest some time around the start of 2022. In practical terms, token unlocks – the process of either future agreements of tokens being realised, or the tokens on-chain mechanically becoming available for trade – are a fairly straightforward thing. VCs and angel investors buy in at an appropriately discounted rate, with team members often also gifted locked tokens as pseudo-equity; to counteract liquid markets emerging very, very early on into said company or protocol’s lifespan, they are unable to sell until a given point, at which point tokens are unlocked by a combination of the sudden (i.e. X% of supply is unlocked/sent out) and linear (tokens are sent out over time, at a cadence that can scale anywhere from monthly to essentially constant streaming).

Sophisticated vesting and unlock schedules had started to emerge evolutionarily in crypto during and after the 2017 bull market. The first crypto assets had generally been fair-launched or pre-mined, and hence the idea of lockups and unlocks generally didn’t come into play. Ethereum at ICO largely lacked any sort of locking, while Ripple had an odd unlock system – the escrow scheme – which was infamous for its lack of transparency but in practical terms mostly replaced the general inflation rate that other networks released through new issuance to PoW/PoS validators.

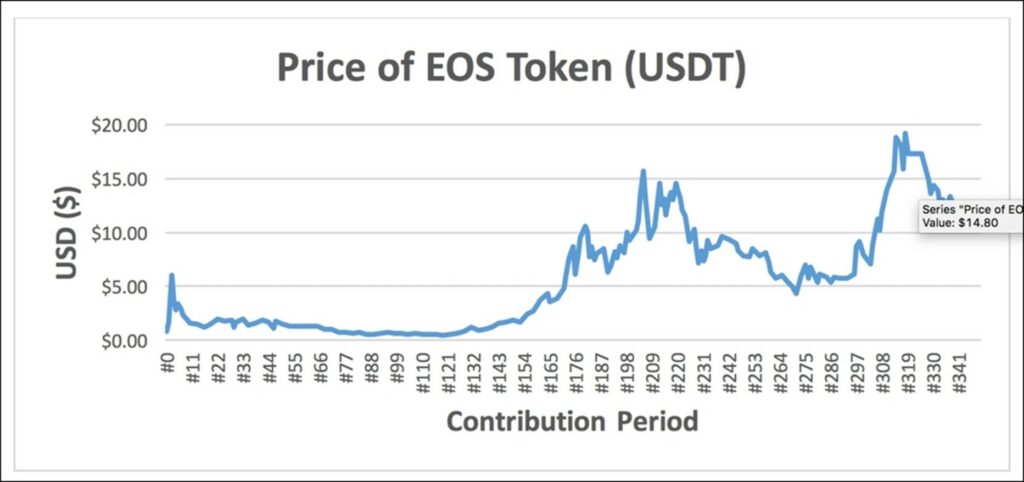

Arguably the first really sophisticated unlock system was the EOS ICO in 2017, which was set up as follows:

- 20% of tokens distributed ‘immediately’ (during first 5 days).

- 70% of tokens distributed linearly over the next year on an hourly basis.

- 10% of tokens distributed over the next 10 years to Block.one, who had conducted the ICO and at the time were effectively the governing foundation.

To confront the elephant in the room here: while these mechanisms make sense for team members and the like, for everyone else (retail and VC alike), these things all come back to price stability and human behaviour. If supply is fully available up-front, the thought goes, holders will dump, and would-be buyers will wait for eternity for the end of a never-ending dump.

For EOS, this gradual release of supply seemed to work out quite well. While there was still a pump-and-dump after that initial release and listing on public markets, the token moved up during the frenzy of November and December, and would be one of the few tokens to put in new highs in Q2 of 2018, only starting to fall off dramatically after the end of distribution on June 1st.

Via eosscan.io.

The first throes of the bull market would step past the ‘ICO question’ with their own form of pseudo-fair launch systems (yield farming), but the questions of price stabilisation on launch and vesting schedules started to emerge with the wave of investment from 2020 onwards, particularly as the targets of said investment came to look more and more like conventional private equity targets (i.e. early-stage, pre-product startups) than the ‘token/chain for token/chain’s sake’ model of the ICO era. From this emerged what is generally referred to casually as the ‘Alameda model’, consisting of an extremely low initial circulating supply (and hence a grossly inflated FDV or fully diluted value), aggressive lockups and incentivisation of new lockups by retail users through staking and similar methods, and ‘cliffs’ where a large number of tokens would vest at once.

For a long time, there was a debate that amounted to ‘do FDVs actually matter?’, and said debate existed because it seemed like in practice they did not. While the ‘Alameda model’ is a little bit of a misnomer with regards to it not originating from Alameda (even within crypto) or them being the sole/only force behind its popularisation (look at the likes of ICP’s disastrous launch in May 2021), they are responsible for some of the learned behaviour around high-FDV projects and unlocks, because – contrary to popular belief – Alameda tended not to dump tokens at unlock.

Why? Unlocks are big, obvious, siren-blaring events for the most part; unlock dates and vesting schedules would tend to get out to at least sophisticated market participants, and increasingly as time went on to mass retail as a whole. Most firms doing these investments and hence with tokens to sell were reluctant to sell upon an unlock, because the buy-side liquidity would simply not exist to a degree that they could sell off significant portions of assets without annihilating a project that they still had interests in beyond the market price of their immediate stash of tokens.

In even a moderately structurally bullish market, hence, unlocks didn’t matter, and as a result, FDV didn’t seem to matter at the time. The assumption was that Alameda were making most of their money through the yield farming of said tokens and slowly dumping the proceeds; for the record, what we learned during and in the aftermath of November 2022 was that they largely weren’t even doing that and were instead using them to build up a colossal network of loans instead.

As retail started to exit the market from mid-2021 on, we started to get indications that FDV may, in fact, matter. One of the more memorable examples was JEWEL, the native token for the Harmony-based DeFi Kingdoms game/protocol, which had a relatively sophisticated system for locking based around using JEWEL as a liquidity reward, automatic unlocking based on a schedule, and OTC systems spring up around buying and selling batches of locked JEWEL.

While it’s difficult to find exact figures in the aftermath, a Substack article on JEWEL from 20th January places FDV at $8.1 billion, noting that 19% of supply was theoretically circulating, but that less than 10% of that 19% was probably actually circulating because of JEWEL’s locking mechanism. In other words, the float was in the region of 2% of that theoretical FDV that valued DeFi Kingdoms are one of the most valuable games/gaming companies on the planet.

We mention the JEWEL story because its rise and fall was explicitly not tied to Alameda or any of the other usual suspects in the 2022 annus horribilis. JEWEL peaked in early January at above 20 dollars, fell to 4 by late March, picked briefly back up to 10, and then was sub-1 by May; it currently trades at $0.13, with DeFi Kingdoms having publically mused for nearly a year now about moving on from the JEWEL token in favour of a new token on the Klaytn chain (this has been implemented – JADE – but not yet to the exclusion of JEWEL).

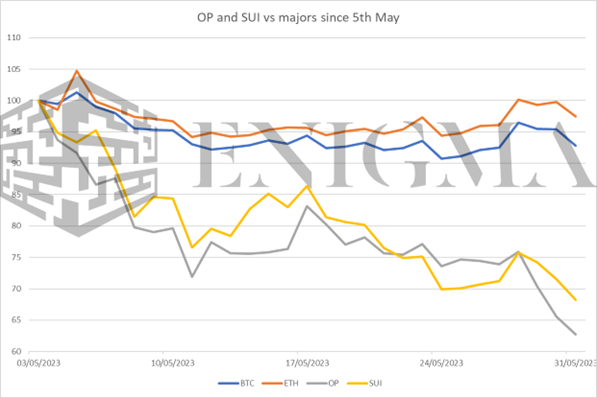

We also mention JEWEL because it helps us understand a little more about how an unlock meltdown tends to happen. The unlock itself is rarely what drives prices drastically down; instead, it is the anticipation of it. For what it’s worth, we have seen this with both OP and SUI over the last few days:

With unlocks, even in the case of cliff-style unlocks, it tends to be the case that the threat is the problem rather than the event itself. The open or at least traceable nature of them makes it difficult for sophisticated parties to trade the event – you can’t just dump your tokens. You can of course hedge/’hedge’ through instruments like perpetual markets less transparently, but this comes with its own problems in terms of aggressive funding rates, a higher likelihood of short squeezes, and so on. Unlocks are less important than one might think overall, then, only really becoming close to actionable in the full throes of a bear market (and even then requiring a significant lead time). They are still worth paying attention to, both in the short-term for the possibility of aforementioned squeezes and the like, and for what price action coming out of them tells us about the long-term prospects for a project. Moderately poor momentum into and out of an unlock generally brings up few red flags; the likes of what we saw from APT in April, and what we might see from SUI going forward, could paint a very different story.