-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

The case for FTX 2.0?

Social channels were set abuzz yesterday after – as often tends to be the case – a court filing. However, while most court filings are distinguished essentially by what they do (or don’t) destroy, this one was interesting for indications at what it might create.

Social channels were set abuzz yesterday after – as often tends to be the case – a court filing. However, while most court filings are distinguished essentially by what they do (or don’t) destroy, this one was interesting for indications at what it might create.

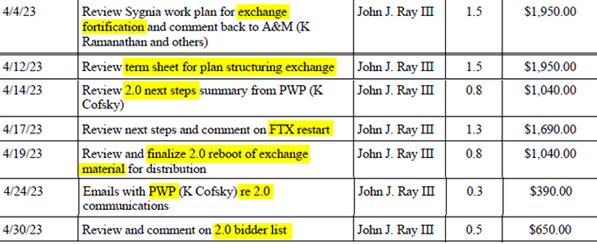

The filing in question was from FTX bankruptcy CEO John Ray III, and contained a number of billable hours in April that made explicit reference to ‘2.0’:

Generally, and specifically in the context of the association descriptions here, this seems likely to refer to FTX 2.0 – a relaunch of the exchange itself under a new operator. When thinking about or discussing this, we tend to think there are three layers to go through.

On the surface level, it seems like complete absurdity. The last nine months have cemented a link in the popular mind of FTX with gross misconduct and fraud. Is this fair? Not entirely; while successive revelations have revealed a FTX that was horrendously internally disordered, to the point of being fradulent (bearing in mind that intent is not necessary for fraud to take place), the worst behaviour was still to be found on the Alameda side, not the FTX side, insofar as the two could be separated.

However, delving – and thinking – a little deeper, the situation isn’t quite clear-cut, and there is a growing grass-roots movement advocating for relaunch. The key arguments in that regard are as follows:

1) FTX was still a market leader in a competitive exchange landscape, and therefore there is significant value in their tech and the exchange stack in general that they had built up. There is some truth to this. It is easy to forget now, but FTX was a relatively recent upstart compared to most of its exchange peers; Binance, founded in July 2017, is among the youngest of the major exchanges, with the likes of Coinbase, Bitfinex, OKX, and others more typically dating back to the earlier half of the decade.

While FTX may be associated now with its big-money sponsorships and advertising spend, it was likely outspent in proportion to revenues by most competitors, and was able to gain traction in 2019 and 2020 on the basis of the superiority of its service. It should be said that a lot of this was human – Sam Bankman-Fried’s accessibility as CEO to what were essentially customer service requests, for instance, or the built-in OTC functionalities of the site – but there was absolutely a period where it also technically shone compared to sites like BitMEX (and its infamous Order Submission Errors).

It does need to be said that this technical advantage was already waning by 2021 as other exchanges scaled up technical staff (something that FTX always struggled with) and that the latency of the exchange on both frontend and API had become a very frequent complaint; nonetheless, there remains value in that stack, particularly compared to anything that could be built up from scratch.

2) FTX claims create a natural, captive userbase for a new exchange. The vast majority of active FTX 2.0 advocates are those with balances that were trapped in the exchange upon freezing withdrawals; they are up-front about this, and make the point that there should be a natural user base essentially consisting of people like them.

It is worth noting that they are not the only ones pushing ahead with essentially this logic, with the OPNX exchange (essentially a relaunch of the collapsing CoinFLEX exchange with the added participation of the Three Arrows Capital founders) and the Xclaim bankruptcy trading platform among others making the utilisation of claims in this way central to their business plans.

3) FTX, for better or for worse, has a recognisable brand, and that brand could survive and thrive in spite of everything that’s happened. This is a more interesting point than it seems, and two comparators come to mind here.

The first is Bitfinex. Throughout its history, Bitfinex faced many crises, but the one that stands out here is the 2016 BTC hack and the haircut on customer deposits, where the company announced a 36% haircut on deposits and created a recovery token – BFX – that would allow for redemption when the company was able to make depositors whole (which ended up happening in April 2017).

The second is quite different – Enron. Without seeking to explain everything about what is now a quarter-century-old case, the general point here is that there were significant similarities between Enron and FTX all the way down, and one of those was that Enron had a rotten superstructure but plenty of divisions that were functional and indeed profitable. One of the most prominent ones, in fact, was its electronic trading platform EnronOnline, and in the months and years after the company’s collapse, a new lease of life for it was a constant source of speculation.

Of course, in the year 2023, we know how it worked out; the division ended up being sold to UBS, but was never able to properly relaunch either with or without any associated Enron branding, and was shuttered soon after.

To be clear here: in general terms, given the historical precedent and given the state of the brand, it is very, very difficult for us to see any sort of FTX 2.0 relaunch working out. The activist efforts to push it forward seem to mostly be founded in the (correct) belief that it is the only way that the FTX bankruptcy ends with anything resembling reasonable returns for creditors given how the bankruptcy proceedings in general are going, and how little will likely be left from a simple dissolution of assets minus the exorbitant fees that John J. Ray III and company are taking at the present time.

However, there are two big differences between the FTX case and most of its antecedents. The first is that, while cases like the Bitfinex haircut do ultimately belong to another time, we at least have a sort of precedent for crypto markets accepting arrangements that would otherwise be anathema.

The second is that, assuming that FTX 2.0 would constitute a substantive rebrand, the exchange landscape is unusually open to disruption at this exact moment. Binance is clearly under significant and constant pressure from regulators and media alike, and FTX’s rise and fall has created a landscape where there is no clear leading challenger to Binance’s incumbent; this is as good a moment as any to launch something new. Again: we have to remain sceptical. However, there is potential, and it does remain worth tracking.