-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Special edition: Hypertetherisation

USDC and Circle USDC faced its biggest crisis since the asset’s inception in late 2018 when it got caught in the crossfire of the Silicon Valley Bank collapse. To explain it as simply as possible: USDC is fully-backed, with its reserves currently split roughly 75-25.

Executive Summary

-

With the events of the past week, it was almost difficult to pin down topics for this week’s Enigma Spotlight, but we have chosen three particular areas of focus.

-

The first is, naturally, the USDC depeg, and the outlook for Circle going forward.

-

The second is the Signature Bank situation specifically, as it is both important in its own right and extremely revealing of the broader view for the crypto industry going forward.

-

The third is a broader view of what comes next.

USDC and Circle

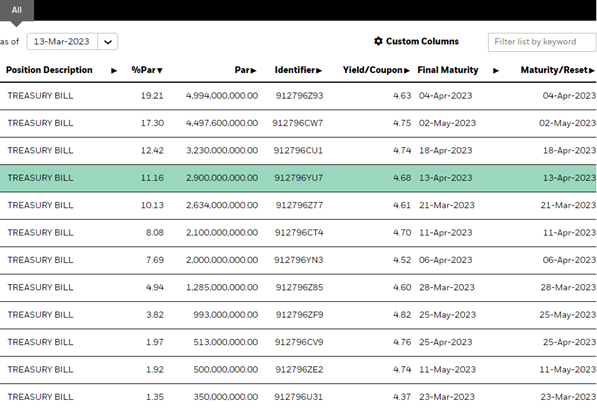

USDC faced its biggest crisis since the asset’s inception in late 2018 when it got caught in the crossfire of the Silicon Valley Bank collapse. To explain it as simply as possible: USDC is fully-backed, with its reserves currently split roughly 75-25. That larger number is a short-dated portfolio of treasuries, publically administered by BlackRock as the Circle Reserve Fund.

The other 25% is held as cash, distributed among six banks prior to last week. Three of those were SVB, Silvergate, and Signature, who need no introduction; the other three were Citizens Trust Bank, Customers Bank, and New York Community Bank. The distribution between those banks are unclear, but with the latter three all being smaller regional banks, and Circle having only been publically partnered with CTB since February 24th of this year, the assumption was that the vast majority of funds were within those three.

While most in the industry would have expected SVB to still probably take third place with respects to holdings – as we will discuss later, the settlement networks were the selling point for both Silvergate and Signature – the collapse of the bank still brought uncertainty, and that was confirmed on Saturday when Circle announced exposure of $3.3 billion to SVB – a substantial portion of the $8bn to $10bn that Circle should hold in cash given their treasury holdings and USDC’s market cap.

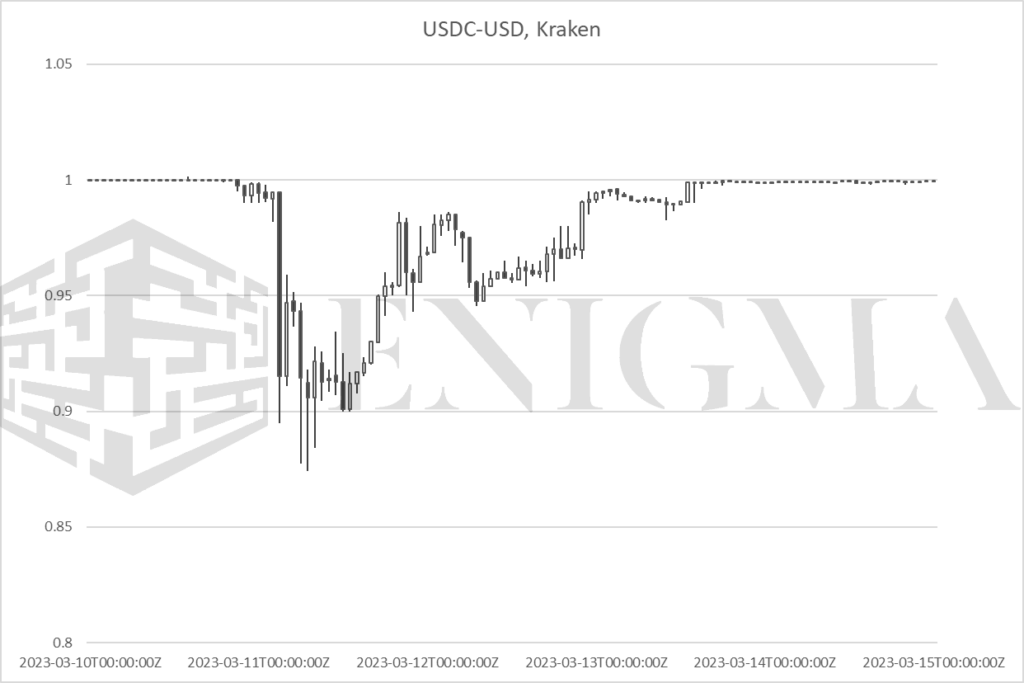

Coinbase (the first home of USDC) paused 1:1 conversions for USDC:USD, and other exchanges followed suit. In terms of the absolute severity, it depends where one looks, but for the same of argument we will use Kraken’s market (both Kraken and Gemini operate USDC-USD pairs as standards for liquidity rather than redemption; offshore exchanges often operate USDC-USDT instead, but the dislocation between them and Kraken/Gemini was minimal).

Data via Tradingview.

USDC traded as low as 87 cents on the dollar on Kraken; in a few places it was worse (brief wicks down to 82 and 84 cents on Gemini). How much was actually traded at those levels is unclear, but there was at the least a protracted period of several hours on Saturday where it traded at 90 to 91 cents on the dollar.

From a pure value perspective, this seemed to be pricing in almost a worst-case scenario where a) the company would see total loss of the SVB reserves and b) the company had no surplus whatsoever (43.5bn USDC were in circulation at the time which would price the 3.3bn impact at around a 7.5 cent shortfall). In truth, most of the discount (or premium on USDT, if you prefer) was likely pricing in the difficulty or impossibility of some holders in going through the redemption process legally if forced to do so.

In the end, things stabilised; USDC traded at around 95 cents on Sunday, and when it became clear that SVB depositors would be saved on Monday, it effectively returned to peg.

The big thought that seems worth articulating on the saga is this. Circle for the most part managed the process well (after some initially poor and unclear after-hour comms on Friday night and into Saturday morning), negotiated things operationally about as well as they could have, and everything came out fine in the end.

For everyone else, the scary part should now be over. For Circle, however, it may only be beginning. As much as we fixate on the quick blowups in crypto and in markets more generally, most deaths are slow; and particularly in crypto, particularly for assets, exchanges, and so on in strong or dominant positions, the pattern we generally see is that:

1) an event happens that is bad but ultimately not catastrophic,

2) it seems to have few short-term consequences, but,

3) the next wave of builders and users don’t trust building on it and choose different rails.

Concerns about USDC being a central point of failure for DeFi in particular have been quietly murmured for a while, but were largely overriden by the trust in it, which is why we see things like e.g. DeFi systems increasingly being built with faith in USDC holding a hard peg to $1, or DAI collateral changes that have made it more reliant on USDC and on firms such as Coinbase over time (albeit this being something that MakerDAO CEO Rune Christensen has signalled concern over) and which hence saw DAI trade at essential parity with USDC throughout the depeg.

USDC has survived the battle, but it remains unclear whether it will win the war.

Signature

It is always difficult to write in the wake of an event like Signature’s shuttering, because we don’t know what we don’t know, and it will be an extremely long time before we know what we don’t know. Hence, any analysis has to lead with that soft disclaimer (in addition to the usual disclaimers put on any research of this nature).

With that being said, what we do know paints an extremely ugly picture – not of Signature, but of regulators and politicians. If Silvergate was the face of crypto business banking in the US, Signature was the muscle, with the two firms making up an unknowable but extremely substantial portion of the US market. Why Silvergate and Signature? In both cases, it was because of their settlement networks; the Silvergate Exchange Network for the former, and Signet for the latter, with both allowing for easy, effectively instant on-ramping and off-ramping for large business in and out of digital assets.

When Silvergate was shuttered last week, it did not cause the panic within the industry that it perhaps should have, precisely because Signature existed – it seemed clear that some degree of pressure had been applied (concerns had very publically been raised about Silvergate’s relationship with FTX), and it would have operational consequences for the industry in the long-term, but if firms like Signature remained in place then the industry would adapt and move on.

However, just two days after Silvergate’s winding down, the SVB collapse happened, and sparked a wave of fear throughout the industry, culminating in an extremely panicked weekend and a Monday open that saw regional banking stocks across the board annihilated, and what for all intents and purposes is a bailout announced by the US government in order to prevent a bank run.

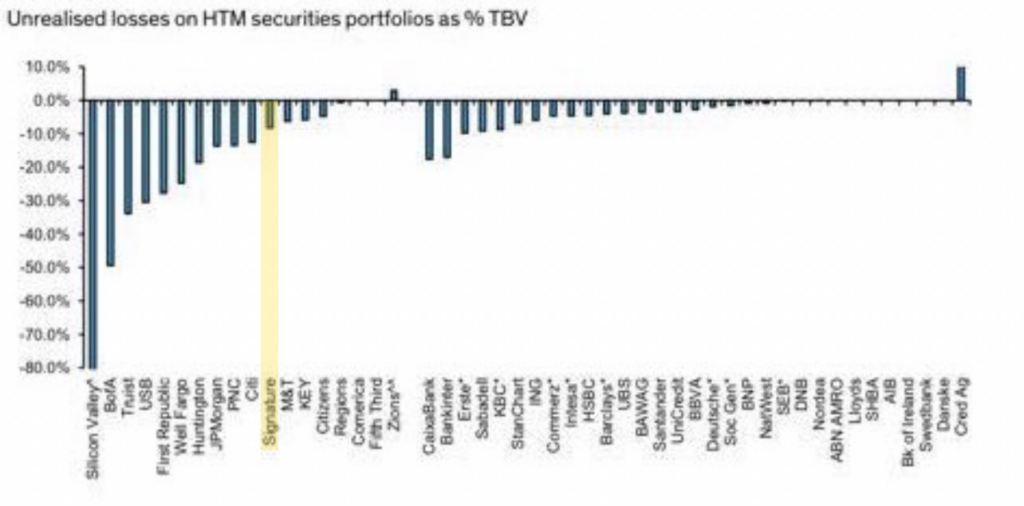

We won’t labour the point on explaining the crisis in general, but a key point here is that were no direct bailouts or takeovers, with the US government very keen to avoid being perceived as bailing out banks (which, again, the FDIC extension is a bailout at best, but we’ll skirt around that). Except for one – Signature. The bank had seen a modest run on deposits on Friday, but by most accounts was not in worse health than any number of regional banks, actually having more limited exposure than the likes of Wells Fargo and JPMorgan Chase to the impetus for the broader liquidity crisis re: unrealised losses on held-to-maturity securities:

Regulators have been unable to provide any particularly convincing justification for why Signature had to be taken over given the relief offered elsewhere (note that announcements of Signature’s takeover preceded the broader campaign), with the New York Department of Financial Services simply saying yesterday that “the bank failed to provide reliable and consistent data, creating a significant crisis of confidence in the bank’s leadership”, and Barney Frank – a board member at the bank and a co-author of the post-Great Recession Dodd-Frank laws – going on a media speaking tour over the last few days to defend the bank’s position in as strong of a set of terms as possible to do for someone in his position.

The quote that has been particularly picked up is this one from the New York Times: “‘They shoot one man to encourage the others’. I think we were shot to encourage the others to stay away from crypto.”

Frank is the furthest thing from an enthusiast for crypto; he is broadly supportive of the present regulatory push, and his position on Signature’s board (since 2015) is because of his interest in and support for the company in its non-crypto dealings (bear in mind here that Signature, like Silvergate, was a traditional bank first, and it can be argued that even at its height, it was still traditional foremost).

As is standard after such a takeover, Signature has announced the opening of a bridge bank, headed up by former regional bank CEO Greg Carmichael; notably, while sounding a similar bullish tone to the SVB bridge bank, there is no mention of the continuity of Signet in its press releases and announcements, and Circle seem to be moving on from Signet as part of their USDC operational flow.

While relevant regulators have largely denied it – NYDFS head Adrienne Harris described the decisions as “not crypto related”, and stressed that “DFS has been facilitating well-regulated crypto activities for several years, and is a national model for regulating the space” – actions speak louder than words ultimately. Going after banks in this way – and specifically those banks offering the most effective settlement networks – seems like a clear signal to all but the largest crypto companies that they are unwelcome in the US banking system.

The reverberations of this over the coming months are unpredictable. There will be other banking solutions in the US no mater what – BNY Mellon and others are still around, and firms like Cross River are picking up the slack for the likes of Circle for now – but it seems likely that, at best, interfacing within the US banking system will be heavily and artificially restricted, and that businesses will either have to significantly reshape their flows or – more realistically – start to look for longer-term solutions outside of the US.

Where next?

The title of this piece rather reveals the core of our thesis on this, but it is nonetheless worth spelling out in a little more detail. To date, Tether has been possibly the single biggest ‘winner’ in the chaos of the last couple of weeks. It has not depegged – in fact, there were points where it traded above peg over the weekend and on Monday, even accounting for the most pronounced cases as such being functions of low liquidity. Its market cap has been steadily increasing since late January, having already been the major beneficiary of the BUSD shutdown over USDC, BTC, and any other assets on a simple flows basis.

Is this to say that all concerns over Tether are lifted and that it is an asset for the ages? Of course not, though there is a solid argument to be made that USDT’s long tail risk has been less than USDC’s since as long ago as November. That Tether has been resilient in this crisis does not, and should not, automagically eliminate all extant concerns over its lack of transparency, the fact that its obscure offshore banking relationships were its major weakness until a week or so ago, and so on.

However, it has survived – and, as far as anyone is concerned operationally, one USDT is still worth one dollar. As much we have concerns long-term over the trajectory of USDC as an asset, it too has quickly gone back to par after re-enabling redemptions. The perceived value of these assets has remained intact – and, while there was more than a little gum and paper stirrers involved in the plumbing with respects to how USDC depegs were treated, DeFi saw very little damage from the whole process.

When we talk about ‘hypertetherisation’, we mean it as much in the lower case as in the upper. What is the most natural response to on-ramping and off-ramping becoming more difficult, and in particular being aligned towards size? It is to accept that the value being held on-chain is real, and to reduce the frequency of use on those ramps, which in turn opens the door to more substantive construction and use of systems on-chain as a result – because more people are willing to retain on-chain wealth in larger and larger quantities.

This does not paint the rosiest of pictures in the medium term, because – as is easy to forget – the construction of systems that work along stable rails of any sort is still in its relative infancy overall. USDC launched in 2018, and essentially everything in the world of DeFi was at best a proof-of-concept up until at least the spring of 2020. The seeds have been in the ground for a while in some cases, and we are beginning to see them sprout in certain respects with relations to tokenised real-world assets at the like; however, overall, things remain in their infancy.

In terms of shorter-term narratives: what we have seen over the last few days is close to a perfect storm for BTC specifically – banks are not to be trusted, regulators too, hard assets are king, and so on, and so on. BTC has outperformed alts, and in traditional markets, gold has been one of the leaders, seeing a 6% trough-to-peak rise from last Wednesday to close on Monday. Markets currently find themselves back at resistance at roughly August 2022 levels of $25,000 BTC and $2000 ETH. BTC did briefly wick above those levels on Tuesday; ETH remains some distance short of them.

Despite all of this, our short-term view does still tend to skew negatively. The rush into BTC feels more based on relief than anything else, and it is telling that volumes on US-based venues like Coinbase are actually lower now than in January’s surge; that combined with desperate moves such as Binance’s announcement of conversion of its $1bn Industry Recovery Initiative fund into ‘native crypto’, and prices falling back significantly yesterday after what looked set to be a break of aforementioned resistance, leaves us sceptical that momentum will continue to carry through for now.

In any case, though, this does solidify a view towards a more sustained resurgence in crypto as early as Q4 or even late Q3 of this year. As easy as it is to roll one’s eyes at the usual hucksters proclaiming a ‘rebirth of crypto’, and bringing up the symmetry of Monday, March 13th, with the March 13th crash in 2020, the action and cadence of regulators seem to be inevitably pushing businesses and users, kicking and screaming, towards a more digitally situated way of operating economically, and that can ultimately only be to crypto’s benefit.