-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Roundup, March 2023

Focus has come off GBTC due to other events, and no further news has come through in the last month, but the discount has now sat at close to -36% for several weeks, and hence seems likely to narrow further coming into the next two quarters.

Weekly Spotlights and Updates

Grayscale latest: “where’s the gap?”, March 8th

Focus has come off GBTC due to other events, and no further news has come through in the last month, but the discount has now sat at close to -36% for several weeks, and hence seems likely to narrow further coming into the next two quarters.

Special edition: Hypertetherisation, March 15th

USDC has remained stabilised, but significant damage has still been done – USDC circulating market cap has dropped from $43bn pre-crisis to $32bn as of April 1st, with Tether seeing a basically countervailing rise from $70bn to $79bn. Details from the Signature shutdown continue to trickle out and continue to paint a picture of government hostility to the bank on the basis of their crypto operations – indications are that any buyer for the bank will be forced to jettison crypto clients.

Arbitrum and airdrops, March 22nd

Arbitrum launched on March 24th with a day-1 close of $1.33; it closed the month at $1.39, though has tracked lower coming into April.

Binance litigation: four (4) thoughts, March 29th

Little to add currently. BNB has mostly remained stable, though dropped somewhat in early April due to seemingly unfounded rumours around Binance CEO Changpeng Zhao.

Markets

Bitcoin and Ethereum

A surprisingly strong month for both BTC (+23.09%) and ETH (+13.49%), with the bulk of gains coming in a 40% rally between the 10th and 17th of March – mounting panic spiralling out from the Silicon Valley Bank crisis saw BTC drop below the $20,000 level reclaimed in mid-January intra-day, and would see further reverberations through the market with USDC’s depeg on 11th March, but ultimately promises amounting to a full government backstop and the resultant general reprieve on regional bank stocks sparked positive action across the board on risk assets.

Crucially, BTC broke through the technically significant $26,000 level and has remained above since. ETH has fared less well comparatively, and ETHBTC broke down below 0.065 for just the second time since January 2022; however, after a trough at 0.062 on March 20th, the pair has surprisingly stabilised, largely averting short-term concerns of a further breakdown for the time being.

The problems with respects to ‘where next’ are fundamentally that this is one of those cases where crypto market structure is likely to take a backseat to macro, and more specifically, to general risk appetite. It does still feel like upside on crypto in general is capped; volumes remain low, exchanges are having to roll back bull market policies (e.g. Binance ending most of its no-fee campaigns), and as impressive as it is to see BTC holding at these levels, pivot points for a potential fuller breakout (starting at around $32k) have yet to be challenged, and we still tend to think that BTC and other assets will be found wanting at said levels.

This amounts to a positive outlook in the extreme short-term, though NFP release on April 7th could be interesting in this regard, especially with traditional markets closed on the day – an intraday rally into NFP and a downturn after a miss seems a higher-probability scenario than anything else, though low-timeframe action around last month’s NFPs (following an 11th consecutive beat) was extremely stop-start.

Mid- and small-caps

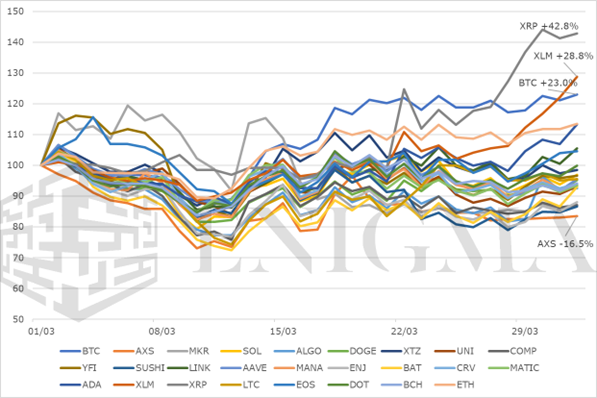

One of the weaker months in a while for smaller-cap assets – while few actively recorded losses, very few outperformed either BTC or ETH.

Standouts on the month to the upside:

XRP: XRP rallied into month’s end (the majority of its gains coming between the 26th and 29th of March) as the Ripple-SEC case continued to march closer to a conclusion, though some of said gains came in incorrect anticipation – reports circulated that Judge Analisa Torres would be compelled to issue a ruling by end-of-day on 31st March, which was inaccurate (the ruling remains pending; lawyer John Deaton noted on social media that “Judge Torres has [historically] issued her ruling on summary judgment within a couple months of her Daubert/Experts’ decision.”

XLM: XLM seems to have largely been a beneficiary of affinity with XRP, with both having a similar dominant use case (enabling cross-border transactions) and hence attracting a similar class of buyers. XLM rallied at the same time as XRP, and peaked a couple of days after XRP on 31st March.

DOGE: Note that our snapshot here does not incorporate April’s gains; even without those, DOGE performed relatively well in March, albeit with little clear individual impetus outside of the familiar Elon Musk-related background noise.

Standouts on the month to the downside:

COMP, SUSHI, MKR: DeFi blue chips in general struggled this month, mostly fuelled by concerns in the aftermath of the USDC depegging. While aessentially all DeFi protocols fared well in the event, the sheer reliance of all of DeFi on Circle as a centralised entity was highlighted, and moves like DAI’s shift towards being essentially an USDC proxy (reflected in price during the depeg) have prompted questions about the long-term reliability of USDC reliance.

ALGO, MATIC, SOL: Significant focus has fallen on layer-2s this month due to the Arbitrum airdrop on March 23rd and the launch of zkSync on March 24th, and both alt-L1s and MATIC – previously the layer-2 of choice by default – have seen modest pullbacks as a result..