-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Roundup, February 2023

GBTC discount fell to lows of 47% on February 13th, not coincidentally at the same time as Bitcoin itself hit monthly lows just under $22,000

Weekly Spotlights and Updates

UK cryptoasset regulation, February 1st

No significant updates; consultation is ongoing.

Grayscale GBTC and ETHE outlook, February 8th

GBTC discount fell to lows of 47% on February 13th, not coincidentally at the same time as Bitcoin itself hit monthly lows just under $22,000; as we said at the time, we will see some degree of variance here that is driven purely by the overall faith in the underlying asset itself rather than the trust. Few developments on the Genesis restructuring proposals. The atmosphere around restructuring at the likes of Voyager and Celsius is a little concerning (particularly the possibility that Voyager’s deal with Binance US may be rejected by authorities), since it suggests that regulators will continue to prevent any quick dissolution of any sort from occurring under any circumstances.

Are stablecoins securities?, February 15th

Gensler’s remarks were less inflammatory than expected, but BUSD redemptions have stepped up significantly since February 13th, with market cap going from $16.4bn to $10.5bn at the time of writing. Tether has gained around $3bn, while USDC has gained $1.5bn, albeit this is in the context of $4bn of redemptions from mid-December on. Coinbase announced on Monday that they would be delisting BUSD as of March 13th; it should be noted that the exchange only said that it “does not currently meet our standards from trading support”, rather than any reference to securities status (compare to XRP’s delisting in December 2020, where Coinbase explicitly said it was because of the SEC lawsuit).

Polygon, layoffs, and layer 2s, February 22nd

MATIC is down a further 11% against both USD and ETH since February 22nd. Regarding our discussion of new layer 2s: Coinbase announced on Thursday the launch of a testnet for their own layer 2, build on Optimism’s OP Stack. OP initially jumped by 13% in the days following, although is back at even now (albeit this being in the context of recent overperformance at a time where most altcoin surges have been followed by significant pullbacks in very short order).

Markets

Bitcoin and Ethereum

BTC ends the month of February almost literally flat (+0.07%), with ETH (+1.26%) not much more remarkable. Volatility on the month as a whole was muted, but not historically so; the 15.51% high-low range on BTC is only the 13th-lowest since 2015, and a higher mark than December or October of last year, pegging very closely in fact to the stagnant price action of the summer of 2020.

There is an argument that there should be some solace taken for bulls in the overall muted price action on the month; firstly, because it was a terrible month with respects to headline impetuses for the most part (plenty of negative stories surrounding US regulation and Gary Gensler in particular) and markets for the most part remained steady (-5.07% on BTC and -6.37% on ETH on February 9th constituting the worst day for both); secondly because, however marginally, the month did at least close green in what remains a very challenging climate for risk assets across the board.

The difficulty is that markets have seemed to run out of momentum across the board at the exact points where it is easy to write them off as an echo rather than as a indication of genuine strength. ETH topped out below its August and September bounces; BTC did better than in September, but ultimately faltered above the $25,000 level that it very briefly wicked above in August. Volumes in February were miniscule; by our estimates, the week beginning February 6th saw the lowest exchange volumes since October 2020 on most major venues.

On the pair, ETH/BTC closed the month at a hair under 0.07, again showing some of the lowest volatility we’ve seen in a while; a brief spike to open the month was almost entirely eroded over the course of the month. To be fair: there may be something more substantive to the solace of ‘headlines not eroding the position’ here, just because of how many things targeted staking (and one might as well be the other with respects to Ethereum and staking as far as many larger investors are concerned).

Our expectation would be for price action to remain depressed over most short time horizons, with potential resistance/invalidation at BTC $26,000 and ETH $1800, with some downside threat on the pair as a result purely on account of ETH’s higher overall beta.

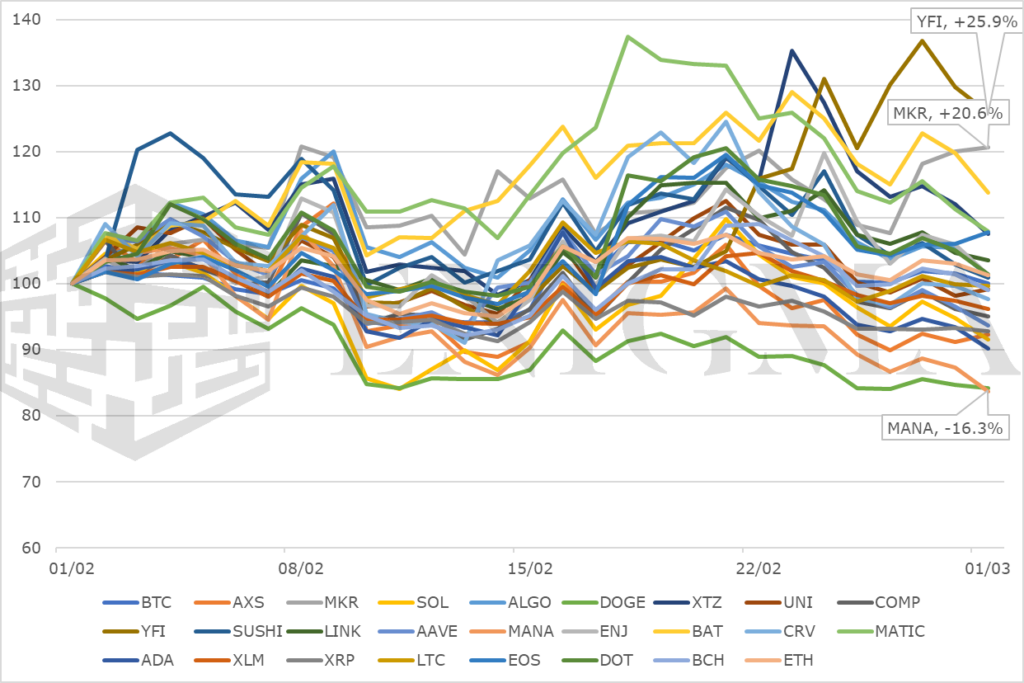

Mid- and small-caps

While BTC and ETH has been stagnant, this has been something of a banner month for mid-caps, with more overall showing upside than downside despite a ranging market that tends to punish them normally.

Standouts on the month to the upside:

- YFI, MKR, LIDO, OP – Liquid staking solutions have been a relatively safe harbour in the overall staking storm; LIDO continues its outperformance, while YFI has also benefited from a teaser released indicating its own liquid staking-related product (yETH, a liquid staking basket product). Elsewhere, OP gained as mentioned earlier from Coinbase’s layer 2 announcement, while MKR gained in the wake of both the BUSD action and the announcement on February 8th of a potential new lending protocol (Spark Protocol).

- NEO, FIL – Both coins among others saw gains this week specifically, linked to an announcement of moves towards a more permissive regulatory regime in Hong Kong; both assets are in the group known colloquially as ‘China coins’ due to their links with the area. We tend to think continued momentum on these and other associated coins will mostly be event-driven rather than a fundamental trend like liquid staking, but it remains to be seen.

- STX – The success of STX is an odd one. The ‘ordinals’ system for creating Bitcoin-based NFTs has caught more attention than anything that has happened in Bitcoin development for years now, but BTC itself is almost too big to be responsive in price terms to such developments, and STX has gained despite having very little to do with ordinals itself just on account of being a token associated with Bitcoin smart contracts in general.

Standouts on the month to the downside:

- APT – While APT still remains well clear of the $3-$4 depths of post-FTX, momentum on it (which was mostly derivative-driven) has mostly cooled over the past month, falling back to the last leg of its January surge at around $12; it will be interesting to see if the current level provides support, since the graph is oddly similar to pre-bubble SOL in early 2021 so far.

- MANA, AXS, APE, GALA – Little luck this month for most metaverse and gaming-connected tokens, with enthusiasm quickly deflating on the likes of APE as the froth around the ‘Dookie Dash’ beta died down.