-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Roundup, April 2023

ETH actually did see a short-term rally coming out of the upgrade, touching above $2100 for the first time since last August, but the rally was ultimately brief and ETHBTC is once again struggling to hold above 0.065.

Weekly Spotlights and Updates

Ethereum and the Shapella upgrade, April 12th

ETH actually did see a short-term rally coming out of the upgrade, touching above $2100 for the first time since last August, but the rally was ultimately brief and ETHBTC is once again struggling to hold above 0.065 (and is hence down further in USD terms). The queue for unstaking Ethereum stood at 17 days as of a couple of weeks ago; withdrawals outweighed deposits briefly, but so far we have seen an overall growth in the net staked balance, curiously in conjunction with a significant increase in gas prices and hence burn rate (staking rewards are reduced with increases in total staked balance).

Bitcoin and daily time serieses, April 19th

BTC has mostly trended down since April 19th, failing to regain $30,000 for all but the most ephemeral of spells. As we said at the time, our view was that the ceiling on the March/April rally was likely to be around $32,000, and while there remains ample opportunity for that to be proven wrong, it has held out so far.

Regulatory inertia, April 26th

Coinbase officially launched their offshore derivatives exchange on Tuesday, as did Gemini; in both cases, the products being offered are extremely basic by market standards (e.g. Coinbase International Exchange only has BTC-USDC and ETH-USDC markets and 5x maximum leverage), with the Coinbase exchange based in Bermuda and the Gemini exchange in Singapore (though curiously, unlike Coinbase, Gemini’s domicile is buried extremely deep in the press material around the launch). It feels unlikely that either are committed to their initial launch jurisdictions long-term.

Markets

Bitcoin and Ethereum

An overall mixed month, with both assets posting small and very similar returns end-to-end (BTC +2.67%, ETH +2.68%) and hence returning positive for four consecutive months for the first time since March 2021, but with both also ending the month on a relatively depressed trend. After a significant positive multi-day move starting on April 10th (one that came, it should be said, with no particularly clear headline impetus), assets had roundtripped the move by April 21st in the context of further SEC enforcement announcements against Bittrex and complications arising on several bankruptcy deals including Voyager’s and Genesis’s.

To reiterate, we tend to think that BTC and ETH have come up against technical resistance and been found wanting; hence, expectations short-term are muted and lean bearish. There is little independent strength in crypto markets, and while correlation with and exposure to sentiment in broader risk markets has at worst been neutral over the course of the last month, this is threatening to change with the latest round of regional bank problems in the US at the time of writing.

In the case of a bearish scenario, BTC is still probably the best place to be among native assets; eternal murmurs around Microstrategy asides, ETHBTC continues to flit around levels which imply significant downside risk, and while a lot of air has been drained out of mid-caps, a headline-driven rush will ultimately hurt most more than either. We tend to see the most significant risk in May overall as backloaded in spite of the First Republic acquisition coming in early-doors; a major move down likely would require an industry-specific crisis (i.e. probably something relating to Binance), with general risk problems acting as a slower and longer suppressant.

Mid- and small-caps

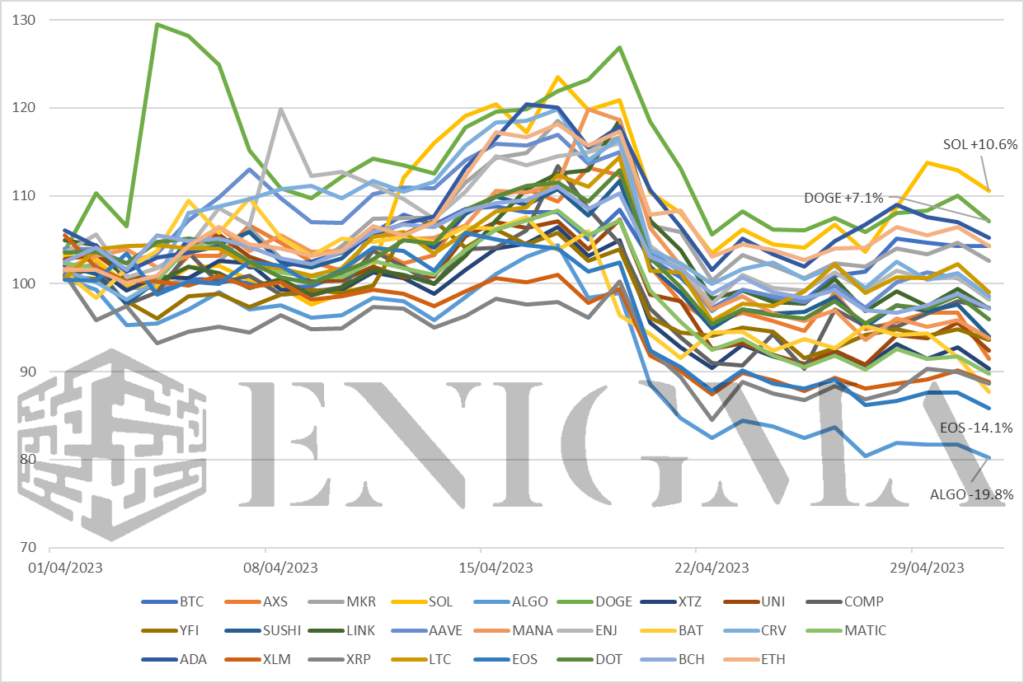

One of the weaker months in a while for smaller-cap assets – while few actively recorded losses, very few outperformed either BTC or ETH.

Standouts on the month to the upside:

SOL: Solana slightly overperformed mainly due to the release of the Solana Saga, the company’s flagship Web3 smartphone, and the collective reminder to the community that there is a sliver of a hope for the firm post-FTX if they can succeed in their mobile push.

DOGE: Up nearly 25% on the month at one point, as usual with DOGE, the impetus here was something ridiculous; the Twitter logo was briefly changed to the Dogecoin logo between the 4th and 6th of April in what was speculated to be an April Fool’s joke pushed extremely late. The asset quickly fell back but remained a slight overperformer on the month.

Standouts on the month to the downside:

ALGO: By far the worst performer among anything that could be described as a bluechip, ALGO’s misfortune was that it was the most significant (barring maybe DASH) of a number of assets cited in the SEC enforcement against Bittrex on April 17th as a security. This came after ALGO staking on Coinbase was suspended on March 24th. It’s unclear what impact the SEC statement really has with respects to the status of ALGO in law, but the signal from regulators is enough to cause panic precisely because part of the ALGO bull case has always centred around its closeness to said regulators. SEC chair Gary Gensler was a colleague of Algorand founder Silvio Micali’s at MIT, and after the announcement, multiple videos surfaced of pre-SEC Gensler talking glowingly about Micali and Algorand.

XRP, XLM, EOS, XTZ: XRP and XLM were notable performers to the upside last month, so poor performance here is partially just mean reversion; however, it’s worth nothing that all four would theoretically be among those with the most to lose if US authorities were to start re-litigating the effective definition of a security insofar as it relates to live crypto assets.