-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Grayscale latest: “where’s the gap?”

On 8th February, we wrote that “resolution on the Grayscale trust situation has been slower than expected or desired over the last few months, and action since the start of 2023 has emphasised those issues.” The tale of the tape has been false dawns followed by long nights wrought over and over.

Executive Summary

-

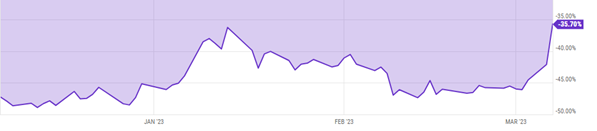

GBTC and ETHE discounts have contracted somewhat – -46% to -35% on GBTC – on recent stories surrounding the trusts.

-

The more significant of these was a positive hearing in Grayscale’s appeal against the SEC blocking conversion of GBTC into a spot ETF.

-

Our view: we remain wary of false dawns in all things Grayscale, and we are still practically infinite length from anything resembling finality, but there may be opportunities within the discount variance.

On 8th February, we wrote that “resolution on the Grayscale trust situation has been slower than expected or desired over the last few months, and action since the start of 2023 has emphasised those issues.” The tale of the tape has been false dawns followed by long nights wrought over and over. However, in the last week in particular, we have seen some developments that at least merit consideration.

The GBTC premium itself has mostly remained fairly stubborn around 46% precisely, with data from YCharts showing a very tight range in that regard even by recent standards. However, as can be seen, recent days have seen a fairly significant upsurge, with the discount narrowing to a reported -36% at end of day.

Two main events can be identified here. The first, lesser one was on March 6th, with the announcement that Alameda Research would be filing a lawsuit against Grayscale “seeking injunctive relief to unlock $9 billion or more in value for shareholders of the Grayscale Bitcoin and Ethereum Trusts (the “Trusts”)”, targeting a recovery of approximately $250m for Alameda creditors.

The arguments trotted out by the estate (as part of the broader John Ray-led FTX receivership) are the familiar ones – the 2% management fee is exorbitant, redemption should have been available long ago, and “if Grayscale reduced its fees and stopped improperly preventing redemptions, the FTX Debtors’ shares would be worth at least $550 million” (for reference, pegging the current market value of Alameda-held shares at $300 million, or about 2.5% of the total float of GBTC and ETHE combined).

While always good for grabbing a headline, the lawsuit seems like something of a non-story overall; it is the exact sort of lawsuit that will not proceed anywhere meaningful and is simply being done to cover bases on the bankruptcy experts’ side.

The somewhat more interesting story centred around the appeals court hearing with regards to Grayscale’s attempted ETF conversion and the SEC’s denial of it. To refresh on this: Grayscale has long pushed to convert the trust to an open ETF in order to increase its potential addressable market, stating that ‘this vision has been present from the beginning of our firm’. While questions can be raised on how precisely true that is – they pulled out of the conversion process before rejection in 2017 for instance – by most accounts, it is at least substantially true.

It can be argued that the current situation presents a powerful disincentive for Grayscale to convert and allow redemptions, because it would mean giving up on substantial management fees. We would, in fact, argue that. However, the scenario of opening redemptions being a net negative, or more importantly, actively and totally potentially destructive to Grayscale’s products has only really become the most probable one in the past year or so; up until that point, losses from redemptions would have likely been more than made up for by gains from greater market access. Hence, the company continues its processes in pushing for conversion, even though in the current climate it will likely make sense for them to delay said conversion.

In any case, the interesting thing was this: by most accounts, the SEC did not come off well in the proceedings. In particular, Judge Neomi Rao said what many within crypto have been saying for a long time:

“It seems to me that [what] the Commission really needs to explain is how it understands the relationship between bitcoin futures and the spot price of bitcoin…it seems to me that…one is just essentially a derivative. They move together 99.9% of the time. So where’s the gap, in the Commission’s view?”

The core of the SEC’s case in denying Grayscale – and all other spot-based ETPs – while permitting products like the Proshares Bitcoin Strategy ETF is that spot crypto markets are unregulated and can be manipulated, while futures markets are regulated (the US derivatives ETFs generally trade on the basis of CME futures) and cannot.

This stance has always been absurd on multiple levels, but for all the complaints that can be made on it from within the crypto industry (as we have done several times previously), in the words of Dwayne Johnson, “it doesn’t matter what you think” – what matters here is whether the legal and traditional financial world start seeing it as so.

For the most part, said legal observers have leaned towards Grayscale having won the battle with respects to the oral arguments. The most widely-circulated note in that regard came from Elliott Stein of Bloomberg Intelligence, who increased his estimated probability of Grayscale winning the case in some form from 40% previously to 70%.

If we took this totally literally, the reduction in premium compression from 46% to 35% may actually underprice things. We would not go that far; as we have said previously, it is both the underlying volatility of the asset and the open-ended nature of any Grayscale-related trade that accounts for the premium, and the latter would remain open-ended even in the case of a total Grayscale victory and the former is a bigger concern than ever (BTC has slipped back to $22,000 at the time of writing, and probabilities favour further downside over the coming weeks and months).

Nonetheless, it will be interesting to see if the premium continues to compress. The high water mark last year (in April) was -21%, and it seems not unrealistic that we could see the discount pegged back to a similar point in coming weeks, which would create both as solid of an exit point as is likely to be found in the next few months for existing GBTC-based trades, and potential opportunities to take advantage of said exists in order to short said discount ‘bounces’.