-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Arbitrum and airdrops

On February 22nd, while discussing Polygon (MATIC), we wrote: Layer-2 development has accelerated significantly as of late, with both optimistic and zero-knowledge rollups receiving a great degree of attention; both Optimism (optimistic) and Arbitrum (zero-knowledge) have been on upswings in almost all metrics…

Executive Summary

-

Arbitrum announced last Thursday (16th) that they would be airdropping a token, ARB, to users on Thursday 23rd March.

-

1.25bn tokens will be distributed to active users of the layer-2 solution.

-

The move is in line with common recent industry practice regarding delayed token launches for new protocols.

-

Our view: expect extreme volatility as airdrop beneficiaries cash out for what they can, but there remains good reason to be optimistic about ARB in the medium and long-term.

On February 22nd, while discussing Polygon (MATIC), we wrote:

Layer-2 development has accelerated significantly as of late, with both optimistic and zero-knowledge rollups receiving a great degree of attention; both Optimism (optimistic) and Arbitrum (zero-knowledge) have been on upswings in almost all metrics…The one place that we cannot judge is on token price for the most part; the way that ‘true’ layer 2s work generally mean that they do not necessarily need a token in the same way as Polygon does.

We then contradicted this almost immediately by noting that Optimism did still have a governance token, which hardly takes a huge leap to see as representative of sentiment on the network as a whole. This has often been the case in crypto, of course. If we were to point to an ignition point for 2020’s ‘DeFi summer’, the launch of the Compound governance token (COMP) on June 16th (and its usage as a reward for yield farming), and the launch of the Yearn Finance governance token (YFI) the very next day, would absolutely be it. We mention YFI over a myriad of other tokens specifically because the advertising on YFI from the developer’s side was to go to great pains to describe it as worthless:

In further efforts to give up this control (mostly because we are lazy and don’t want to do it), we have released YFI, a completely valueless 0 supply token. We re-iterate, it has 0 financial value. There is no pre-mine, there is no sale, no you cannot buy it, no, it won’t be on uniswap, no, there won’t be an auction. We don’t have any of it.

It has long been perceived as essentially inevitable that Arbitrum, in turn, would launch a governance token; the only question was when. Last Thursday, we received our answer – in one week (i.e. this coming Thursday), Arbitrum would launch the token by airdropping 1.275 billion ARB (out of a total future supply of 10 billion) to users.

At this point, it is crucial to understand not only what airdrops are, but what they have become over the last few years in crypto. Airdrops were initially conceived as something between a marketing scheme and a fairer early distribution method for new tokens, with initial airdrops generally consisting of just sending coins en-masse to random addresses on an existing network.

Airdrops faded in popularity over the course of 2017 through to roughly 2021, because a) transaction costs became appreciable enough on major networks (especially Ethereum) to make them prohibitively expensive, b) protocols found ICOs and then yield farming to be better ‘fair’ distribution methods that also had positive outcomes in terms of driving usage and hype towards said protocols. However, over the last two years, they have seen a resurgence in popularity, primarily because of better infrastructure allowing for better carrying out of selective airdrops and claim systems that reward users of the protocol.

To put this in extremely cynical terms: airdrops have come back because the model for most of the market has shifted from an immediate token launch to a delayed one, because unless crypto markets are in an overall frenzy, the existence of a liquid market for a token is far more likely to disappoint users than excite them in aggregate over time.

Airdrops are perfect for that, and there has been the emergence of something of a semi-symbiotic, semi-antagonistic relationship between protocols and airdrop farmers – users that perform activities on pre-token protocols in an attempt to qualify themselves for any future airdrop. These are symbiotic in terms of driving the metrics of protocols upwards, but antagonistic because, for all the talk of governance as the reason for governance tokens, airdrop farmers are ultimately vultures – they farm to receive the governance token, and tend to sell it immediately upon receiving it.

Why are we talking about the history and mechanisms of airdrops before anything about Arbitrum itself? Simply put, in terms of ARB as an asset in the short-term, it is far, far more important to understand the general rather than the specific. Airdrop assets operate as an extreme version of most crypto listings: launch high, perhaps see a pump that could last anywhere from days to literal seconds, and then significant declines over a period of days of weeks. OP was a particularly extreme example of this in June last year; note that while some of this could be attributed to the broader collapse of markets in June, OP was already down 46% from its first close (and 70% from its first open) when BTC fell below $28,000 support on 12th June.

No matter what the merits of ARB, it is likely to see a similar pattern. IOU markets have already opened on some less-than-reputable exchanges on ARB, and in the day or two following the airdrop announcement, the IOUs traded as high as $15 – something that would put ARB at a FDV of $100 billion, i.e. more valuable than all of DeFi combined or thereabouts. At the time of writing, ARB IOUs are trading at around $7-8, reflecting a circulating valuation of $10 billion and a FDV of $80 billion.

This is clearly absurd, but does lead to the question: what constitutes fair price, and how good are those long-term prospects?

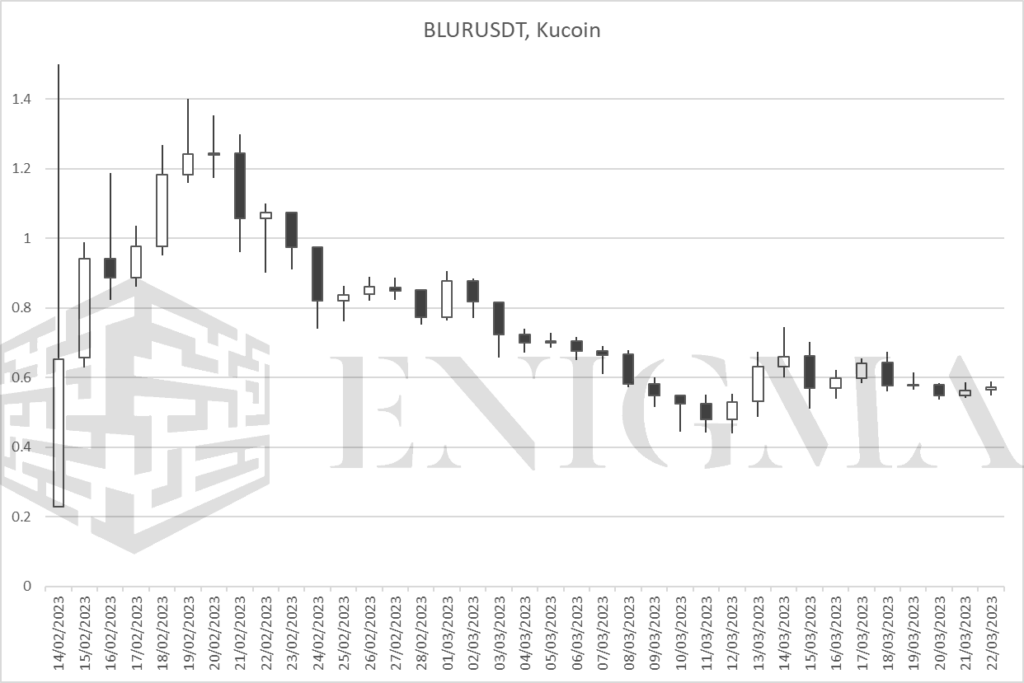

With regards to Arbitrum’s long-term prospects as a layer-2, there are a few general points to make. The first is that, in terms of current metrics, Arbitrum is generally even or better than Optimism. Per DeFiLlama, Arbitrum DeFi TVL is nearly $2bn to OP’s $1bn, and has 247 tracked protocols to Optimism’s 117. OP trades at a market cap of $800m circulating and $11bn FDV, so on that basis alone, a $2.5bn circulating/$20bn FDV for Arbitrum doesn’t seem nonsensical, implying a $2 valuation. Most indicative OTC pricing that we have seen is around the $1 to $1.50 range, so it’s possible that we may see early price action more like BLUR (airdropped last month to users of the Blur marketplace), wherein price swung upwards during the first few days of active trading (note that a day-1 wick up to $5.60 has been cropped off here):

Furthermore, it tends to be the case in crypto that the key is to be in a sub-sector that seems destined for an upward trajectory over the next couple of years; as we have said before, layer-2 scaling is absolutely one of those areas. In that regard alone, Arbitrum hence is interesting, or rather will become interesting once it weathers the first few weeks of price action.

That being said, the longer-term view for Arbitrum within said subsector is a little more chequered. The Arbitrum ecosystem is in practical terms thinner on the ground than the metrics would suggest (an old tale in crypto); the biggest app on the chain is probably GMX, a decentralised perpetuals exchange that initially launched on Avalanche in 2021, and has seen successes in previous months (perhaps most notably accruing higher one-day fees than the Ethereum base layer at one point in February) but whose continued success in coming months still requires monitoring (Perpetual Protocol, dYdX, and Mango Markets among others having demonstrated that such protocols are not necessarily as sticky as one would hope).

Additionally, the Ethereum Foundation and firms like Coinbase have been warmer towards Optimism than Arbitrum (with the latter building their Base layer-2 on Optimism’s tech). While it is never bad to be in pole position, as more eyeballs – and more money – enter the layer-2 space, it’s entirely possible that we see an erosion of Arbitrum’s early lead in the same way as we’ve seen many times before (e.g. Polygon vs. 2017-18 era scaling solutions like OmiseGo, or Solana vs. advanced layer-1s like EOS and Cosmos in 2021). On the basis of current metrics, it seems likely that Arbitrum will be overvalued against Optimism looking into the long-term.

Still: ARB volatility will eclipse OP in the short-term, and it remains worthy of monitoring. The elephant in the room here is of course that ARB, OP, and any other small-cap asset is likely to trade in high correlation to BTC and ETH, and while short-term action has been promising, it retains all the risks associated with that. In spite of that, it is still likely the asset to watch over the next few weeks.