-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Roundup, September 2023

A modest positive print on the month for both BTC and ETH, especially BTC at +4%. This wasn’t entirely unexpected, even in the context of our general and consistent bearish position on Q3 as a whole (which still ended -12% on BTC and -14% on ETH); as we noted in our piece on September 20th, our thinking was that market participants were likely over-indexing on the possibility of regulatory action in late September, and we did in fact see an extra +4% tacked on as of October 1st which probably wasn’t insignificant (albeit also perhaps connected to the launch of Ethereum futures ETFs in the US the day after).

Weekly Spotlights and Updates

Headline updates: FTX, ETF, BNB, September 13th

FTX: regulators agreed to allow liquidation on assets. It is unclear if liquidations have started yet; if they have, they appear to have had little market impact, with SOL in particular consistently overperforming. ETF: new news there has centred around Ethereum, with a number of firms filing for Ethereum strategy ETFs, and the first of those being approved on Monday, albeit to poor early volumes. BNB: only thing of note was Binance announcing its exit from Russia last week in an assumed attempt to ingratiate itself to Western regulators, with any scant goodwill from that probably undone by immediate (unconfirmed) rumours that Binance still substantially owns the CommEX entity that it sold its Russian business to.

BTC: September seasonality and the regulatory spectre, September 20th

Discussed in our markets section partially. Our general thesis here was that no judgements would come down in late September; there had been a couple of small cases prior to our research here, but nothing new has come down as of yet, and we expect to see some relief in markets beyond what we’ve already seen over the last couple of weeks.

Q3 market review and Q4 market outlook, September 27th

Discussed in our markets section.

Markets

Bitcoin and Ethereum

A modest positive print on the month for both BTC and ETH, especially BTC at +4%. This wasn’t entirely unexpected, even in the context of our general and consistent bearish position on Q3 as a whole (which still ended -12% on BTC and -14% on ETH); as we noted in our piece on September 20th, our thinking was that market participants were likely over-indexing on the possibility of regulatory action in late September, and we did in fact see an extra +4% tacked on as of October 1st which probably wasn’t insignificant (albeit also perhaps connected to the launch of Ethereum futures ETFs in the US the day after).

We wrote at length last week about our outlook for Q4 as a whole, but our core points there were that we do expect record-low volatility to break at some point in the next couple of months, and our inclination is that said break will come to the downside unless – and perhaps even if – the Bitcoin spot ETF applications are heavily accelerated compared to their current deadlines for approval in March.

We also mentioned in said piece that we were expecting a minor positive move in the first week or two of October. We have already seen a +9% tail-to-top since the publishing of that piece on BTC, but a pretty sizeable pullback off that on Monday; nonetheless, we tend to think that in the extreme short term, at current levels, risk/reward is weighted towards further action to the upside. The FTX trial (which began yesterday) seems in its early stages to be less of a media circus (at least one damaging to crypto markets) than it may have otherwise been, and we tend to think that there stands a good chance of a move up to around $31,000 on BTC (i.e. a non-breaking move) in the next fortnight or so as short pressure eases somewhat.

Interestingly, ETH specifically is in a rough spot, with ETHBTC falling below 0.06 for the first time since last June; this has mostly been in the context of a slow bleed downwards outpacing BTC, albeit with a sharp shock on Monday after the ETH futures ETP launched with near-nil volume (this shouldn’t have been unexpected – ETH still does not hold anywhere near the same mindspace as BTC does among the population at large, and in any case isn’t perceived in the same terms as BTC re: passive vs. active asset). We will likely see stabilisation and modest recovery on that in the short term should BTC improve, but if we do indeed see momentum drop into November and prices in general start trailing downwards, expect to see ETH move outsizedly to the downside as part of that move (towards ETHBTC 0.05).

Mid- and small-caps

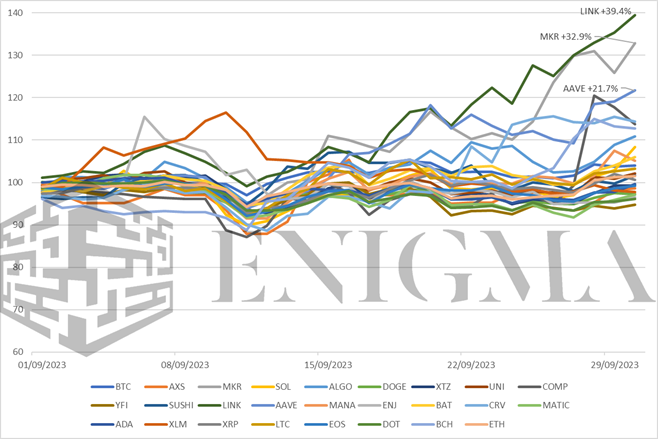

Standouts on the month to the upside:

LINK, MKR: LINK up 39% on the month and MKR up 33% for two of the best such marks for both assets in a long time. MKR was also a major winner last month, and we noted at the time that this was at least in part as a result of policy shifts among MakerDAO leadership away from Ethereum exclusivity. Two other factors to note with LINK now joining the party: first, there has been a significant uptick in interest in real-world asset solutions on-chain, and both LINK and MKR have historically and in the present positioned themselves to take pole position in facilitating that (LINK with proof-of-reserve verifications, MKR with its ongoing pivots towards USDC and then towards off-chain yield as backing for its DAI stablecoin). Second: it does need to be said here that both LINK and MKR have been serial underperformers in bull and bear alike for most of the last three years (MKR dropped 80% against ETH between its own local peak in August 2020 and May 2023; LINK dropped 92% against ETH over the same period), so some degree of simple correction needs to be accounted for here.

AAVE: Up significantly on the month at 22% for one reason alone: the Michael Egorov saga, for them at least, looks to be over, with the Curve founder entirely paying back his active position on the platform, eliminating the looming threat of bad debt. (CRV itself is up a more modest 14%).

Standouts on the month to the downside:

YFI, DOT, MATIC: In truth, there weren’t many significant downside cases this month, with the worst that we track being YFI at -6%; most underperformance centred around general bleed to the downside from inactive or relatively inactive projects. YFI’s bleed isn’t of much concern in the long run; what is a little more concerning is the continued struggles of DOT and MATIC. The former seems almost redundant as rollups gain more steam and better-resourced L1s like SOL (+9% albeit this probably won’t continue in October) stick around, while the latter has been even more directly sidelined by said rollups and a challenging bizdev environment. Both have largely gone to ground and are pushing big new upgrades – Polkadot 2.0 and Polygon 2.0 respectively – but both processes will inevitably be slow, and even if the plans work (Polygon’s plan looking the more solid of the two), stakeholders are likely to have to suffer a lot of bleed in the coming quarters regardless.