-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Roundup, October 2023

An enormously and outsizedly positive month with BTC +29% (best since January 2023) and ETH up a more modest +9% (still the best since March). We did come into the month relatively bullish on BTC because of what we saw as a likely unwind of short pressure from September, but had pegged $31,000-$32,000 as a ceiling on the move; instead, after capping out there for a few days, BTC moved upwards in a single fell swoop on the 23rd from $30k open to $33k close and has consolidated above it since.

Weekly Spotlights and Updates

Headline updates: FTX and FCA, October 11th

As expected, the FTX trial has played out in a relatively low-key manner over the last few weeks – with media scrutiny throughout, but with very little in terms of genuinely unknown or shocking revelations coming to light. Sam Bankman-Fried wrapped up his own testimony on Tuesday and closing arguments are set to begin today (Wednesday) with jury deliberation to follow. FCA: Bitfinex has now joined the list of exchanges to receive warnings but little else of note there; after its local advertising partner was rejected, Binance has for now stopped onboarding new UK customers but still reportedly intends to re-enter the UK market.

Bitcoin spot ETFs and fake news, October 18th

Fake news continued and continues to abound, as we talked about in the week after’s paper. Our expectations remain the same as ever: that spot ETFs will be approved some time between December and March, that markets will rally principally within range coming into the event, and likely fall off afterwards because the short-term impact of new market access granted by said ETFs is generally being overestimated.

BTC, ETFs, and the rally: 2020 redux?, October 25th

Discussed in our markets section.

Markets

Bitcoin and Ethereum

An enormously and outsizedly positive month with BTC +29% (best since January 2023) and ETH up a more modest +9% (still the best since March). We did come into the month relatively bullish on BTC because of what we saw as a likely unwind of short pressure from September, but had pegged $31,000-$32,000 as a ceiling on the move; instead, after capping out there for a few days, BTC moved upwards in a single fell swoop on the 23rd from $30k open to $33k close and has consolidated above it since.

While this consolidation is technically significant re: potential structure break and shift in the market, we tend to remain somewhat cautious. Our overriding concern here is that BTC is dominant in the market (gaining in the month on almost all assets, often by a significant margin) with little rotation seen into other assets – to put it bluntly, we think retail remains sidelined, that upside is still hence likely to be capped in the short term, and that while we sit in the middle of a new range for now, we are more likely to see regression back towards the downside than further upside in the short-term.

On ETH: significant ETHBTC contraction over the month all the way down to long-term support at 0.052. We expected downside on negative BTC performance but something closer to stabilisation on positive; while we should stress that this was a consistent downtrend, the degree to which it was still outpaced on green days overall for BTC is concerning. We do nonetheless see current levels as close to or at a short-term and medium-term bottom in terms of relative valuation.

Mid- and small-caps

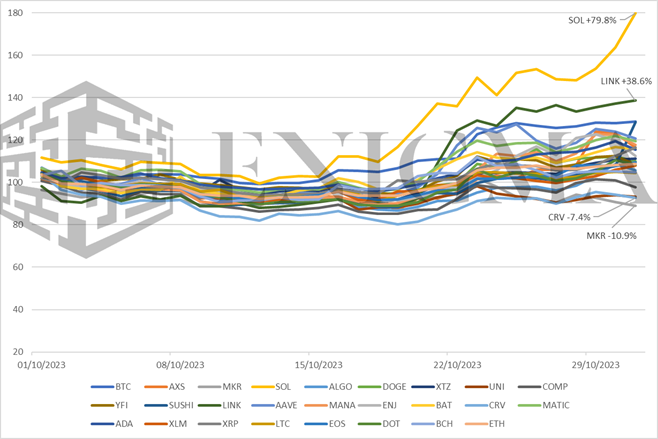

Standouts on the month to the upside:

SOL: Generally has outperformed over the last few months but significant growth in the back half of this month, finishing a tad shy of 80%. Why? A large part has been easing of fears over the FTX estate’s significant held reserves of SOL; as is often the case, there were concerns of an extremely sharp short-term market impact should the estate have proceeded to start to sell in an unsophisticated manner. The estate received approval to start liquidations on September 13th; after underperforming in the first two weeks after that announcement, SOL has generally been on the higher side since. Further, as we have noted in the past, SOL’s relative valuation was tracking too aggressively to the downside by the middle of the year (the network undoubtedly being the #3 layer-1 behind BTC and ETH). At a $16.5b market cap vs. $10b for ADA and $9b for TRX, we do think that RV is now somewhat elevated and that we will see a significant correction in the next two weeks or so (Solana’s annual Breakpoint conference runs through November 3rd; layer-1s often record gains during said conferences, and even more frequently see significant hangover corrections afterwards).

LINK: Continues to just find itself in the right place at the right time re: a heavy push towards RWAs and its facilitative role within that, very similarly to 2019/2020 (where it was a contributor to DeFi infrastructure and led almost the entire market). Market cap of $6.1b puts it above MATIC ($5.8n), UNI ($3.1bn), LDO ($1.6bn) and others. Like SOL, RV is becoming questionable, but lower chance of reversion in the extreme short-term.

Standouts on the month to the downside:

UNI, CRV, MKR: A weak month that in fairness likely has a lot to do with 1) poor performance from ETH and 2) mean reversion after a historically strong September. Why did MKR see reversion when LINK did not? Again, RWA narrative is quietly important to price action right now (which does again betray lack of retail participation), and while Maker has made noises in that direction, overall their exposure to the narrative is less direct than Chainlink’s. On UNI in particular: Uniswap announced that it would be charging a 0.15% swap fee for use of its frontend, which seems like it should be bullish (actual revenue!), but fees are going to the company rather than to token holders, thus bringing back into focus the ‘fee switch’ dilemma.

BCH, LTC: Slightly unusual – generally coins closely connected to BTC have tended to rally with it. There is again mean reversion involved here, and again, we think this continues to speak to the limited nature of participation in the current rally.