-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Roundup, June 2023

The BlackRock filing saved what was otherwise looking like a weak month, after May provided the first red close technically in five; BTC ended +12% in the aggregate on the back of a +27% low-high move between 15th and 23rd June. ETH (which had closed positively in May) had an overall worse month (being a passenger rather than a driver on the upswing thanks to the Bitcoin-specific nature of the headline impetus) but still managed to end at +3%. ETHBTC put in its lowest print since July 2022 at 0.0608 on June 29th close, albeit rallying somewhat on June 30th.

Weekly Spotlights and Updates

UK regulatory latest: Sunak’s accelerator, June 14th

The Financial Services and Markets Act passed its third reading in the House of Lords on June 19th, and was officially signed into law on June 29th; as we said in the piece, passage of the FSMA is significant for crypto assets in the longer term because it provides the framework for a framework to be build for the sector, but does little in itself to set out a more specific regulatory regime.

BlackRock, gold, and Grayscale: ETF latest, June 21st

Following the BlackRock filing, a number of other providers have re-filed their previous failed bids (most notably Fidelity). BlackRock have already had to amend their own filing because of ‘insufficient information’, though it is unclear exactly what information was supposedly missing from the first iteration. Outside of that, little news or further market impact, at least in crypto markets themselves; Coinbase stock however has seen around about a 45% move upwards since the filing news and is beginning to threaten previous 12-month highs in the process.

Q3 market outlook: continuity in the doldrums?, June 28th

Re-discussed in our market overview section.

Markets

Bitcoin and Ethereum

The BlackRock filing saved what was otherwise looking like a weak month, after May provided the first red close technically in five; BTC ended +12% in the aggregate on the back of a +27% low-high move between 15th and 23rd June. ETH (which had closed positively in May) had an overall worse month (being a passenger rather than a driver on the upswing thanks to the Bitcoin-specific nature of the headline impetus) but still managed to end at +3%. ETHBTC put in its lowest print since July 2022 at 0.0608 on June 29th close, albeit rallying somewhat on June 30th.

We gave a fuller discussion of our view going forward in last week’s Q3 outlook piece, but to reduce the focus to the shorter term, we are at a particularly odd point right now. BTC is above its April highs and trading at levels last seen in May 2022; that can not be ignored. Neither can the stabilisation over the last week or so looking somewhat healthier in pure price terms than similar events in March or April.

Our view has been that BTC is likely to continue finding itself at a local top at around $32,000, and that we tend to expect downside in the short term. We continue to reiterate that view. The holiday in the US makes the read harder than it would otherwise be, but volumes on most venues remain putrid, and we really cannot see anything that would lead to genuine medium-term momentum generating at the moment.

With that being said: the relative strength being shown here (e.g. the sell-off on 30th June over misconstrued reports about the BlackRock filing) is interesting. We think that downside is the more likely scenario, but the short-term upside case hinges on very little technical resistance being likely to exist between $32,000 and $38,000, hence implying potential upside upon a break of around 25% in short order.

We would be surprised to see a breakout or breakdown within the next week or two just because of the details of many of the potential impetuses for either move; however, coming into the end of the month and into early August, we see a violent move in either direction as exponentially more likely, and asymmetric scenarios emerging with regards to that possibility.

Mid- and small-caps

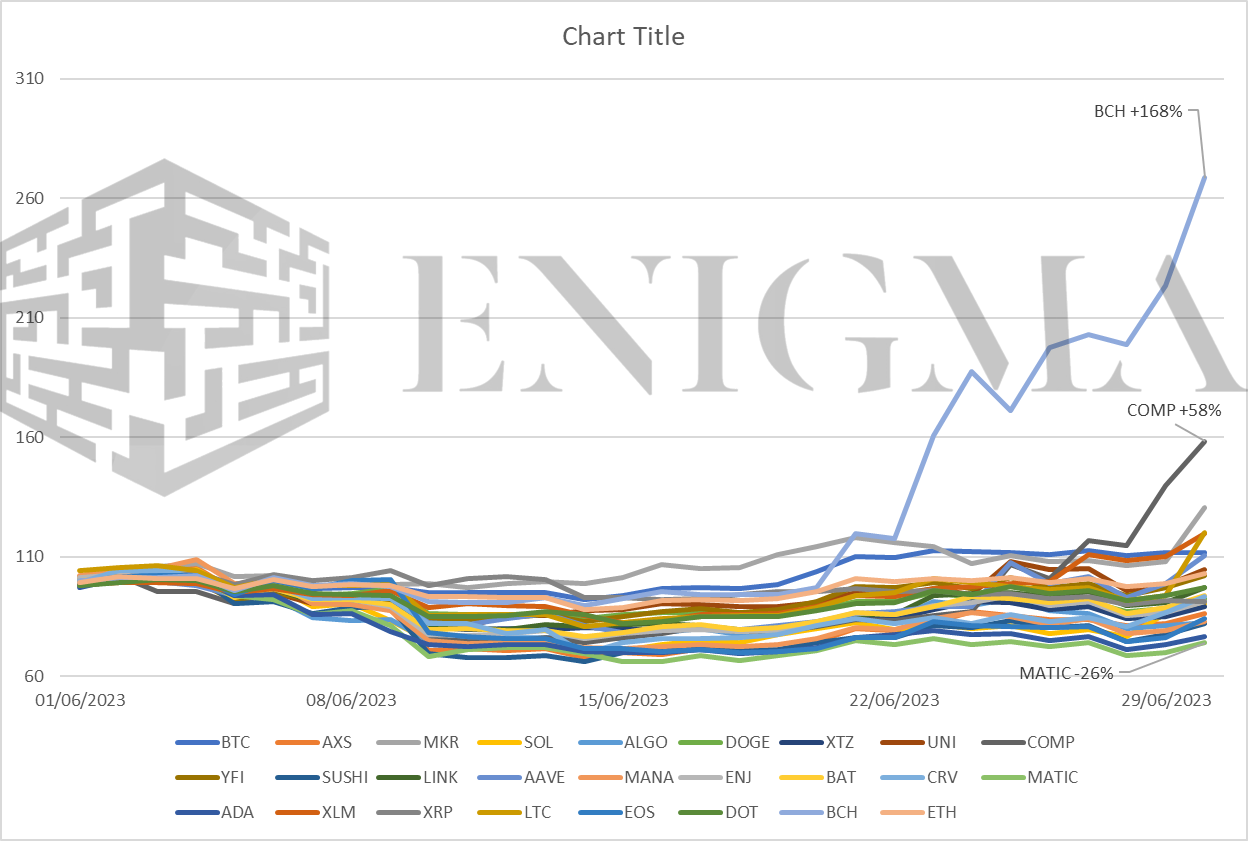

One of the more divergent months we’ve seen in recent memory, with significant downside on some of the largest mid-caps in the market for reasons that amount to little more than trend/momentum, and extremely significant upside on others for reasons that verge into the suspicious.

Standouts on the month to the upside:

BCH: Making our usual graph nearly useless, we see BCH at +168% on the month. Why? The general explanation being given centres around BCH being one of the few mid-cap assets that is almost completely immune to being labelled a security by US regulators (as a proof-of-work coin), and the presence of BCH on the newly-launched EDX exchange (a non-custodial exchanged backed by Citadel and Fidelity among others) alongside BTC, ETH, and LTC only. but isn’t really sufficient to explain something like a $3bn market cap gain in days. All that can really be said at this point is that the move was likely heavily futures-driven and doesn’t feel entirely organic, and it would be very surprising if it did not give way to a dramatic reversion over the course of the next month or so.

LTC, XLM: These two are more straightforward and likely can ascribe their gains on the month (both +20%) to their unusually clear regulatory status and their associations with EDX in the case of LTC and Coinbase in the case of XLM.

COMP: An unusually good month for DeFi bluechips; even CRV, which has been embroiled in a scandal over its use as collateral for risky loans by founder Michael Egorov, only closed at -7%, with most modestly up. For the most part this feels like a relief move more than anything else, but COMP (+58%) is worth highlighting; it saw massive gains towards the end of the month after founder Robert Lesner filed for the creation of a short-term government bond fund making use of Ethereum as a ledger (we should note that the project for now does not directly involve Compound; the momentum here comes from hopes that protocols like Compound and Maker will be able to carve out space in RWA tokenisation as it grows).

Standouts on the month to the downside:

ADA, ALGO, EOS: Alt-L1s continue to suffer as focus shifts towards scaling, layer-2s, ZK technology, and everything in-between, as well as continued concerns over the long-term status of certain assets with regards to potentially being considered securities. ADA (-26%) has been a particular victim due to its weak ecosystem and reliance on staking for inflows; we see a strong possibility that SOL overtakes it as the largest smart contract alt-L1 by market cap in the next month or two for the first time since March 2022.

MATIC: Despite the aforementioned focus, MATIC (-26%) has continued to slide. Why? To put it briefly, MATIC gained adoption precisely because it was a first mover in scaling, but rollups threaten to both outperform it and largely make it obsolete in the long run (at least as a distinct pseudo-layer-2 as opposed to a tech provider or something of that ilk). First-mover advantage is valuable in crypto, but it is not the be-all and end-all, and in terms of token value accrual MATIC looks like an increasingly uncertain prospect.