-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Roundup, July 2023

A weak month as expected. Both BTC and ETH reached less than 5% above their monthly opens ($30,500 and $1930 respectively) at their respective highs, and would both end the month at a few bps below -4%. As we said last month and in our Q3 outlook, we don’t see the market currently as structurally strong, and while something has to give eventually with low volatility, 1) it can persist longer than anyone expects (and tends to persist longer every time), 2) there aren’t that many impetuses on the horizon that can shake that out.

Weekly Spotlights and Updates

GHO, Aave, and the future of stablecoins, July 12th

GHO saw its first inflows on July 19th and market cap increase has so far been modest at around $10m as of the time of writing. GHO is currently trading below peg on most markets (at around $0.98) due to a mixture of low liquidity and concerns over AAVE’s near-term future due to the ongoing CRV loan-related potential bad debt issue.

SEC-Ripple: the good, the bad, and the ugly, July 19th

No direct developments of great note here, though one thing worth noting is that in SEC vs. Terraform Labs (the Luna/UST case), district Judge Rakoff denied a motion to dismiss yesterday (August 1st) on grounds that essentially directly contradict Judge Torres’ ruling. To quote: “Howey makes no such distinction between purchasers. And it makes good sense that it did not. That a purchaser bought the coins directly from the defendants or, instead, in a secondary re-sale transaction has no impact on whether a reasonable individual would objectively view the defendants’ actions and statements as evincing a promise of profits based on their efforts.”

On Worldcoin and odd ducks, July 26th

Price action on WLD has been stronger than typically would be expected, sitting at around $2.40 at the time of the writing. It should be said that this is a relatively high point across the week as a whole, and we would still tend to expect a slowing-down over the next month or so, but still – no news is good news.

Markets

Bitcoin and Ethereum

A weak month as expected. Both BTC and ETH reached less than 5% above their monthly opens ($30,500 and $1930 respectively) at their respective highs, and would both end the month at a few bps below -4%. As we said last month and in our Q3 outlook, we don’t see the market currently as structurally strong, and while something has to give eventually with low volatility, 1) it can persist longer than anyone expects (and tends to persist longer every time), 2) there aren’t that many impetuses on the horizon that can shake that out.

The Ripple case developments brought about a brief surge, but even that was concentrated mostly on altcoins rather than BTC or ETH themselves, and didn’t see BTC or ETH break through what we considered likely to be the local tops ($32,000 on BTC).

Our view broadly remains the same with regards to BTC/ETH trend being structurally negative for now exclusive of any countervailing headline impetus. For the next month or two, the possibility for said impetus to the upside remains any development on the BlackRock ETP; the pace here is nearly impossible to discern this far out, but we would say that it seems likely that the chart will tell the story first (i.e. a break on $32,000 BTC could imply news coming soon and therefore further upside).

While this is possible in August, we would also say that probabilities are higher that an impetus emerges to the downside. Two things stand out to us right now. Firstly, Binance’s ongoing woes as it continues to come under regulatory pressure; most stories are being shrugged off at this point admittedly, but if disaster were strike, it seems like that it would come out of the Binance stable in some form. Secondly, the CRV/AAVE situation, which we will explain in more detail in the mid-caps section.

Mid- and small-caps

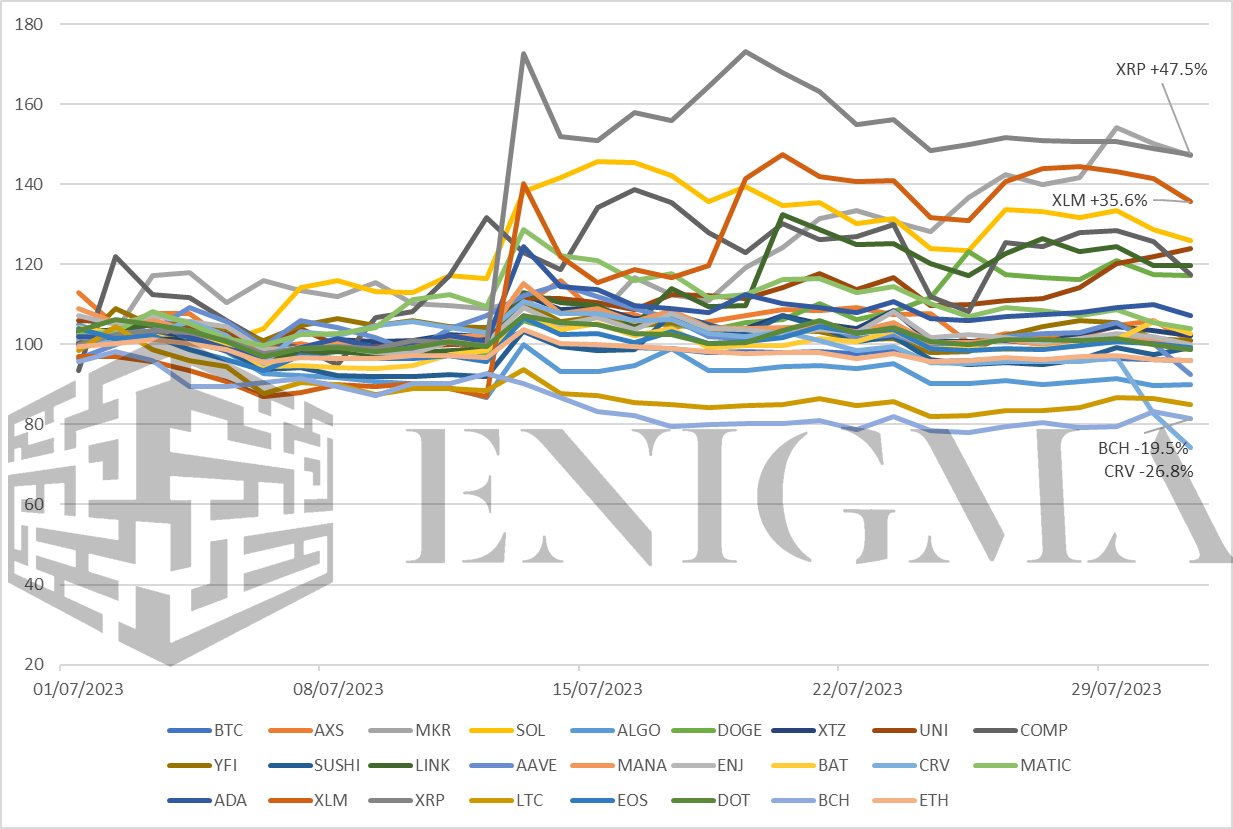

Surprisingly strong performance overall on the month from altcoins; this perhaps should not be too much of a surprise given the XRP ruling standing as the major headline point in general (which directly boosts almost all altcoins), but even outside of that surge, most assets outperformed BTC and ETH, which is very rare in stagnant or bearish periods within crypto.

Standouts on the month to the upside:

XRP, XLM: In short, the big victors of the XRP case; XRP directly, and XLM because the two chains are so alike in use cases, market, etc. and have traded so closely in tandem over the last few months. It will be interesting to see if the XLM correlation survives the re-listing of XRP on major venues given that said correlation could be ascribed to it being the only way for many to get exposure to something XRP-esque on the likes of Coinbase and Kraken.

MKR: Maker’s move upwards seems to be on the back of a token buyback program that went live on July 21st – to put it briefly, excess DAI in Maker’s surplus system will be used to buy back the MKR governance token programatically. Experience in the last bull market was generally that these sorts of ‘soft’ buyback schemes generally stop having a significant impact on price or momentum after about a month or so, so that should be borne in mind, but Maker has been such an underperformer relative to its overall position in DeFi that it could easily run up further over August and early September before starting to slow back down.

SOL: As mentioned, most mid-caps overperformed, but the one other one worth singling out here is SOL. We said last month that we could see SOL reclaiming the lead in market cap over ADA, and in fact it did that intermittently between July 14th and July 17th, before falling off somewhat towards the end of the month. It does seem likely that the next month or so may be rougher again for it (the last thing that SOL ever wants is public focus on FTX and the like), but we reiterate that it seems in a better medium-term position than it has been at any other time over the last year or so, particularly if the L2 hype cools after Base’s disastrous pre-launch.

Standouts on the month to the downside:

AAVE, CRV: This could command an entire research piece on its own, and may still do so in time, but in brief: Curve Finance is a decentralised exchange platform and a long-standing DeFi blue chip. A version of Curve’s architecture had a bug that allowed pools to be drained, and several were on Sunday, mostly from protocols that used Curve’s tech such as Alchemix but also at one point with the CRV-ETH pool itself.

This naturally led to a CRV selloff, which brought back up a long-standing problem on AAVE – a huge portion of the circulating supply of CRV is held by founder Michael Egorov, and a huge portion of that holding is collateralised on AAVE for a $60m loan on USDT. That loan is perpetually worryingly close to undercollateralisation/default, and if (or in some readings when) that happens, AAVE will be left with bad debt due to the near-impossibility of liquidating that much CRV. While not an existential risk or anything like that, this would have contagion risks throughout the ecosystem.

Egorov has looked to defend his position, including making multiple significant OTC sales of CRV at far below market price to pay down part of the debt, but the situation remains an ongoing concern that weighs heavily on both CRV and AAVE, hence the drop. The situation does look to be stabilising at the time of writing, but these things can of course always turn suddenly, and even in the best case scenario we wouldn’t expect a particularly aggressive rebound.

BCH, LTC, ALGO: The only other three coins on our watchlist to underperform BTC and ETH. For BCH and LTC, this was a lot to do with pure mean reversion – the two surged very late in June primarily because of being two of the only assets to explicitly escape scrutiny on the SEC’s anti-midcap push (and their listing on the new EDX Markets venue), and as expected, that price action wasn’t particularly sustainable particularly when the Ripple case took a little weight off the rest of the market. ALGO continues to disappoint in general and will likely always naturally struggle in the current structure when competitors like SOL are on the up.