-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Roundup, January 2024

One of those classic months where the monthly candle tells a very misleading story. Both BTC and ETH ended the month higher than they started it – in ETH’s case by fractions of fractions of a percent, for BTC by a more substantial +0.61%, representing the fifth consecutive positive monthly print for both (first time since February 2021).

Weekly Spotlights and Updates

On ETFs and RWAs, January 10th

As we have openly gloated about in every weekly since, the spot ETP launch in terms of price action and demand dynamics has gone pretty much entirely as expected – day-1 dislocations did not last until day 2, net inflows were modest, price hasn’t come close to touching highs (on BTC) set minutes before the ETPs launched, and the brief panic around quick downside because of GBTC flows has also not come to pass. We exited January at a relatively nominally high mark ($42.5k); we continue to expect a slow negative trend through the remainder of Q1 from current levels.

Explaining the BTC ETP market, January 17th

The spot ETP market in the US has progressed roughly as expected – GBTC continues to see outflows, IBIT and FBTC are the most liquid instruments and have seen the largest inflows, total AUM sans GBTC stood at $7bn at the end of January. APs were able to process $640m in one day on January 22nd (i.e. the $500m figure was a soft cap rather than a hard one) but outflows have now started to slow significantly and the discount on GBTC has been basically non-existent since the week beginning January 29th. To re-emphasise, the degree to which GBTC outflows represented a negative supply-side event in themselves was overstated in the days after the ETP launch, and while we will probably continue to see slow outflows from Grayscale for a while yet, our general bearish thesis on Q1 just relates to a lack of demand (note that many of the smaller tickers are no longer seeing daily consistent inflows and even FBTC in the #2 spot is down from around $150m a day in the first two weeks to $30-40m already).

After the spot ETFs: outlook for BTC, January 24th

ETHBTC and the future of finance, January 31st

Discussed in our markets section.

Bitcoin and Ethereum

One of those classic months where the monthly candle tells a very misleading story. Both BTC and ETH ended the month higher than they started it – in ETH’s case by fractions of fractions of a percent, for BTC by a more substantial +0.61%, representing the fifth consecutive positive monthly print for both (first time since February 2021).

Of course, this masks all the volatility within said month. BTC moved up to threaten key levels ($48k) not challenged since April 2022, and 2021 before that leading into the ETP launch, before going on a ten-day slide after that back down to $38k. ETH meanwhile, which has struggled across 2023 but in particular since spot ETF acceptance became an inevitability in September, finally saw a significant surge against BTC…for about two days, before giving up most of those gains and ending the month slightly negative on ETHBTC.

We laid out our general market outlook for BTC going forward last week, so to recap: we lean bearish across the remainder of the quarter. While we don’t consider the GBTC situation to be serious (particularly on an ongoing basis), we ultimately think that markets were overbought in Q4, and that there was and is very little in the way of retail demand coming in which, like it or not, is a prerequisite for any genuine bull trend in any speculative market. We tend to think ETH has also essentially bottomed against BTC but is unlikely to gather significant independent momentum over said period.

Going into Q2, we think any spot ETH ETP approval is likely to be underestimated (especially with the modest nature of BTC ETP flows and the misplaced concerns over ETHE dragging markets down after GBTC outflows) and will be a bullish catalyst on arrival due to the attention that it will bring ETH as an asset. We hence expect ETH to end up being the first up in terms of short-term overperformance among large-caps when markets do move. We reiterate that our general view is major upside in Q4 or late Q3, but likely no challenge on all-time highs until 2025.

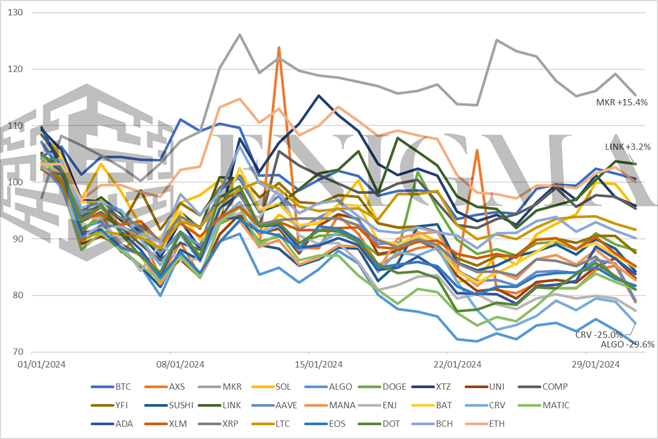

Mid- and small-caps

Standouts on the month to the upside:

LINK, MKR: January was an extremely rough month for the field in general; out of the assets we track most closely, only four finished above even, and two of those were BTC and ETH. The two exceptions – LINK and MKR – are a relatively familiar tandem; both are heavily connected to RWA assets, and hence have tended to perform well when the rest of the market struggles because of that. At this point, we wouldn’t be surprised if LINK replicates what we saw with it in 2019/2020 with regards to overperforming significantly during a pre-bull market period of consolidation (albeit ultimately disappointing after that); the same could be said of MKR if rates remain elevated and rates cuts fail to materialise in Q2.

Standouts on the month to the downside:

AAVE, CRV: Taking a broader view here, performance on DeFi bluechips wasn’t too bad all things considered this month; yes, all returned negatively against all of USD/ETH/BTC, but given their long-term tendency towards underperformance anyway, and the likes of COMP and YFI having some of the fewest overall losses, things could have gone a lot worse all things considered. The two notable laggards were AAVE (-23%) and CRV (-25%); we tend to think that this slight underperformance relates back once again to the Michael Egorov situation, which – while largely resolved at this point – came back into the headlines for a bit due to the expiry of the handshake lockup agreement on CRV that had been OTC sold by Egorov back in September. We are inclined to expect a bounce on both CRV and AAVE this month as a result, particularly given encouraging developments on Aave’s GHO stablecoin (now trading within 50bps of peg instead of the persistent -2% or more discount it has generally traded at over the last few months, and even nominally hitting said peg on certain venues for the first time yesterday).

DOT, ADA, ALGO: Among the worst performers were DOT (-20%), ADA (-17%) and most notably ALGO (-30%). As we have said many times, while there’s going to be a moment in the cycle where any given alt-L1 could see a sudden and outsized surge, in general and in next, expect underperformance. The uncomfortable secret with L1s in general is that turning a L1 from an empty shell into something with genuine activity is a process that takes several billion dollars being thrown out to anyone who will take it – essentially, you have to create a significant developer community with enough sunk cost that they stick on the chain, and eventually by sheer virtue of numbers that developer community will stumble into something that will get adoption (at least within the context of crypto). Ethereum did this back in the day with Consensys, and Solana held onto enough runway and was aggressive with it in 2023 to break through. On all three of the L1s mentioned, as with others, we haven’t seen enough consistent signs of such an approach, and hence we would tend to expect them to continue to lose ground on SOL and lose ground to various upstart L1s going into 2024.