-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Roundup, February 2024

OI has – unsurprisingly given recent price action – continued to rise, albeit not too far above levels on February 14th, and with micro-BTC in particular seeing a decent sell-off/shift towards the short side going into last week. Whatever the dynamics were at play there, it doesn’t seem to have correlated particularly strongly with price movements in the short-term, though next week’s report (coming after February expiry and before/during the ongoing breakout) should be interesting.

Weekly Spotlights and Updates

CME futures and CFTC data: BTC and ETH, February 14th

OI has – unsurprisingly given recent price action – continued to rise, albeit not too far above levels on February 14th, and with micro-BTC in particular seeing a decent sell-off/shift towards the short side going into last week. Whatever the dynamics were at play there, it doesn’t seem to have correlated particularly strongly with price movements in the short-term, though next week’s report (coming after February expiry and before/during the ongoing breakout) should be interesting.

Ethena and the yield race, February 21st

Ethena almost immediately got itself into controversy after pens went down on our article. Ethena realises its yields on the basis of epochs, and in spite of collecting an impressive 44.3% APY, initially tried to cut back the APY paid back to stakers to just 15.2% (probably not coincidentally almost identical to what we identified as the ‘default’ rate for the product) and pay the rest into the insurance fund. This was immediately and robustly hit back on by the community, and Ethena were forced to walk that back; going forward, the protocol intend to pay full APYs to stakers and instead pay nearly all non-staked USDe gains into the insurance fund (which, for now, are substantial, with 57% of USDe not actually staked). This was the right call, and Ethena may be on the cusp of explosive growth given that funding rates even on large-caps have jumped heavily as price has increased (consistently running at over 60% and going 100%+ regularly on BTC and ETH), but this does again speak to the entire tail risk with Ethena: there is a degree of trust involved with regards to how Ethena conducts operations internally that is more significant than its initial branding seemed to let on.

BTC ETPs latest: assessing the field, February 28th

Inflows fell just short of hitting new highs on Sunday – $648m net albeit with heavy countervailing GBTC flow. Note, however, that mention of GBTC flow – it was down to very small amounts just a couple of weeks ago, but is back into the $300-$500m range again now. While much is being said now about non-price-sensitive ETF flows propping up BTC (and therefore, moon etc.), we have to note here that we are seeing high volume but relatively little net price appreciation during the windows where the buying to support said ETFs is happening (late evening European time, late afternoon US time) with gains instead concentrated during the Asian session (up until about 9AM European); the flows over the next couple of days as momentum threatens to cool off somewhat will be interesting.

Markets

Bitcoin and Ethereum

One of the best months in recent memory from a price appreciation and long-term holder’s perspective, and one of the worst months in terms of making any intuitive sense with regards to how it trades on low time-frames. To put it simply, sellers have been nowhere to be found; the post-ETF launch drawdown and stabilisation ended up leading to a seismic rise between the 7th and the 16th to $52k, protracted strength there, and the parabolic action over the last week or so to take us to a new nominal all-time high. ETH has also outperformed in the net, though this is significantly less surprising given how oversold it was previously.

The general rule with crypto markets is that double/triple tops don’t exist and to buy any breakout. We shifted our own medium-term bearish view above around $48k or so, and we ultimately think the risk-reward on almost all time frames has to slant towards favouring upside at this point across the board. There are two general notes we would make, however. The first is to point out what we alluded to earlier: high breaks are transformative but there is still a tendency for momentum to stall at them. BTC’s 2017 high was always a little disputed with regards to the ‘real’ number, but it was generally adjudged to be somewhere between $19k and $20k; the initial break on $19k on November 24th saw momentum drain for a couple of weeks and we didn’t reclear and go above $20k until December 16th. While markets have defied every expectation with regards to where they should stall over the past few months, it is something to bear in mind especially with the red flags being put up by things like perpetuals funding rates.

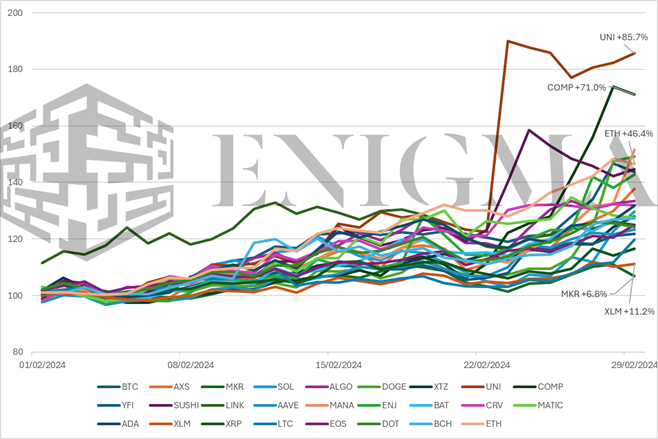

The second is how money rotates through different crypto assets when markets do run. Right now, with retail only just starting to buy in, we think it’s safest in general to look towards the ETHBTC ratio; ETH has been stuck in a corridor between around 0.050 and 0.063 since it broke down vs BTC in June 2022, and we tend to expect it to keep within that corridor in the short-term, thus making for some potentially very easy RV or long-short treades there. It seems to us very unlikely that ETH ultimately breaks towards the downside in the medium-term (i.e. outside of that channel), and our view has been since January that the ETF ETF will be bullish, though perhaps a little pause for thought will be needed if the expectations for said ETH ETF ramp up drastically going into it (right now they still seem measured). We have seen a small ‘memecoin’ craze again in the last week or so, so in terms of assets of a high enough quality to be generally tradeable, we would tend to expect a rotation of BTCETH -> DeFi and L2s (L2s in particular have been underbought for most of the last month) -> other easily ETH-accessible sectors (e.g. LINK, SNX, DYDX, maybe ATOM) -> more stagnant assets and alt-L1s. The temptation is always strong in these cases to chase into new ecosystems; we don’t think the market is there yet in general.

Mid- and small-caps

Standouts on the month to the upside:

UNI, COMP: Very, very few assets that we track actually outperformed either BTC or ETH this month which speaks to the nature of the rally. Two of the outliers were UNI (+86%) and COMP (+71%). There isn’t an obvious specific reason for why COMP went up beyond the cost of borrowing in general suddenly ramping up across crypto (Compound’s USDC borriwng market is currently decently over the 93% level at which APRs increase significantly and hence nominally is quoting around 14% borrow APR at the time of writing), but for Uniswap, the jump came from positive developments on the utility of the token itself; to cut a long story short, Uniswap’s token was launched with an implication that eventually a ‘fees switch’ would be turned on and therefore UNI holders would get some share of fees from the protocol. This has, to date, not happened, with the somewhat-spoken reason being that it would open UNI up to scrutiny with regards to potential securities status in the US. The protocol recently put forward a proposal for rewards for staking and delegating UNI which would ultimately fill a similar function to the fees switch; UNI ended up running up nearly 50% in a day on said news. We would question how far it can really run even on positive momentum on the market in general and around its sector in particular (bearing in mind it already sits at the #14 market cap at around $12bn) but there is some potential there.

DOGE: The only other coin in terms of our main tracked ones to surpass BTC and ETH was DOGE – up 49% in February and more in March as part of a more general ‘memecoin’ craze (SHIB – esentially the ERC-20 version of DOGE – is up 215% in 7 days, while other coins like WIF, PEPE, FLOKI, and BONK have returned comparably). As usual, this is all based on nothing, and DOGE has pulled back somewhat today. Nonetheless, we would not be surprised to see it run up further in RV versus majors in the next couple of months; the market cap against BTC and ETH is currently almost exactly 20x on ETH and 55x on BTC, and it did get to 13x and 19x respectively at its peak last cycle (and retains the properties that have made it inherently attractive to retail buyers in every bull market since 2015).

Standouts on the month to the downside:

MKR, XLM, XRP: As mentioned, while almost every asset was positive this month in USD terms, most underperformed, and a few badly underperformed. MKR leads the list at just +7% – this is far from the first time that we have seen a tendency for MKR to show relatively low correlation to the rest of the market, and right now we think there’s a sort of ‘hangover’ going on from the degree to which MakerDAO has emphasised access to RWAs and real-world yields as its general selling point over the course of 2023 (i.e. it makes MKR the last port of call when the rest of the market is in a speculative fervor). XRP and XLM are suffering along similar lines; their increased focus on remittances and forex is a hard sell to speculative investors, and that combined with a lack of retail buyers on established venues have left them in a spot primed for underperformance overall.