-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Q3 market review and Q4 market outlook

At the time of writing, there remains a few days left on the board for Q3, but barring a development with very few analogues (ironically the ‘Xi pump’ in the last week of October in 2019 is probably one of them), the picture looks to be drawn for Q3 2023 – and, with this being the case, it has to be said that it has played out very predictably.

Executive Summary

-

We review market structure in Q3 and look towards Q4.

-

Q3: low volatility and downwards bleed, very much as expected.

-

Q4: short-term constructive, potential full-quarter upside, but expect volatility to downside in spells in November/December

Q3 market review

At the time of writing, there remains a few days left on the board for Q3, but barring a development with very few analogues (ironically the ‘Xi pump’ in the last week of October in 2019 is probably one of them), the picture looks to be drawn for Q3 2023 – and, with this being the case, it has to be said that it has played out very predictably.

Our Q3 outlook back in June stressed two main things: that the tightening volatility that had started to take shape particularly towards the backend of Q2 was likely to continue through the entirety of Q3 in spite of an increasing chorus of expectations (or hope) for a breakout, and that with volatility low and price therefore range-bound, it was overwhelmingly likely that we would exit Q3 at lower levels than we entered in.

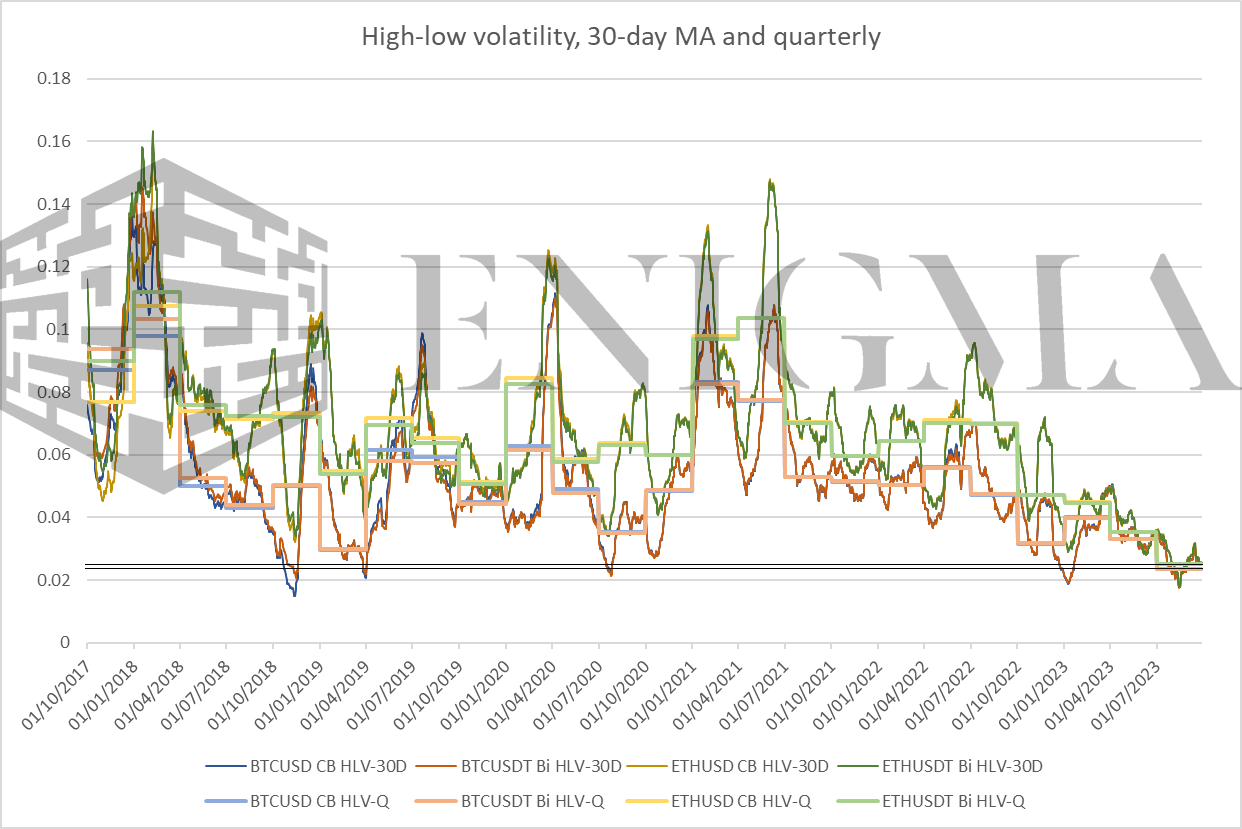

The former has certainly played out. High-low volatility (i.e. the average daily deviation between high and low prints) will come in at around 2.3% on BTC on most venues. Q2 (3.3%) was comparable to some of the most fallow periods post-2019; this goes further than that. Coinbase BTC-USD data goes back to Q2 2015, and volatility here will just about scrape below the absolute low mark (2.36%) set in Q4 2016. Furthermore, ETH – which has always seen significantly higher-volatility intra-day than BTC even when the two have been at their most correlated – is barely more volatile (~2.5%), continuing a convergence seen for the first time in Q1 of this year and obliterating previous record lows in its case.

We will discuss more on longer-range volatility later, but certainly for Q3 at least, volatility remained compressed throughout. In terms of price overall, we will indeed exit the quarter lower than we entered in, though this doesn’t quite tell the whole story.

While we do see market structure overall in bearish terms, our argument for lower across Q3 as a whole was not because we expected a significant downturn or negative catalyst; as we laid out in that research, while neither was particularly likely, an event-driven view overall tilted towards more potential positive catalysts than negative, with the former being fairly straightforward (positive to extreme-positive outcomes on the Ripple and Grayscale cases) and the latter being far murkier (Binance’s ongoing position re: regulatory scrutiny).

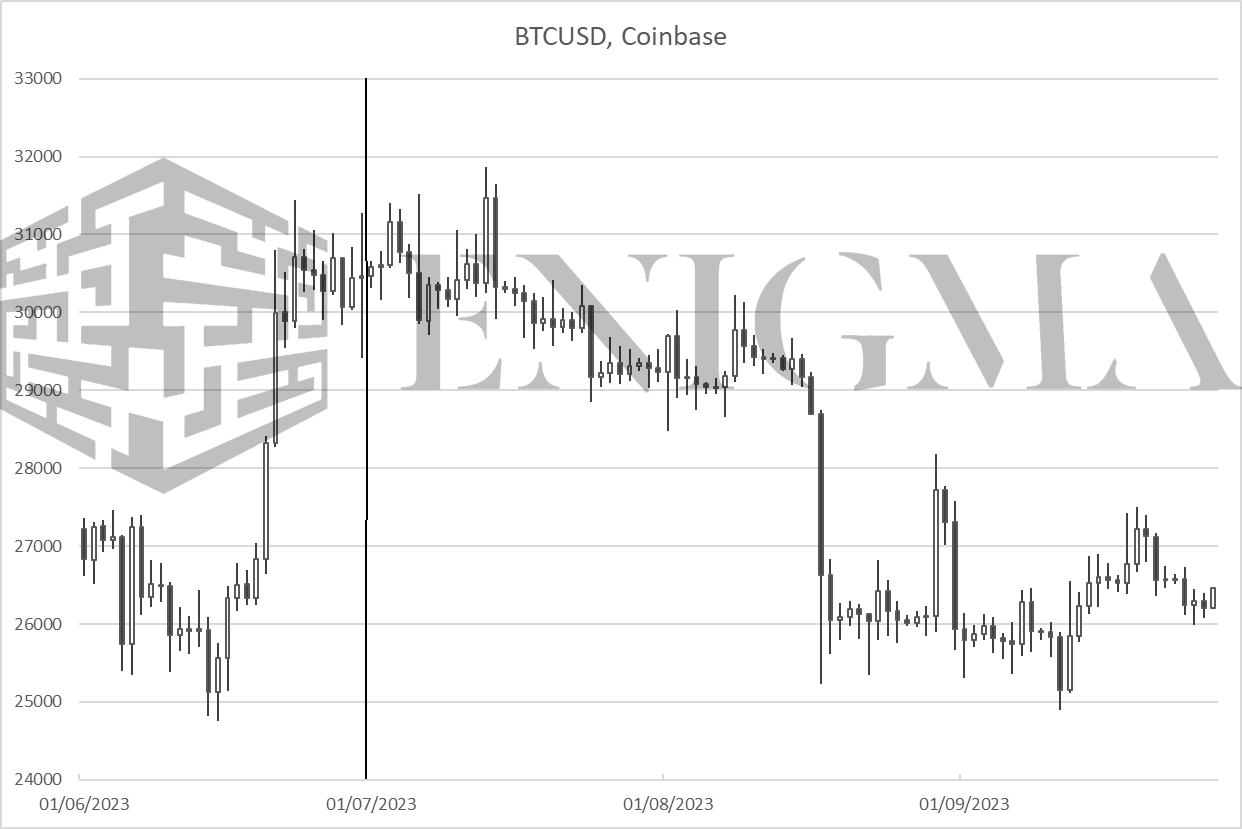

In the end, even those positive catalysts (in the forms that we received them – Ripple was positive and somewhat beat expectations, Grayscale was positive but in line with expectations) failed to change market structure, with only Ripple of the two even seriously challenging it (the quarterly high at around $31,800 on BTC was put in within minutes of the Ripple judgement); and while losses were concentrated in a few days nominally (particularly 17th August – this came without a clear impetus, with the closest thing having been the realisation of a delay on the Grayscale judgement from 15th to eventually 29th August), on the whole, we have seen a slow grind downwards.

We of course tend to focus on BTC as a proxy for the markets as a whole in any case, but it should be noted that even by the standards of said markets (i.e. extremely heavily correlated), Q3 saw little to talk about.

Most assets, including ETH, have done little except trail BTC slightly to the downside – as they typically do when market structure is in this low-volatility, low-demand state. Of the five that we track most closely among mid-caps, three (XRP, XLM, SOL) are beneficiaries of a surge around the Ripple decision in July (for reasons relating to some clarification on their securities status); the other two are MKR, which has embarked on an aggressive campaign of cross-chain and layer-2 expansion as its ‘Endgame’ proposals are clarified (and was a serial underperformer throughout the bullmarket), and LINK, which is in a similar situation re: expansion and historical underperformance.

Q4 market outlook

So: where to next? To be entirely clear on this, our thesis on the market being structurally negative at the most basic level boils down to the idea that there is no significant amount of money coming in or out. There is a reason why we have seen a push to emphasise things such as the proof-of-stake move for Ethereum technically opening the door to the asset becoming long-term deflationary (it is worth noting here that after an actively deflationary April/May, supply settled and is back to being modestly inflationary since the start of the month); crypto was designed to be non-consumptive, and if the post-Bretton Woods era of precious metals markets have taught us nothing else, it’s that even a supply-stable asset of that ilk turns everyone into a promoter.

Structurally, this changes with greater market access. It still seems overwhelmingly likely that we will see the go signal for the ‘final frontier’ in this regard, at least for BTC, with the approval of spot BTC ETFs in Q4 or Q1 2024. To restate the situation there in brief: BlackRock has submitted a spot BTC ETF application, it is seen as unlikely that BlackRock will be rejected given their track record (only one prior rejection – an attempt to create an actively managed ETF), all other spot ETFs have re-filed to sync with the BlackRock ETF’s deadlines, and said deadlines at maximum extension are in mid-March 2024.

The standing theory is that, after the Grayscale loss (which forces the SEC to re-review Grayscale’s application though it does not compel them to accept it), the SEC will retreat from their anti-spot ETF stance (given that they have already accepted futures ETFs, and the Grayscale case specifically saw their main blanket reason for denying spot ETFs – that spot markets could be manipulated while CME futures markets could not in spite of the former completely underpinning the latter – was rejected in court) and approve several ETFs at once (in order to not ‘crown’ any individual provider).

We currently tend to think that a decision will come down before the March deadline, most likely in late December, but this will be a month-to-month and week-to-week consideration in practice. While approval is unlikely to augur a major short-term shift (albeit possible depending on conditions at that moment), we should see a local low set roughly within two weeks of the move on either side, with markets being constructive from there.

Outside of the spot ETF, while we tend to think that we are on the cusp of a minor positive move through the first week or two of October (late September sees an increased concentration of SEC/CFTC cases, but as we said in last week’s spotlight, we think the bark of said threat is far greater than its bite), we lean bearish. Why? We railed against expecting a breakout just on the basis of low volatility in June due to said periods of low volatility becoming longer and longer in a more developed market; but, even acknowledging that, we are entering the 28th week since the last major breakout (the move from $21,000 to $28,000 on BTC on the week of 13th March).

This is now getting into territory without real precedent, and we expect a change in structure prior to any ETF decision. Unfortunately, this means that said move will in all probability be towards the downside. The good news and bad news are the same here: it is unclear what said event could be, with Binance’s problems overall continuing to smoulder near-imperceptibly, the FTX sales unlikely to even show on the seisometers, and in general most industry anxieties being longer-range ones at this stage.

Market reaction to headlines in general has been notably muted over the last few months (again, note that the one major directional move in Q3 was not directly linked to a headline impetus). We tend to think that this will likely change through November and December; the crucial thing here will be not to be caught off-guard in underestimating volatility as a whole when that shift does happen.

With regards to a simple projection: across the quarter as a whole, given the levels we are entering in, we lean very slightly bullish, primarily on the logic that we are unlikely to touch Q4 2022/Q1 2023 lows even in the case of a breakdown and hence are presented with asymmetric risk/reward towards the upside (the opposite of Q3). However, expect a wide range; the closest models here are Q3 2016 and Q4 2019, both of which ended substantially off the intra-quarter lows but still negative (-10% and -13%) on their respective quarters.