-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Q3 market outlook: continuity in the doldrums?

Q2 has not exactly been lively for crypto. Our view coming into the quarter was that, in spite of the rally in mid-March, upside was likely to be capped and baseline directionality leaned negatively; markets were no longer in a state of panic, and had held up surprisingly well in the face of action like the Binance CFTC case (note that this was separate to the SEC case – the CFTC case did go along similar lines but came out in late March), but we felt that macro and general uncertainty provided a ceiling on growth, and that we were probably already close to that ceiling.

Executive Summary

-

We look this week at the outlook for BTC, ETH, and crypto markets going into Q3 of 2023, and different possible cases for directionality.

-

Q2 largely played out as expected with a weak negative trend and failures at expected levels of resistance.

-

Our median-case expectation for Q3 is extremely similar to Q2 - at current levels, this would tend to imply downside against the expected quarterly open.

Q2 has not exactly been lively for crypto. Our view coming into the quarter was that, in spite of the rally in mid-March, upside was likely to be capped and baseline directionality leaned negatively; markets were no longer in a state of panic, and had held up surprisingly well in the face of action like the Binance CFTC case (note that this was separate to the SEC case – the CFTC case did go along similar lines but came out in late March), but we felt that macro and general uncertainty provided a ceiling on growth, and that we were probably already close to that ceiling

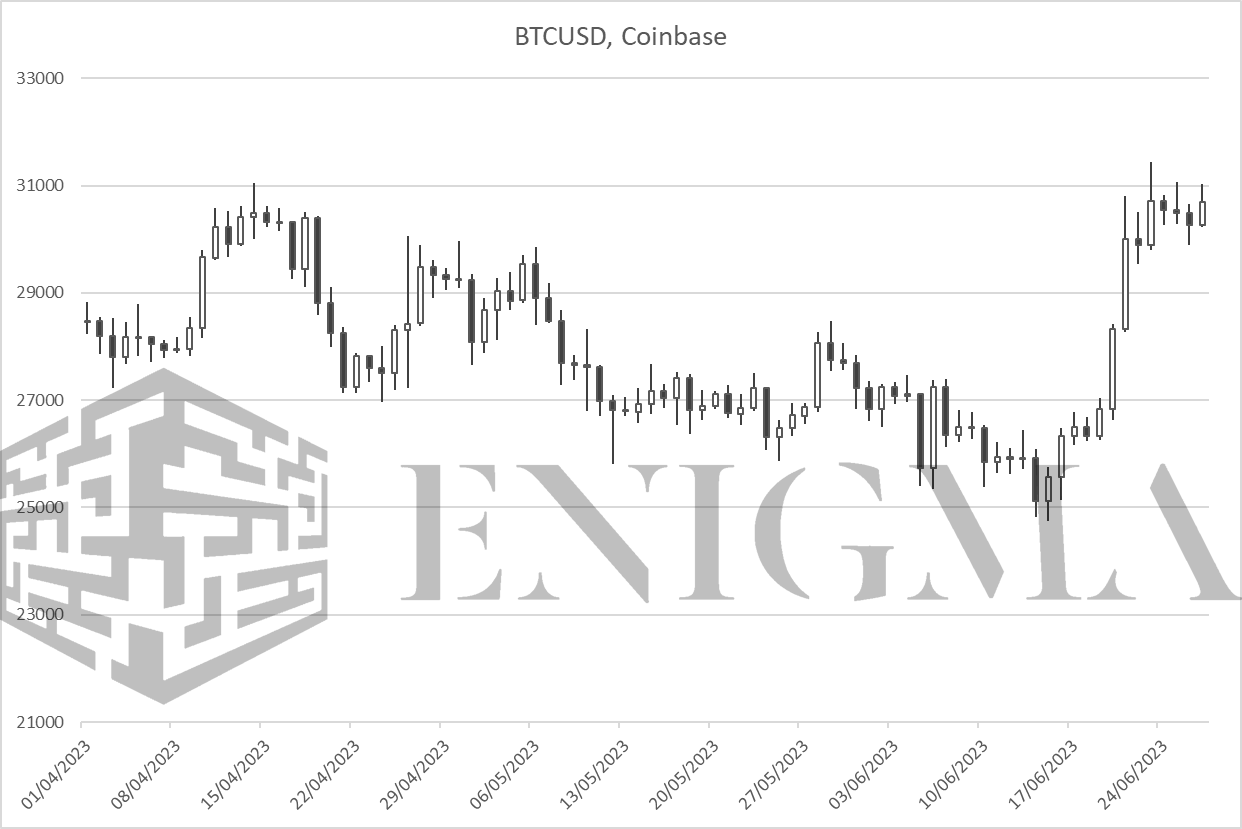

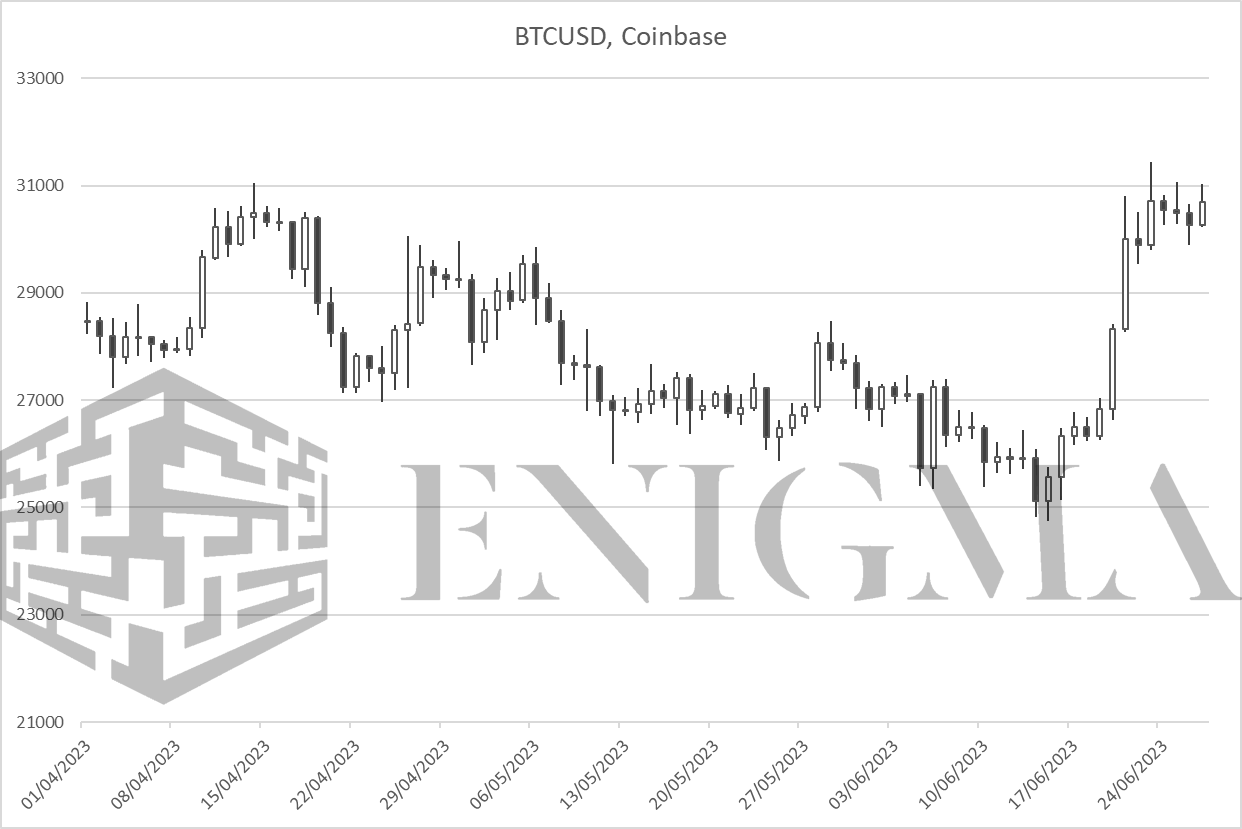

This has largely played out; after peaking at just above $31,000 on April 14th, the trajectory was mildly but consistently negative, only reversing somewhat on June 15th to bring us back around those opening levels. With that in mind: what’s next?

Median case

Our general view, and our median case, for Q3 can be summed up in one word: boring.

While the volatility common to (if not inherent to) will always mean that a boring day in crypto would probably be a 4-sigma one somewhere else, we think that there is a persistent tendency to underestimate how long they can stay in a basically non-trending, or slow-trending, pattern overall. Maybe the best example of that was 2019 and 2020; if we exclude the March 2020 crash (given that it was overwhelmingly an external panic and that correction coming out of it was rapid), there’s an argument to be made that markets were in a state of something resembling Brownian motion for the better part of a year and a half from the local top in late Q2 2019 to the breakout in Q4 2020.

We would argue that, on the whole, there hasn’t been a particularly aggressive structural trend overall since the breakdown after the first big round of bankruptcies (3AC, Celsius, etc.) in late May and June of 2022. The handful of drastic moves in that time have largely been event-driven (e.g. the November/December gully during and after FTX’s collapse), and generally most assets have been mostly reverting towards a mean of around -65% against all-time high on BTC and ETH (roughly $24,000 and $1700 for reference), with drawdown steepening as you go down the list.

Volatility this quarter has been low. We tend to think high-low daily ranges are usually a good indication of this; a look through those on a few common pairs and exchanges sees figures of just over 3% on BTC and 3.5% on ETH, which ranks down with Q4 2022 and Q1 2019 for the former and is unprecedently low for the latter.

This is a pattern we have seen in crypto markets in the past; volatility compresses and compresses, and it eventually leads into a breakout in either direction, because crypto markets structurally cannot suffer low volatility forever because of the speculative view of most market participants therein. This will almost certainly be true again this time; there will be at least one more overall crypto market cycle as we’ve grown to understand them.

However, the collective tolerance for lower volatility increases with every cycle. Speculative markets mature by virtue of their participants maturing above all else, and if we take BTC’s investor base as a whole here, we are at this point getting very far along with the profile of both the average retail investor and the makeup of investment re: unrestricted retail, versus restricted retail (think wealth manager clients), versus institutionals in their own right.

Most people, even if and when they were ready to dismiss the March crash as basically a non-native event, overestimated how long volatility could stay low, and how long the trend could remain Brownian, in 2020. The halving in May was supposed to set the stage for a stream of inflows; instead, we saw an anticipatory move up to $10,000, and then nearly six months of the most stagnant and low-vol price action we have ever seen on BTC. Even DeFi summer – ETH’s Rubicon moment with regards to providing real value transfer – did little to shake that out.

The chorus is likely to build up throughout Q3 that a move must be incoming. For the most part, we tend to think that chorus should be ignored. Markets can remain non-volatile for much longer than you can remain interested.

Now, to be slightly more precise, our median case here is that we exit Q3 at a lower level than we enter it. Why? As we said last week, we don’t think the ETF situation provides a basis for a short-term breakout in spite of price action mid-week (more on this in the bull scenario section), and BTC comes into Q3 trading right at the top of the range it’s held for the entirety of Q2, and in general since May 2022. If that range were to break, it may change things; our assumption currently is that it won’t.

The bull case

With that being said: under what conditions could we see a range break to the upside?

The two big semi-foreseeable things to keep an eye on are both legally-grounded: the SEC case agaisnt Ripple, and the Grayscale case against the SEC. The former has of course been a long-running saga, but seemed to be coming to a close with Judge Analisa Torres’ issuance of a preliminary decision on March 6th (a mixed ruling that was nonetheless generally considered an overall victory for Ripple); hopes for a quick summary judgement have proven fruitless, but we would expect to see resolution on this front by September at the latest. For Q3, an earlier judgement that favours Ripple could be a catalysing event, though it would have fewer direct implications for more general concerns over token securities status than one may think.

The latter is, similarly, being pencilled in for a very late Q3 judgement, and expectations are tilting towards a relative defeat for the SEC but not for anything that would open up the possibility of full conversion. Again, the significance here is not so much providing any structural or regulatory change that would shift the market overnight, but that it could be a significant enough short-term catalyst in terms of sentiment and momentum to allow for a break.

The key thing with both of these events would be that, while they would be unlikely to solve anything for serious market participants in terms of providing full clarity moving forward on these markets, they would provide a soft indication of a potential shift in the general climate in the US for BTC and ETH at the very least over the next year or two; we could see retail and more agile players move to take advantage of that.

Even in the bull case, we tend to think upside is somewhat limited. On BTC, confirmation of this bull case would centre around closes above around $32,000 for the most part, and we would expect to see significant selling between $38,000 and $39,000 which would hence only imply around 30% upside from current levels (BTC ran 27% high-low between 15th and 23rd June for reference, and is around +85% year-to-date). However, most catalysing events here are realistically likely to come down in late July or early August, so there will be time for better potential entries here if this were to play out.

The bear case

BTC has been holding up well as of late, and it does seem less and less likely that we will see lows beyond those seen in November and December of last year. However, again, we do think that markets are coming into Q3 at a relatively elevated price, and therefore risk is skewed to the downside overall at the present moment.

We do think that the aforementioned events are asymmetrically positive for markets in general; negative judgements against both Ripple and Grayscale were being priced in as the default for a long time, and in truth, there is little that could come out in either case that would cause serious concerns with respects to the longer-term picture for the markets or major assets (outside of XRP, which generally isn’t traded on-shore in Western jurisdictions anymore anyway).

In terms of a catalyst to the downside, at this point, it likely all centres on Binance. The exchange continues to be pushed out of small Western jurisdictions (Belgium being the most recent one), and has in general been dogged by small, but consistent, negative headlines. The latest centre around TUSD; the stablecoin is increasingly being pushed by Binance as a BUSD replacement, with BTC/TUSD markets on Binance turning over daily volumes close to or in excess of TUSD’s $3bn market cap, but there are suspicions over the velocity of its growth and the solidity of its reserves, with it briefly depegging overnight on Tuesday on Binance.US.

It is always hard to forsee negative catalysing events precisely, but the key things we are watching for are a) any negative developments with respects to potential asset freezes on either the main site or Binance.US (an agreement on June 17th appears to have quelled that threat for now), b) any negative developments with TUSD, c) further destabilisation of BNB that takes it significantly below last year’s lows of $200 (there is little suggestion that BNB has been abused for collateralisation etc. like FTT was, but it trading significantly below its 2022 lows could nonetheless still cause complications).