-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Market outlook latest: structural stagnancy

After a somewhat flaccid July, August has so far shaped up rather boringly for most crypto assets, as it tends to do. We revisit the outlook for BTC and broader crypto markets as we approach the halfway point of Q3.

Executive Summary

-

We revisit the outlook for BTC and broader crypto markets as we approach the halfway point of Q3.

-

View of structural weakness exclusive of headline impetus has so far played out, BTC -2% on quarter.

-

Expectation is for a continued slide through Q3, with opportunity for a shift in the market likely bumped to Q4 at earliest.

After a somewhat flaccid July, August has so far shaped up rather boringly for most crypto assets, as it tends to do. While Bitcoin seasonality is hard to take too seriously numerically given the extreme volatility in both asset and class and the degree to which said volatility is event-driven, it’s worth noting that at -0.2% between 2010 and 2023, BTC returns are far closer to even in August than any other month (albeit trending perhaps more negatively than that figure may let on overall – an outlier 65% return in 2017 does a lot to boost that number).

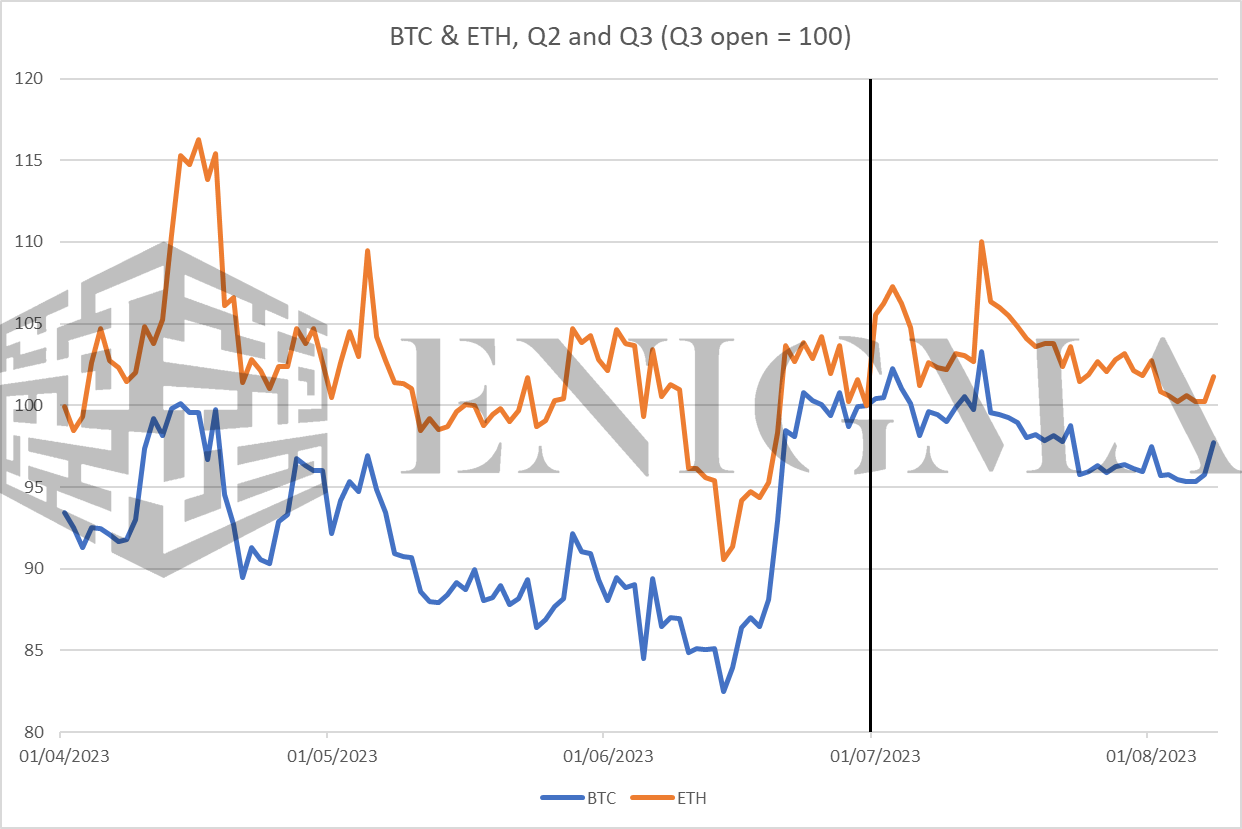

With that in mind, while perhaps a touch on the early side, it seems worth taking something of a market heatcheck and thinking about what may be next. Our general thesis coming into Q3 was fairly straightforward: a structurally-negative trend, some impetuses perhaps backloaded to break it out, but outside of those we would generally see things drift off from the quarterly open. That, so far, has largely delivered:

One may be able to spot that the overall downtrend here from here has been somewhat less acute than Q2’s, with roughly a -9% high-low over 46 days from June 23rd (given that the July 13th high was almost immediately retraced) compared to -21% over 62 days from April 14th to June 15th. As we mentioned before, this is reminiscent more than anything of the volatility compression we saw in the summer of 2020, with BTC in particular remaining price-ignorant of anything and everything going on elsewhere in the crypto space (until eventually breaking above local highs and beyond from late October onwards).

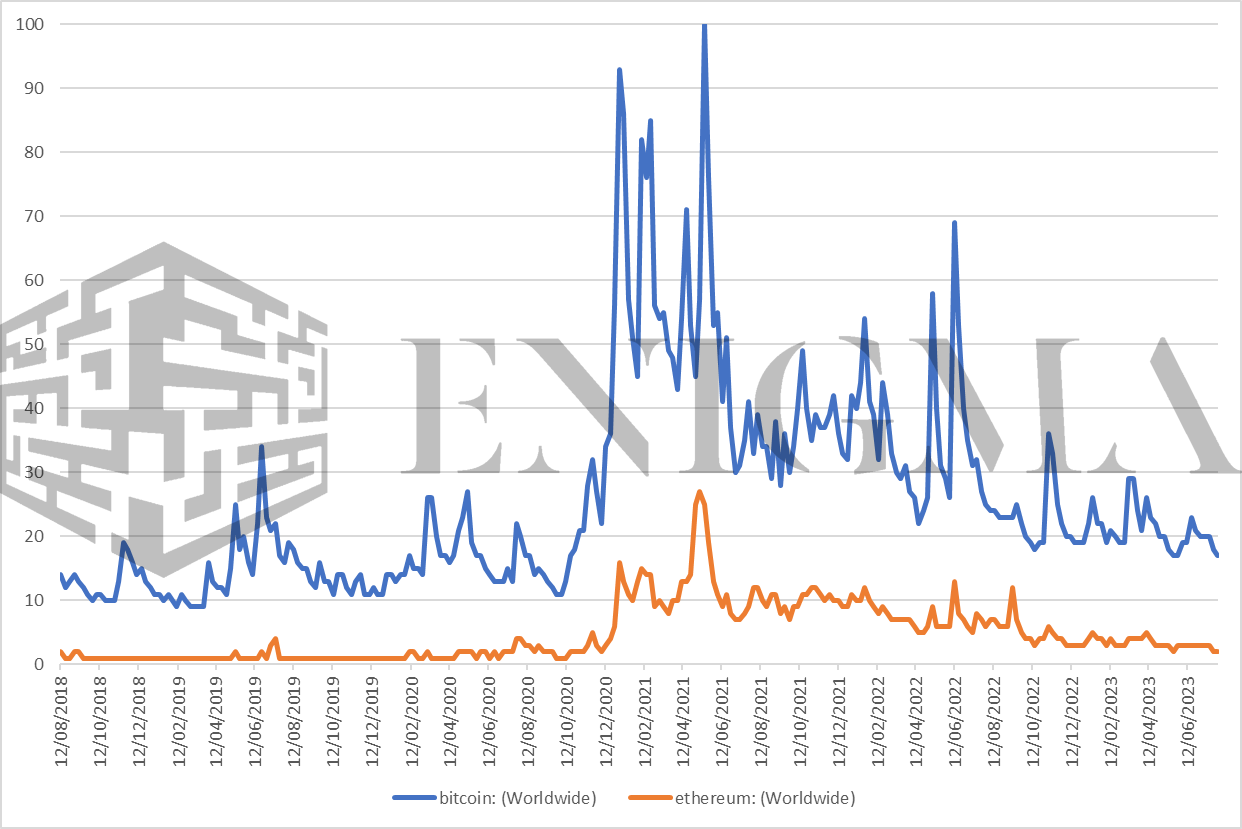

So: structural negativity exclusive of headline impetuses would seem to indeed be the name of the game as it stands, and we see no real reason why this would reverse any time soon; while what we’ve seen recently points to a stabilisation of crypto in general rather than retreat, public enthusiasm and interest remains aggressively muted. Google Trends data tends to be a nice way to take a quick heat-check in this regard, and both ‘bitcoin’ and ‘ethereum’ find themselves at comparable levels to 2020 in that regard:

There is a lack of new demand and a lack of fluidity within the system in general (DeFi TVLs mostly flat or shrinking, BTC fees low but elevated compared to 2021), and even the fundamentally strongest assets in crypto are largely not valued on anything resembling fundamentals, therefore, price go down; same as it ever was. There is not much further to add on that front.

With that in mind, we move to the more operative question: what things could deviate us from that trend, or even shake us out entirely? The bull case in June mentioned two big points – the SEC’s case against Ripple, and Grayscale’s case against the SEC. The former was responsible for that brief local top on July 13th (which amounted to much more on many alts naturally), but any attempt to break out from the existing market structure was short-lived.

The Grayscale saga – and, entwined with it, BlackRock’s push for a Bitcoin ETF – remains unresolved. While the case may still see a resolution by late Q3, projected timeframes by those claiming to be in the know (albeit very much talking their own book in that regard) are beginning to drift out further than that after a lack of movement over the last couple of months. The hard deadline (insofar as such a deadline can be hard) is seen as February 2024 (because at that point the SEC will be forced to rule on the BlackRock product), and “four to six months” has become the rallying cry after comments by Galaxy CEO (and book-talking permabull, admittedly) Mike Novogratz on the company’s earnings call on Tuesday – which would of course map out to between December 2023 and February 2024, i.e. late Q4 rather than late Q3.

Ultimately, the ETF drive continues to be the only major foreseeable bullish impetus available to Bitcoin and wider crypto markets as far as we can see it; and if even the more bullish voices are lengthening the time frame, that makes it overwhelmingly likely that we won’t see substantial upside even compared to current levels in Q3 as a whole.

The good news is that the likelihood of a significant bearish impetus in the short term also looks lower in the near term than it did in June. Much of the noise around Binance has for now quietened, with the associated focus shifting towards Justin Sun and Huobi; to cut a long story short, there are concerns over the solvency of both Sun personally and the Huobi exchange that he is known to hold an interest in (and rumoured to have acquired fuller ownership over at some point in the last two years), but even if those concerns play out in the worst way possible, the short-term and long-term effects would likely be relatively modest, the potential collapse of platforms like JustLend (the 5th-biggest platform by some TVL measurements, and the largest with no Ethereum presence) notwithstanding.

All of this ultimately does amount to: steady as she goes, nothing new to note. Nonetheless, it seems worth talking about and ultimately reiterating, because these sorts of periods are unfamiliar and uncomfortable within crypto markets, and the temptation can mount to short vol in whatever form that may take. Expect more of less to come.

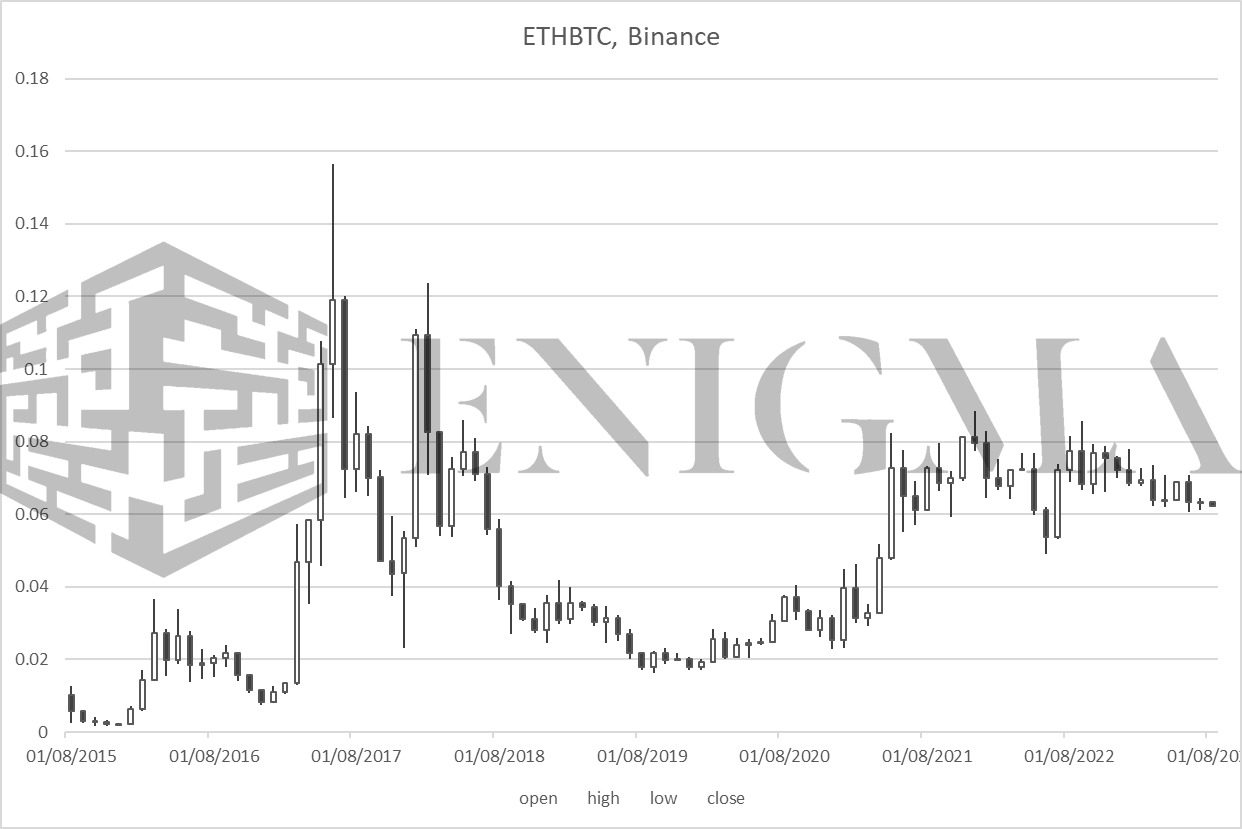

Finally, some quick words on Ethereum and relative valuation. ETHBTC is now trading at relatively low levels compared to 2021 and 2022, but still significant above its 2019 lows:

As ETH is relatively shorn of natural independent momentum at the moment (most of the implied roadmap for the ecosystem as a whole is centred around the advancement of L2s, which themselves are currently cooling off after a frenzy at around the time of Arbitrum’s launch in May), we find it hard to look past BTC as the driving force for the market as a whole. If BTC price in general bleeds off, we would expect ETH to bleed harder, pushing the ratio down, and creating a significant proposition with regards to short- to medium-term relative value at around 0.052 or so (baseline network activity has been higher than in 2019 even in a relatively stagnant environment, as evidenced by the surprisingly consistent supply contraction under the EIP-1559 burn regime). While we don’t expect this to play out quickly, it remains worth monitoring.