-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Headline updates: FTX, ETF, BNB

The aftermath of FTX continues to play out as one would expect it to given that so many lawyers are involved – that is, slowly, and painfully. Further details came out on Monday (via a court filing) on the FTX 2.0 reboot plan, with the estate looking to any and all potential bidders – the presentation in question mentions 75 bidders, with The Block identifying Bullish Global and Tribe Capital as among them. A deadline has been set for September 24th for new bids, working towards a Q2 2024 restart.

Executive Summary

-

FTX: Liquidations likely to start soon but impact is being overstated

-

ETFs: No news, no signs of movement as of yet

-

Binance: Smoke after a quiet few months - something to be aware of

FTX

The aftermath of FTX continues to play out as one would expect it to given that so many lawyers are involved – that is, slowly, and painfully. Further details came out on Monday (via a court filing) on the FTX 2.0 reboot plan, with the estate looking to any and all potential bidders – the presentation in question mentions 75 bidders, with The Block identifying Bullish Global and Tribe Capital as among them. A deadline has been set for September 24th for new bids, working towards a Q2 2024 restart.

However, while tea leaves like these may be the more significant ones to read in terms of the longer-term view, they are not where focus has gravitated. As tends to be the case, the focus – and panic coming out of that focus – has centred on FTX’s digital assets and their disposal. The plan from the FTX liquidators has always been to liquidate assets and distribute in fiat, and the fear arising from that has always been that, given the quantities of assets that need to be liquidated, both FTX claimants and markets more broadly would suffer from the impact and results of that forced selling.

Liquidators put forward a petition for the sale of assets (with Galaxy Digital acting to facilitate) last month, with Delaware Bankruptcy Court set to decide today (September 13th) on said petition. While the presence of Galaxy brings more calm than concern due to their relative expertise in crypto markets (and in particular in OTC markets), this is clearly unlikely to be anything but negative overall, particularly given the current market context (stagnant and negative-trending price action and extremely weak demand).

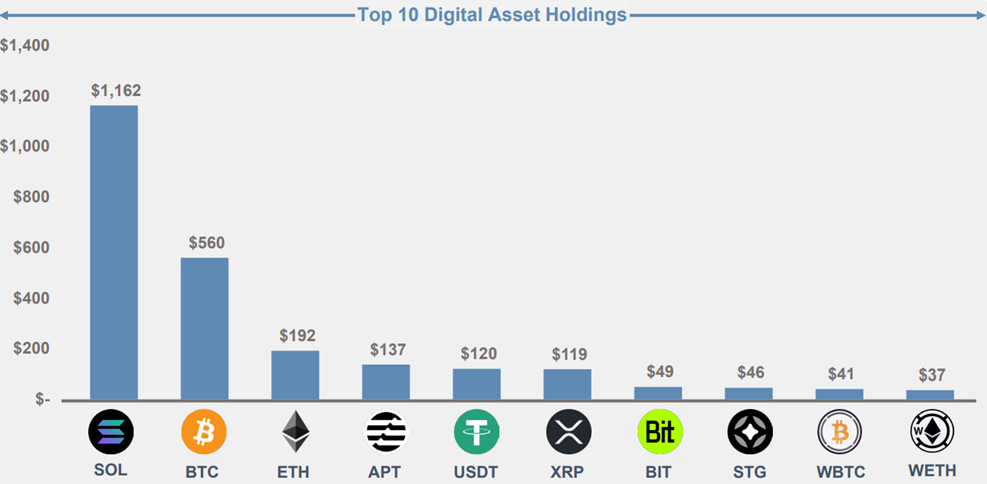

With that being said, we tend to think the problem here is being overstated, at least as a mechanistic concern. Why? First of all, the numbers due for disposal at this point are actually not that large:

The biggest tranche by far is in SOL at a valuation, as of August 31st, of $1.162 billion. This would track to around 50 million SOL, or around 10% of circulating supply, though some on-chain investigations have suggested the figure may be higher. These sales will materially affect price and market structure for SOL specifically, but a big caveat here is that a lot of said SOL cannot be sold in the near term between vesting and staking lockups (estimates are generally that maybe 25% of that headline figure is available for sale as it stands); so, while FTX liquidations threaten a persistent drag on the market in a similar vein to e.g. post-PlusToken BTC liquidations in 2H 2019, they would be unlikely to cause a significant crash.

On other assets, the impact may barely be felt. The $560m of BTC and $192m of ETH make up just a few percent of nominal daily volumes in public markets for both. Granted, even clean volume data represents the same dollar being used over and over, and one-way traffic works very differently; nonetheless, we are not talking about huge sums here relative to either market cap or markets in general. The historic rule of thumb has been that a dollar in or out of a relatively mature crypto market (e.g. post-2016 BTC) represents something like a 25 to 30 dollar swing on market cap; if we take that as the case, it would imply just under a 3% drop on both assets – obviously not nothing, but not a significant structural drag.

Additionally, liquidations are projected to only take place at a maximum rate of $50m per week initially, increasing to $100m later on. The FTX estate has made myriad mistakes, and the overall disposal process here is certainly less than optimal for creditors, but in terms of avoiding a significant market impact, the overall approach here is reasonable. The only concern here, essentially, is whether the process fuels market anxieties; but, as we have said many times, we see markets as structurally bearish in the short-term in any case.

ETFs

At some point, this becomes boring to write about, but write about it we must. There has been little movement since the Grayscale case outcome, and authorities remain largely tight-lipped on it; SEC chair Gary Gensler did answer questions on the topic from the Senate Banking Committee on Tuesday, but revealed very little, simply saying that they were re-reviewing it.

Franklin Templeton did file for a spot ETF on the same day, but this means little except to get their name in the file along with everyone else. In terms of approval, the relevant dates for now remain around the end of the 240-day expiry on the BlackRock ETF (and the rest of the field) in March; while there is always the possibility that things get moved up, there will be some description of signs to precede that and we have seen nothing in that vein as of yet.

Binance

To finish, a tricky topic, because there is relatively little concrete to say on it, but it stands as something to be aware of. Binance has enjoyed a fruitful summer, by which we mean that it has enjoyed a largely quiet summer; after the CFTC and SEC cases earlier in the year, and the firm having to do something that it has been extremely reluctant to do historically in cutting back staff, it has very much been a case of no news being good news (outside of a few high profile departures in July)

Unfortunately for Binance, we did finally see some news this week, with Binance.US reportedly laying off around a third of its workforce, and CEO Brian Shroder – who had been in post since ex-Coinbase CLO Brian Brooks’s 3-month stint in charge through August 2021 – reportedly departing the company.

This news in itself is not exactly earth-shaking; bear in mind here that Binance.US in the very best intrepretation has been a well-meaning failure, and in a more realistic interpretation was little more than a panacea to US regulators before said regulators ended up going to war with Binance and other firms anyway.

However, it does have to be said: we have tended to see bad news on Binance and other exchanges come in clumps in the past, and there does seem to be more than a little smoke around Binance currently – a concern especially given that we are approaching one of the busiest times of the year for regulatory enforcement and action (with late September in particular often a busy time – Block.one penalty in 2019, BitMEX action in 2020, etc.).