-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Grayscale verdict: what it means, and what’s next

After months of speculation and anticipation, we have finally seen some action. On Tuesday, the D.C. Circuit Court of Appeals ruled in favour of Grayscale in their case against the SEC, stating the point unequivocally: “The denial of Grayscale’s proposal was arbitrary and capricious because the Commission failed to explain its different treatment of similar products. We therefore grant Grayscale’s petition and vacate the order.”

After months of speculation and anticipation, we have finally seen some action. On Tuesday, the D.C. Circuit Court of Appeals ruled in favour of Grayscale in their case against the SEC, stating the point unequivocally: “The denial of Grayscale’s proposal was arbitrary and capricious because the Commission failed to explain its different treatment of similar products. We therefore grant Grayscale’s petition and vacate the order.”

The full ruling is fairly short at 21 pages, and can be summed up very simply: the court did not agree with the futures market defense. Since approving the ProShares (October 2021) and Teucrim (May 2022) Bitcoin futures ETFs, which are based on CME Bitcoin futures markets, the SEC’s stance has been to continue to oppose spot ETPs (a straight-up superior product for the consumer due to the lack of contango bleed) on the ground that spot Bitcoin markets are not regulated to the same standard as CME contracts are.

This has always been an absurd bureaucratic nonsense. To disallow both spot and futures ETPs was stupid but understandable. To pretend that the CME futures market somehow existed disconnected and purified of the spot market underpinning it was ridiculous and not much short of an insult to everyone’s intelligence. Grayscale, in giving evidence, demonstrated that correlation, and further demonstrated that outside of this distinction, their proposed ETP would sit under a for-all-intents-and-purposes identical surveillance system to that employed by the Teucrim ETP.

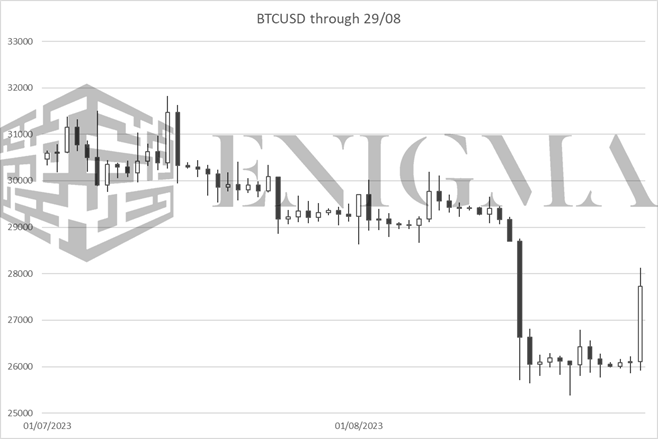

While these things can never be fully known, it has been widely understood for a while that the SEC on the defense side took a hammering in arguments on the case in March, and that they were likely to lose the case. Furthermore, as we have noted several times over the last few months, late August was about the time at which we expected to reach a conclusion on the case, albeit with the date having drifted. Market movements over the last months saw a significant short-term breakdown on August 17th and 18th, in large part because of August 15th having been thrown around by a number of analysts as a likely date for an answer (and having come and gone. You can almost cleanly see a ‘valley’ in BTC price between August 18th and yesterday on that basis:

So, what next? Let us first be clear on what this decision is and isn’t. The decision requires the SEC to review the ETP proposal. It does not do two things that certain headlines may force one to believe. The first is that it does not compel the SEC to ultimately accept the proposal after review; the spot-futures distinction was a significant part of the SEC’s case, and hence it is difficult to see on what grounds the SEC could reject it at this point. Nonetheless, bureaucrats are nothing if not inventive, and we should hence not rule a renewed attempt to block it out.

The second is that it does not imply immediate conversion or anything of the sort. It is wholly unclear when and how quickly Grayscale would be able to achieve conversion once approval is reached, but to reiterate: this does not constitute approval. GBTC discount narrowed from -25% to -18% as of yesterday’s close on the news, bringing it above the high end of where we expected redemptions to narrow back in June (-21%); while we likely will end up seeing it in a higher range for the foreseeable future now, it has to be remembered that a large part of the GBTC discount is risk pricing on BTC as an asset (and on the difficulties and margins involved in straddling a theoretical GBTC-BTC trade) and that risk is weighted towards the downside at current levels.

The value of the decision is that, because of the timing, it provides ample opportunity and encouragement from the SEC to back down from their anti-spot ETP stance. We discussed Grayscale in June specifically because it came in the context of a filing from BlackRock – a firm who, upon filing, have a 575-1 record on ETFs being approved in the US (the single rejection coming in 2014 as part of an industry-wide nipping-in-the-bud of a proposed new class of actively managed non-transparent ETFs – for their own spot ETF, which was followed within a day or two by almost every other firm that had previously proposed a spot Bitcoin ETF doing so.

After refiling at the start of July, the current extended deadline for BlackRock and half a dozen other essentially identical ETFs is March 16th, 2024; the bullish view is that, at some time before that day, the SEC will approve BlackRock, Grayscale, and several other ETFs. Why? Part of this is because the SEC has now seemingly lost its reason for blanket denial on the entire class of ETFs, but it has also been noted that one of the operational concerns in the approval and conversion process would be that by approving any ETF first, the SEC would be giving an unfair advantage to the creator of that ETF (again, bear in mind here that the first wave of spot ETFs are expected to be essentially undifferentiated products outside of the brand attached to them).

We do tend to think that this will play out, though identifying an exact date for it is difficult; we would tend to expect December or January, but these things can always drift or even come in earlier. Furthermore, we do think it matters significantly for the market in the medium and long term. While comparisons to gold post-2004 are overstated and overblown, the market access that an ETP grants (particularly coming from someone like BlackRock) is not only a long-term boon, but in our view, is completely essential to another BTC bull market, and by extension to some degree another crypto bull market full stop. We think, like gold, that it won’t be structurally catalysing in the short-term, but it should do enough to pick up sentiment that its launch will ultimately line up very closely with the bullish shift we expect coming out of Q4 2023 and into Q1 2024.

In the short-term, though, we have to be clear here: it would be very, very surprising if this did anything to turn around fortunes for that late Q3 and early Q4 period that looked (and continues to look) overall bearish. As we said back in June, the bull case for Q3 basically rested on markets picking up the ball from either the SEC-Ripple or SEC-Grayscale case outcomes and running with it in terms of sentiment. Ripple saw a brief surge followed by a quick tapering-off, and at the risk of saying something that will look very stupid in short order, the Grayscale case looks to be playing out the same way if not moreso – there may or may not be upside over the next day or two, but this doesn’t seem like a catalyst for a more fundamental upside move and therefore structure shift in the market as a whole.