-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Explaining the BTC ETP market

For all the pomp and circumstance, it seems fair to describe the ETF launch overall and price action surrounding it as having been very, very predictable. Early volumes and inflows have been healthy and support the case of the ETFs capturing significant market share in the long term, but $800m net inflows in the first two days were very good without being earth-shattering, and we have seen the starts of what will probably be a deeper drawdown with BTC around 15% off its launch day highs. There isn’t much new to say at this point; as it stands, priors seem to have been largely confirmed here.

Executive Summary

-

We take a look at the range of spot BTC ETPs now available in the US.

-

These products should trade at par, and are trending towards doing so as it stands.

-

We also examine what degree of differentiation exists between said products.

For all the pomp and circumstance, it seems fair to describe the ETF launch overall and price action surrounding it as having been very, very predictable. Early volumes and inflows have been healthy and support the case of the ETFs capturing significant market share in the long term, but $800m net inflows in the first two days were very good without being earth-shattering, and we have seen the starts of what will probably be a deeper drawdown with BTC around 15% off its launch day highs. There isn’t much new to say at this point; as it stands, priors seem to have been largely confirmed here.

The one thing that we have seen a number of requests to explain is the differentiation existent within the 11 spot ETPs that are currently live. This is an interesting question because efficient spot ETPs are, by definition, not particularly differentiated products; they hold an asset, they offer an ability to create and redeem the asset easily. Therefore, the ETPs trade basically at par, with any moves off par on said assets either being quickly arbitraged away or existing essentially as data noise rather than anything else.

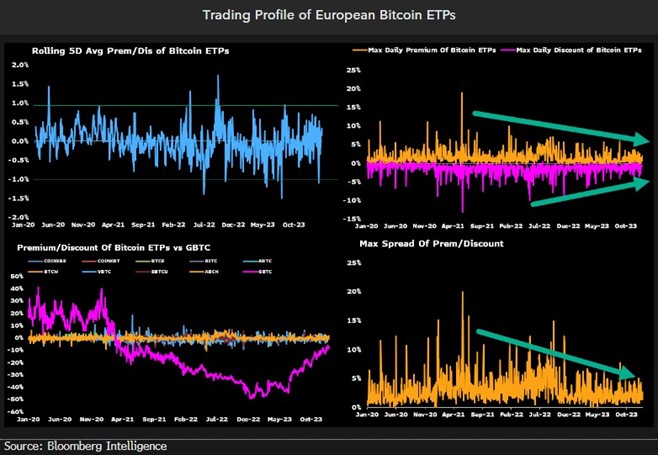

We will note that this has actually long been a significant pitch point for BTC ETPs in European and other international markets – that they tend to trade extremely efficiently compared to underlying. Bloomberg noted this on the day of the launch, showing that the European ETPs as a class traded at no consistent premium or discount, and indeed were trading closer and closer to zero over time:

Any graphing of any one of these products will basically show the same – a few prints either side of the line (even the high/low prints on the daily premiums here are artifacts of particularly illiquid ETPs or other data errors), but overall at par, with dislocations mostly driven by products with extremely low liquidity and relatively high market access (which rarely exists persistently). Note that the management fees are essentially unpriced because of the ease of said redemptions (while having enough friction to stop them being arbitraged on tiny dislocations), as well as the creation and redemption fees, being that they are usually essentially nominal (ABTC, 21Shares’ flagship European product, is $150 plus 4bps; most of the US spot ETPs have no explicit fees, the futures ETPs typically had a small flat fee and no AUM fee).

There had been speculation to the contrary leading into the ETP launch; this speculation was always extremely wrong, and we feel the need to correct the record on this. As best we can tell, said discussion was fueled by a Bloomberg interview on Monday 8th January with Reginald Browne, the co-global head of ETP trading and sales at prop trading and market making firm GTS, with the banner headline going as follows: Could See Spot Bitcoin ETP 8% Above Fair Value: GTS’s Browne.

Eric Balchunas, who was interviewing Browne, reported this (with no small degree of incredulity), but clarified the next day: Browne had misspoke and had actually meant that the ETPs would trade at a small premium to spot of 8bps (i.e. 0.08%). This makes much more sense; again, creation/redemption fees are nominal, management fees were already expected to be low and were in fact in aggregate subsequently lowered via updated prospectuses in the days leading up to launch, and this combined with barriers to redemption on small lots (e.g. BlackRock’s IBIT requires 40,000 shares, or roughly $1m at launch, for redemptions) all sum to the ETPs trading at par but with occasional dislocations and perhaps a slight skew towards premium.

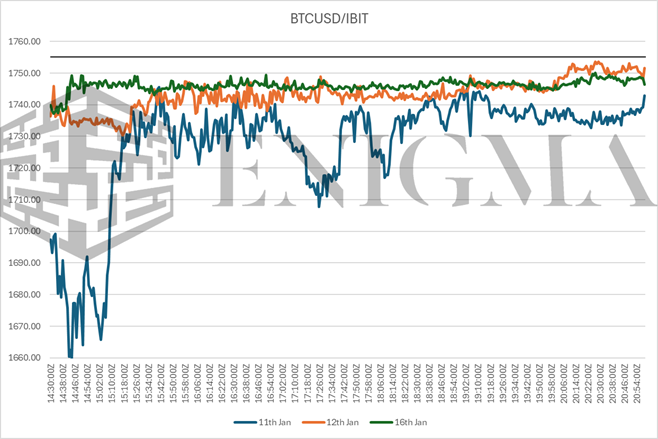

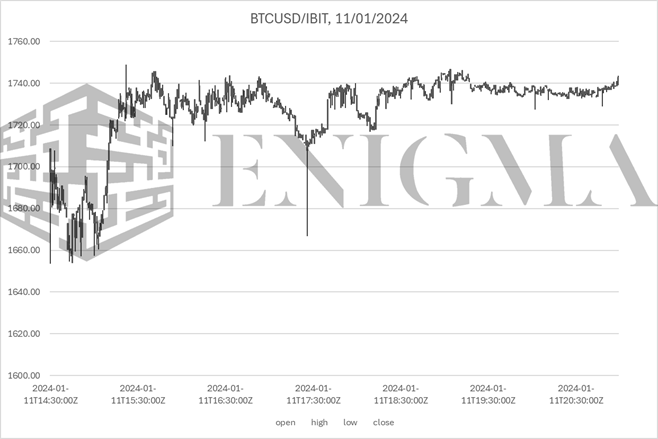

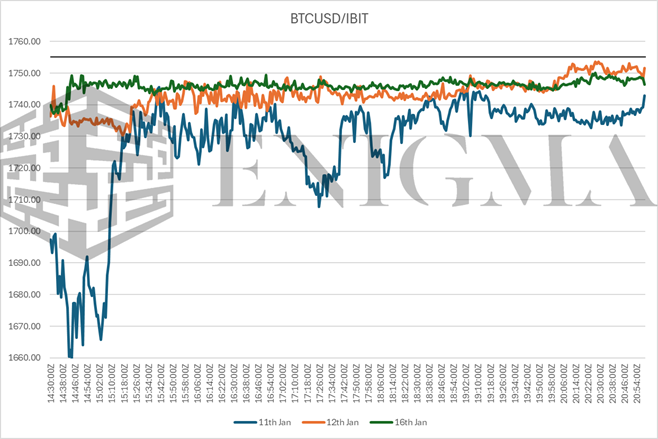

Now, with that being said: there was, very briefly, a more significant premium. The BlackRock ETP IBIT launched on Thursday with just $10m of shares having being created for the seed creation baskets (Fidelity started with $20m, Bitwise started with $2.5m, and most others started with a basically nominal amount). The upshot here is that in the first hour of trading, there were temporary premiums emerging on some ETPs due to low liquidity. IBIT is the easiest one to show this with (having the highest early volumes and also lower inflows than Fidelity or Bitwise); per prospectus, IBIT launched with 400,000 shares representing 227.90250 bitcoin, or 1755 shares per Bitcoin. Comparing to Coinbase price, we saw a print at 1659 shares per BTC in the first 15 minutes, representing a premum of 5.7%, but this didn’t last long:

IBIT closed the day at 1742 shares per BTC, or a 74bps premium. At Friday’s close, it was 1751.5, or roughly 19bps (even not accounting for management fees). NAV calculations at the close (via Bloomberg) suggest roughly the same – 16bps on IBIT, -4bps on FBTC, and ranges between -4bps and 52bps on remaining products excluding GBTC (still trading at -117bps to NAV as of Friday’s close). Tuesday, in turn, was much of the same; a nominal open at 1733 but traded within a band of 1745-1750, final print at 1750.73.

We expect this to continue to be the case going forward, and points like lot size, the general volatility of the asset, the difficulty in hedging efficiently for the margins involved, and so on, make it difficult to do much with the trade here, especially bearing in mind that all these products are for now only cash-settled (physical delivery being the thing in the past that helped enable things like the infamous Grayscale trade).

With that asides: can we expect much differentiation in either the short- or long-term between the ETPs in general? The experience in the past with similar products (i.e. the ever-present spectre of gold ETPs) is that we tend to see a market leader emerge, but that ultimately there is generally room for a litany of ETPs with nine-digit or more AUM with very little between them, because 1) AUM derives from these products as a long-term investment, 2) said investors will still hold if secondary markets show relatively weak liquidity for a time, and 3) the sales force for said products are approaching which one to sell in terms of relationships and other factors, with the details of the product itself being basically irrelevant. As of December 2023, 14 ETPs in America, 17 ETPs in Europe, and 17 elsewhere, maintained AUM of over $100m for basically undifferentiated products.

The one thing to note is that the largest ETP – SPDR GLD – is one of the worst product in the only variable that really matters here, that being expense ratio (i.e. how much the fund spends annually on all expenses), at 40bps compared to between 10 and 20bps for most of its major-market competitors. The product that ends up with the plurality of AUM and volume in BTC may not necessarily be the most competitive one, but simply the one with the best marketing and the most consistent inflows.

In the service here of providing at least some colour, here are the notes we would make on the field:

IBIT, FBTC: We would say that these are likely to continue to compete for the status of market leader (IBIT sits at $500m AUM as of Friday’s close, FBTC at $427m, with BITB a distant third). BlackRock is BlackRock, and Fidelity are huge in their own right with a long and pretty distinguished history in crypto (being one of the earlier ones to launch a serious digital assets arm in 2018 and having been quietly Bitcoin-friendly as a company for a long time). Occam’s razor here favours IBIT because of size and prestige, but Fidelity look to be more committed to presenting a liquid secondary market (higher seed share count, higher day-1 flows, product actually trading at a very slight discount at Friday’s close) and this may position them well given that all expectations are for a significant rally by end-of-year 2024.

BITB, HODL: Competing the most heavily for crypto-native, or at least crypto-adjacent, mindshare. VanEck’s HODL committed 5% of management fees to BTC developers Brink; Bitwise’s BITB one-upped them a couple of days later with a 10% pledge. VanEck has also notably been marketing heavily towards crypto natives via social media (West Ham) – the entire conceit here is likely to establish credibility with the type of people who would be inclined to create in-kind upon that being approved at some later date (almost all prospectuses initially proposed this but it has – unusually – been blocked for the time being by the SEC). Bitwise grabbed significant day-1 flows but struggled on volumes and seemingly struggled significantly on liquidity, being (like Grayscale) connoisseurs of what we might term the “airport advertisement” model of ETP sales; we’re currently unsure of how much market share they will ultimately be able to grab, and think there’s a good chance that HODL ramps up over time.

ARKB, EZBC, BTCO, BRRR, BTCW: Little to say about the pack here. We think these will just be buy-and-holds pushed by advisors affiliated with their respective issuers, and therefore relatively illiquid. Dislocations are most likely to occur on a more regular basis here, but most have similar minimum lot sizes to IBIT’s (i.e. in six digits $ at least) so may not be simple arbs.

DEFI: Important to mention even though it generally isn’t being included a lot of calculations. Why? Hashdex’s DEFI already existed as a Bitcoin futures ETP prior to last Thursday, and while it has filed and been approved for conversion to a spot ETP, as of Tuesday it reportedly had not started to purchase spot BTC yet (presumably it will do so when its current futures contracts settle). Note that Hashdex has kept its fees much, much higher than most of the field at 90bps – we tend to think that with its low AUM ($16m), relatively small natural market (Hashdex being a crypto-native firm with a small client base), and ticker (DEFI) that Hashdex are looking to convert DEFI away from pure spot into something more novel at the earliest possible opportunity.

GBTC: The elephant in the room. GBTC has remained at 150bps, and there seems to have been a recognition that GBTC no longer has any shot at long-term viability (i.e. ever growing its AUM). This is an opinion we have expressed several times in the last few months; as a product, GBTC has been stained badly by the premium inversion fiasco, and the future of Grayscale likely leans on essentially putting it into maintenance mode, hoping that its AUM will be somewhat sticky for various obscure reasons, and looking to either look towards new markets (i.e. mid-cap coins become easier to list and trade as new ETPs) or possibly look to pivot GBTC itself somehow in a similar manner to Hashdex.

GBTC has seen $600m of outflows in its first two days as a redeemable product. As always, this is done through its APs; it is unclear from the prospectus whether its creation lots of 10,000 shares (around $380,000 at today’s open) are enforced on redemptions. The GBTC discount should theoretically narrow all the way towards zero as redemptions process (note that day 2 outflows were significantly larger than day 1, but still sit at a relatively small proportion of its $29bn AUM); we think that a discount continues to exist at this point because of potential limits on AP’s daily capacity to process redemptions, but even with its dismal feels situation relative to the field, we would be surprised if this was cause enough for a persistent discount a month or so down the line.