-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Ethereum\’s Dencun upgrade: unpacking the blobs

Today will see – or, by the time you read it, most likely has seen – the Dencun upgrade come to Ethereum. In truth, this was not something that we particularly planned to write about here; while Dencun is an important upgrade (and the realisation of many, many years of working and pivoting on the Ethereum roadmap), for reasons we’ll get into, it seems like something of an odd choice for those not on the technical side of Ethereum (and the on-chain world in general) to fixate on. Nonetheless, we have had enough enquiries here, and there is paradoxically little enough to say on the market more generally right now (beyond ‘ride momentum’) that it seems worth spending some time explaining what it is, why it’s important, and what it ultimately means for Ethereum going forward.

Today will see – or, by the time you read it, most likely has seen – the Dencun upgrade come to Ethereum. In truth, this was not something that we particularly planned to write about here; while Dencun is an important upgrade (and the realisation of many, many years of working and pivoting on the Ethereum roadmap), for reasons we’ll get into, it seems like something of an odd choice for those not on the technical side of Ethereum (and the on-chain world in general) to fixate on. Nonetheless, we have had enough enquiries here, and there is paradoxically little enough to say on the market more generally right now (beyond ‘ride momentum’) that it seems worth spending some time explaining what it is, why it’s important, and what it ultimately means for Ethereum going forward.

The context

Ethereum has had something of an odd relationship with its own roadmap since its very early days, as mostly easily explained (and represented) in its transition to proof-of-stake. To put that story in brief: Ethereum launched on a proof-of-work consensus algorithm (i.e. the same basis as Bitcoin and almost all other blockchains at the time), but proof-of-stake (where verification is based on distributed validators verifying transactions rather than PoW computation) was already on the radar at the time, and there was open acknowledgement that Ethereum should move over to PoS as soon as possible from very early on. How early? Well, Vitalik Buterin (Ethereum’s primary co-founder) wrote at significant length several times between 2014 and 2016 (i.e. before the network even launched), and you can find versions of the original whitepaper that contain references to PoS; while the reality of the technology at the time took it out of the launch discussion quickly, PoS was there as a consideration and a future goal all the way from pre-launch.

In practice, it took a long, long, long time for Ethereum to move over to PoS – and, bear in mind here, this was in spite of the fact that outside of a brief period right at the top of the 2017 bull market, it wasn’t like Ethereum was particularly overutilised (i.e. there was little social or technical pressure towards inertia in general). It remained perpetually a year away for about five or six years before things finally started to move forward in a meaningful way, with the Beacon Chain coming online in late November 2020, the move to a PoS-compliant fees system in August 2021, and the ‘Merge’ to move fully to PoS issuance in September 2022.

Ethereum’s roadmap for scaling has been a similarly fraught process. You may come across the term ‘protodanksharding’ to refer to Dencun, which is a term that is up there with antidisestablishmentarianism in terms of being total nonsense without understanding the full context behind it (and even then, perhaps not entirely). To start with: sharding. Like with PoW, there was an acknowledgement from the start that despite Ethereum’s technical superiority over Bitcoin in terms of TPS (in practice this has been about double Bitcoin’s – quoted figures vary drastically depending on who’s trying to sell you what elixir, but between 15 and 25 for Ethereum is generally the accepted figure – it was going to eventually find itself insufficient should the network scale to the levels of usage that he needed to be a success in the long term.

Sharding was, with PoS, part of both that original vision and what it turned into vis-a-vis post-launch in that 2015-9 or so period. To put it as simply as possible, sharding was a server-esque vision for Ethereum – essentially, the network would be split on a base level into multiple portions (‘shards’), sharing the same token and technical standards, but being validated separately from one another.

In the end, sharding never went anywhere, because it became clear some time around 2019-20 or so that an arbitrary splintering of the network in that manner would cause too many potential problems to be worth doing (note that it probably isn’t coincidental that this lines up with the rise of USDT and then USDC on Ethereum as a trusted settlement asset), and we also started to see progress being made on layer-2 scaling solutions instead.

What is a layer-2? Essentially, instead of splitting the main network, a layer-2 operates as something of a clearing house for transactions – transactions are made within its subnet and then batched and sequenced onto the layer-1 in order to ultimately reduce costs. Note that this is something where the terminology has historically been somewhat misused – early ‘layer-2s’, most notably Polygon in its current form, instead operated in practice as sidechains with independent architecture. This matters because it can easily lead one to assume that layer-2s are a less recent phenomenon than they actually are – the major ‘true’ L2s generally released their mainnets in 2021 or later, and even those are imperfect in some senses (e.g. Optimism launching without fraud proofs).

The upgrade

As a result, we come to protodanksharding, which is essentially an upgrade to help layer-2s and hence realise what is, in practice, the descendant and successor to the old ‘hard’ sharding model that has been formally abandoned from the overall Ethereum roadmap by now. The ‘protodank’ part of the name is actually a lot simpler to explain than the ‘sharding’ part incidentally – it comes from the fact that the two Ethereum researchers that have spearheaded EIP-4844 are Dankrad Feist and Diederik Loerakker, with the latter going by the pseudonym Protolambda. Hence: protodank.

EIP-4844, for reference, is the Ethereum Improvement Proposal containing the specs to be implemented; Dencun is the upgrade and contains multiple EIPs, though most are relatively marginal outside of maybe EIP-1153, and hence most of the talk about Dencun is about 4844 specifically. While a little difficult to explain for a non-technical audience, we are going to nonetheless give it a try.

Essentially: because of how they work, blockchains always have some upper limit on the amount of data that can be written and transmitted through them at any given time. To be clear, the entire reason that blockchains work is because blockspace is scarce and monetarily valuable; this is a feature, not a bug. It does, however, mean that when said chains actually see utilisation, you inevitably have more requests for transactions than there is room at a given time, which is solved through the fee market – if you want your transaction to go through, you have to pay enough to get it in the next block.

While it waxes and wanes, it has been a long time since Ethereum fees were palatable for even mid-sized transactions, and early bull market interest has as usual overloaded it entirely (e.g. a quick look reveals that a single swap on-chain has cost at least $40 at all hours of the day for the past week, and closer to $100 more often than not – the last time it genuinely felt acceptable, i.e. let’s say $10, was back in October).

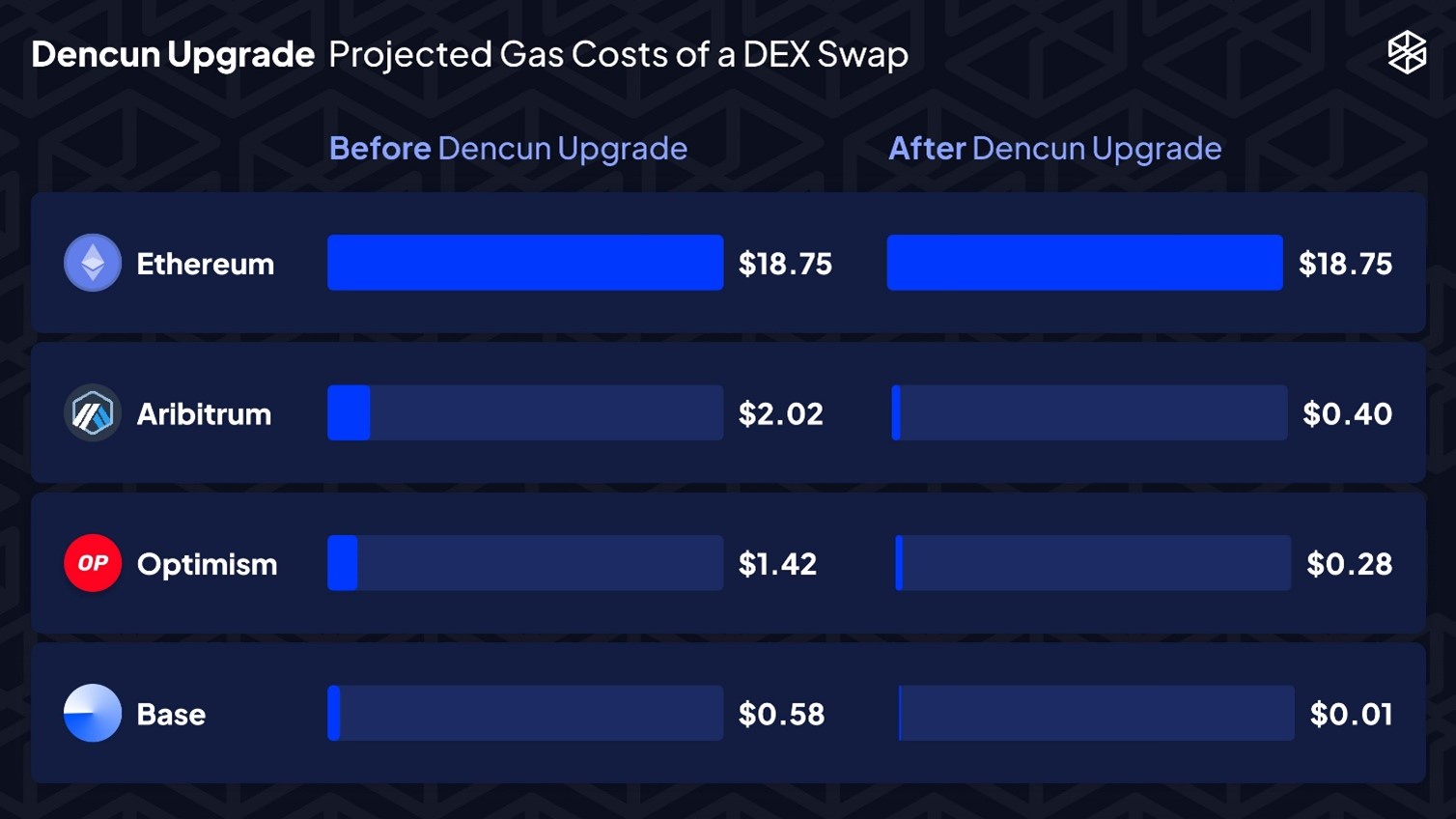

Fees on layer-2s right now are generally much better, in the order of cents in most cases – but those are likely to scale up, particularly if we end up seeing what we’ve seen in the past on both Bitcoin and Ethereum where traffic starts to disproprtionately shift off base layer out of necessity. The idea with EIP-4844 is to create temporary data ‘blobs’ that aren’t permanently written to the ledger, and hence are able to be priced differently (and more cheaply) than how they currently work (written to the ledger via the calldata function). This is expected to cut transaction costs on L2s by between 5 and 50x, per IntoTheBlock:

What’s next

Again: when this comes out, we expect the Dencun upgrade to have completed on mainnet, most likely fairly smoothly (there have been relatively few complications historically when Ethereum has upgraded its network); assuming that’s the case, what happens afterwards?

The elephant in the room here that needs to be addressed is that, with regards to expectations and consequences, this feels a little similar to the merge in September 2022. Ethereum’s main problems right now are that 1) any base movement of money is expensive (cheaper than a swap but still) and 2) the ecosystems around most layer-2s are still somewhat nascent – some like Base and Blast are a few months old or not even launched yet, and are mostly still just a decentralised (or centralised) exchange with some memecoins and not much else in practice. The merge was much-anticipated, but after it happened, everyone remembered that this doesn’t mean much for the underlying asset itself, and prices fell about 30% in the two weeks afterwards (before stabilising, rebounding, and then oh dear, FTX happened). Note here also that there is a lag time in terms of fees coming down too – Arbitrum and a few others will support it day 1 but there will be a lag on others (Optimism and OP-based chains, Polygon-ZK, Scroll among others).

It does seem conceivable that we might see the same next time, though with the market seeming to hold as strong as it is, this would most likely only speak to underperformance rather than a material drop (and bear in mind here that ETH is only around 10% above technically significant levels vs. BTC, so we are talking relatively modest margins here for attempting to play that rotation).

In the longer-term, things like 4844 just serve to strength the medium- and long-term case for outperformance against BTC and against the market as a whole, as well as ARB and OP as potential beta trades against ETH itself; we mention these specifically because both worked extremely well right up until the start of January and have had a torrid couple of months since (-35% on OPETH for instance). We feel that both sentiment and structure likely bring those trades back, sentiment in terms of the potential increased usage of L2s, and structure in terms of the ease and ability of users on those rollups to access those assets should retail end up flocking to them (though do note that both OP and ARB are not settlement or gas assets like ETH is for Ethereum).