-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

ETHBTC and the future of finance

Last week, when talking about near-term outlook for the market, we wrote:

We have noted in the past that there has been a tendency for price to pivot off options expiry in either direction; with monthly expiry coming up on Friday, and with the tendency of the sort of money that was chasing ETF approval as a buy event to load up heavily on monthly options, we think that price action through Friday will probably be very telling of the month ahead. Our default case here is that we see a degree of stabilisation and possibly a small uptick over the weekend and into early next week. We should stress here that even if this does come through, we are talking about relatively limited upside potential (i.e. maybe to 43-44k on BTC and some overperformance on ETH) before we start to grind down again.

Executive Summary

-

We discuss ETH's long-term underperformance against BTC.

-

ETH spot ETFs are a strong potential catalyst for a period of overperformance in Q3/Q4 2024.

-

Despite that, there may be better means of exposure to the Ethereum network as an entity.

Last week, when talking about near-term outlook for the market, we wrote:

We have noted in the past that there has been a tendency for price to pivot off options expiry in either direction; with monthly expiry coming up on Friday, and with the tendency of the sort of money that was chasing ETF approval as a buy event to load up heavily on monthly options, we think that price action through Friday will probably be very telling of the month ahead. Our default case here is that we see a degree of stabilisation and possibly a small uptick over the weekend and into early next week. We should stress here that even if this does come through, we are talking about relatively limited upside potential (i.e. maybe to 43-44k on BTC and some overperformance on ETH) before we start to grind down again.

The first half of that has played out impeccably; we did indeed see a turn in fortunes on Friday and a high on Tuesday just short of $44,000 on BTC. (We do think that relief rally has probably capped out in spite of some prognostications on the shifting picture on ETF inflows but there’s no long discussion on that worth having at this exact moment).

The second half has not. While ETH underperformance over the last few days has been relatively slight (helped by a strong Tuesday), it nonetheless has not overperformed; and, with the first signs of more serious attention from the big research desks onto the potential ETH ETFs later in the year coming through, it seems worth talking a little about ETH’s chronic underperformance as an asset, the potential impact of the ETF, and whether there are better forms of exposure to the Ethereum network as a structure as we move forward into the next market cycle.

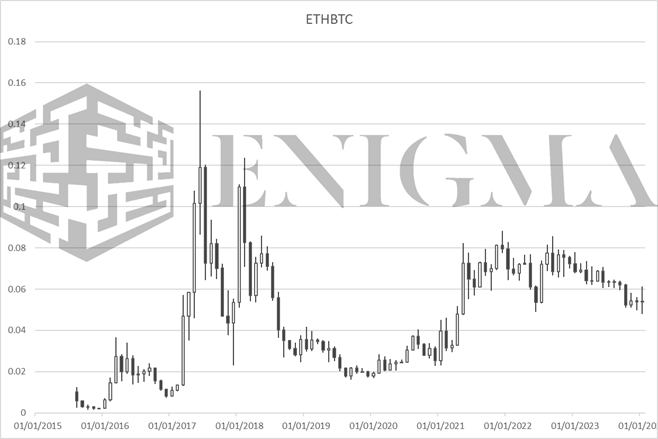

One of the most surprising graphs that one can pull up for those with some, but not full, familiarity with crypto and how its markets work is the long-term plot of ETH vs BTC (i.e. the ETHBTC trading pair):

ETH has never come close to touching its mid-2017 highs relative to BTC. Of course, context is important here; this was when BTC was barely removed from trading in the hundreds (let alone where it is today), as well as before a significant degree of inflation during the ETH PoW years (i.e. those highs today would basically imply a higher market cap for ETH than for BTC). Still: while ETH has ticked up and done particularly well in boom periods, it has spent much of the last few years in aggregate bleeding against ETH, in spite of far greater adoption, actual uses being found for smart contracts, etc.

This can be hard to get to grips with, because it goes counter to what stares us in the face with regards to the relative success and adoption of Ethereum against Bitcoin and basically any comparable crypto network. There are some perspectives, however, from which it shouldn’t surprise us. Let us put it this way: why are there so many Bitcoin maximalists in crypto, so many people out there with years of experience who are insistent on trying to build on and around a network that has such limited capacity and support natively for said ventures?

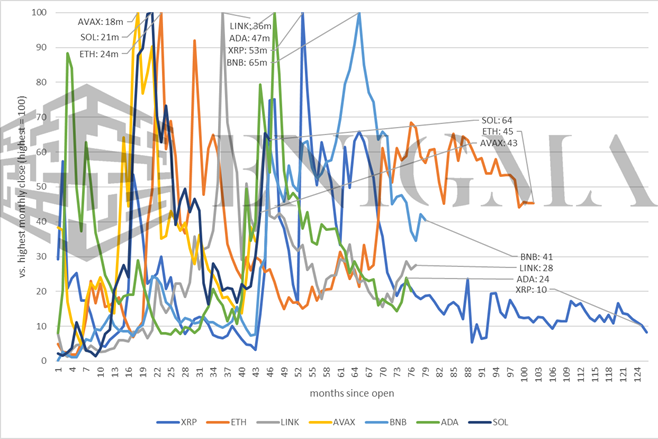

Setting aside ideological veneers, the reason is that Bitcoin maximalism, from a perspective of base asset appreciation, just works. Since the first Bitcoin alternatives, competitors, complements, whatever we want to call them, came around and started picking up decent traction in around 2012-3, Bitcoin as the incumbent has weathered all storms, because it ultimately is the index instrument for the entire crypto market. When markets boom, it underperforms (but still does very well); when markets bust, as they constantly do, it is the last asset to get sold, and therefore tends to overperform. Since speculative markets spend longer busting than they do booming, and since a 50% gain doesn’t cancel out a prior 50% loss, this has meant that even assets that do end up surviving and sticking around tend to lag BTC in totality. We have plotted a few such assets indexed to their highest point against BTC to illustrate that:

To add on to this context, ETH does have some specific things working against it too. We are now entering year 5 of ‘DeFi Winter’, the term assigned to the slowdown of new developments in the DeFi space in late 2020 after a boom period running from April to around October (‘DeFi Summer’); without making this an entire seminar on that chunk of the industry, there was a significant slowdown in new DeFi primitives, new inflows suffered because of other sectors of crypto (particularly NFTs) taking a lot of the attention at the top for retail in Q1 2021, real-world rates increasing took some of the attractiveness of DeFi away (i.e. its ability to match up parties to achieve non-zero yields and use on-chain mechanisms to reduce counterparty risk etc. to acceptable levels on said yields), and while RWAs and the like may end up bringing back some of that reason to be, DeFi in general has been a dog even against spot ETH prices for a while now.

The other big point, and one that we think is very relevant for the best forms of Ethereum (not ETH) exposure going forward, is Ethereum largely abandoning sharding as a scaling approach and instead moving towards promoting layer 2s and rollups instead (with ‘protodanksharding’ and EIP-4844, explicitly built around facilitating rollups, replacing sharding in the roadmap). To be clear, we absolutely think this is the right move – the long-standing vision for sharding always had a significant share of issues and wasn’t achievable insofar as it was even properly defined – but it is a move that is likely to continue to see ETH as an asset struggle, as focus instead goes into the ecosystem around L2s and rollups (and in some cases economic value is extracted by said L2s and rollups instead of by the base network).

The bull case for ETH

In spite of all of that, we tend to be bullish both ETH in absolute terms and on ETHBTC on most timeframes. Why? ETH did overperform in the aggregate during the last bull market (even if it was concentrated into a relatively short period), and if it wasn’t obvious, we are very bullish on Ethereum as a network, and that tide should still end up raising ETH off its recent relative lows over time.

However, we think the spot ETH ETFs are very interesting in terms of being a bullish catalyst. As we said last time, the easy comparison here is going to be to the BTC ETF – hype coming into the event, ruminations on market access, and all of that falling apart in the face of disappointing inflows in the short-term at least. As we also said last time, we don’t think that it’s likely to play out the same way. Part of this is just that expectations coming into the ETH ETF should be suitably chastened, but we also see a key piece of the equation here just being that ETH is starting from a lower baseline.

Specifically, we refer here to the attention and mindshare being paid to Ethereum as opposed to Bitcoin, particularly in Western markets. While Ethereum may have eight or nine years of provenance for itself already, it has never come close to penetrating the cultural sphere in the way Bitcoin did by the same age (which for reference would be around 2016-7 even if we ignore the pre-genesis work on Ethereum nearly entirely).

The availability of an ETH spot ETF has the potential to drive interest and curiosity in the asset in a way in which the BTC spot ETFs were never going to do. We aren’t talking about market access here really – like BTC, anyone who would want to make a large investment in ETH isn’t still waiting to do so ultimately – but we think the eyeballs that a spot product may bring to ETH may lead to short-term gains, especially given that the overhang from ETHE compared to GBTC is likely to be far less severe (very few early premium traders given the difficulty in loaning ETH in 2020, very few late discount traders given ETHE’s lower liquidity and tightly comparable discount throughout 2023, smaller holder base overall, opportunity for Grayscale to lower fees on ETHE if they assess that they have a chance at growing AUM there, etc.)

Hence, we think ETH will likely overperform coming out of ETF approval. One note of caution we would flag up is how certain approval is, and by which date. On the former, while we would say approval is very likely by the same logic that ultimately guaranteed the BTC ETFs (SEC losing its justification for allowing futures ETFs but not spot ETFs in court), it’s not impossible that new criteria comes up to deny (how closely CME ETH futures correlate to spot for example, or some attempt at a justification around ETH’s native yield or some other feature of it as an asset).

Even if not outright denied, it’s possible that we could see pressure put on applicants to refile in order to delay. We would class this as a heterodox view overall, and we tend to think that we will still see approval in the middle of this year, but the point here is that it shouldn’t be seen as a sure thing, particularly given the political context (election in November, BTC approval already representing an embarrassing loss for Gensler and the Democrats, a crypto boom in Q3 likely playing more to the benefit of the Republican nominee, etc.)

In terms of dates, May 23rd has come up, with the justification that VanEck’s application expires on that date. Our inclination is that we probably miss this date and that VanEck end up refiling to come into accordance with the rest of the pack, as happened to a number of BTC spot ETFs with final deadlines before BlackRock’s (for reference, Blackrock’s final date was mid-March, and is August 7th this time around).

The bull case for Ethereum?

Finally, something that we have mentioned before, but feels worth laying out explicitly here as a footnote. As mentioned, the problem with ETH fundamentally is that it’s a far weaker instrument of value accrual than most chains; BTC is a totalising asset in itself on Bitcoin, and most L1s tend to see more gains in net concentrated on the base asset because a) the ratio of new inflows to existing ones on said chains and b) the fact that there’s rarely much to do on said chains (SOL is a good example here – Solana in the 2021 boom was an absolute wasteland, a set of Potemkin villages, and that was a lot of the reason that it was able to rally to the magnitude that it did late that year, and why its comeback this year has arguably been more measured in spite of a somewhat stronger chain ecosystem).

We think that ETH will find itself in a relatively unique situation in the bull market where, because of the focus on layer-2s and rollups, assets relating to said rollups will be higher beta, higher alpha, and have a sufficiently high correlation with ETH to justify greater allocations than usual to said assets instead of holding ETH itself. The two leaders right now in that regard are probably OP and MATIC/POL – OP because the Ethereum foundation is heavily backing Optimism and OP hence should continue to perform (even as a governance token), and MATIC/POL because, despite our historically negative view on Polygon, it does remain one of the largest players in the L2 space, and its transition over to a zkEVM architecture seems to be proceeding relatively smoothly and may allow it to get first-to-market in a similar manner to how it was able to position itself as a general scaling solution in 2021. Other assets like ARB may also be worth paying attention to.