-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Crypto ETP latest: BTC, ETH, LSE

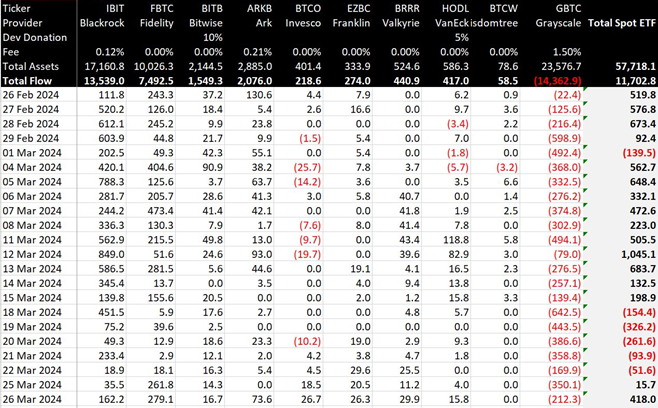

After a couple of poor days at the end of February and start of March, flows did go back to the levels seen in the second week of February (they had trailed off afterwards), and after the ATH break on 8th March (itself a relatively modest day), we saw a record day on the 12th, at net inflows of over $1bn for the first time. Since that week, we have seen a significant depreciation of inflows however, in a very similar manner to what we saw up through the last week or so of February – except, in this case, with higher GBTC outflows turning the net figure negative for every day of the week of 18th March.

BTC ETP flows

Since our last issue (28th February) on the topic, flows have been somewhat up-and-down. There was something of a perception that inflows were breaking new heights every day as we approached and broke ATHs, but per BitMEX Research data, this was something of a mischaracterisation:

After a couple of poor days at the end of February and start of March, flows did go back to the levels seen in the second week of February (they had trailed off afterwards), and after the ATH break on 8th March (itself a relatively modest day), we saw a record day on the 12th, at net inflows of over $1bn for the first time. Since that week, we have seen a significant depreciation of inflows however, in a very similar manner to what we saw up through the last week or so of February – except, in this case, with higher GBTC outflows turning the net figure negative for every day of the week of 18th March.

We would say that what we’ve seen with the inflows so far does speak to something important with respects to the nature of said inflows. While activity over the first couple of months has far outstripped any reasonable expectation in terms of both net flows and volumes traded (even accounting for the fact that e.g. some of the attempts to directly compare the entire class to something like SPDR GLD launch are lazy on a few different levels), said flows do not represent what some are still trying to present them as with respects to being non-reflexive and/or non-price-sensitive.

We think the volumes being traded on said ETFs also speak to that, surpassing $100bn as of March 8th (per Yahoo Finance and The Block). Those figures suggest that the entire AUM of the spot ETFs are being turned over roughly once every 30 days; for comparison, per Slate Street data, that number is typically around 200 for GLD. The point we’re making here is that expectations of a structural underpinning, or indeed to large extend a structural overhang from GBTC, towards persistent and significant pressure on BTC from the ETFs is incorrect in the short-term. It is correct in the longer-term (though the likelihood that BTC trades above gold’s marketcap within the next 4-5 years does temper the trajectory here still).

Beyond that, there are a couple of things worth noting in our view. The first is the flow into ARKB – ARK Invest’s product. ARK have been out of the headlines in general after their major nominal losses on their flagship funds in 2021 and 2022, but returned well last year, and have tended to be big on pushing BTC-specific narratives whenever they sing the praises of crypto; if the flows here are symptomatic of a) a broader ARK revival and b) a stronger emphasis on crypto again, that may cause some interesting ripples for relative valuations within crypto over the next year or two.

The second is that it does seem like we are seeing the beginnings of a pattern emerging, wherein flows notably weaken going into the back end of the month before picking up soon after. The last trading Friday of this month is on the 29th; with a fresh ATH challenge looking possible going into the weekend at time of writing, we will see if that pattern holds up once again.

ETH ETP

While things have largely kept on keeping on with the BTC ETPs, something that has been shifting is the perceived outlook on the possibility of US ETH ETPs in short order. This has waxed and waned somewhat as a topic of conversation, but the immediate reaction in some corners – especially after the disappointing first week or two of the BTC ETPs – was to look towards the potential impact of an ETH product, given that a) BlackRock and other providers have already filed for them (BlackRock in mid-November of last year, i.e. at about the same time as a January approval for BTC ETPs started to look overwhelmingly high priority), and b) clearly, the BTC ETPs were doing something to the market, especially on the lead-in. (Our general view at the time was that an ETH ETP would likely be modestly positive leading in and more positive leading out, mainly due to ETH’s lack of mindshare relative to its size in the market, and its struggles with underperformance over the bulk of the last couple of years).

Initial hopes were high; however, probabilities are being placed much lower for approval in May at least, most notably by the analysts at Bloomberg (Eric Balchunas and James Seyffart) who were largely ahead of the curve on the BTC ETPs, with Balchunas putting the chances at “25%…a very pessimistic 25%” as of Monday of this week. Why? The major, concrete problem is that there have been very, very few signals of the SEC and of the providers themselves engaging in pre-preparation for a sudden launch compared to how things ramped up from about October onwards leading into BTC, as well as some side-points around particulars that mean that approval isn’t automatically guaranteed by Grayscale conversion and the BTC ETPs (the main two being attempts by providers to integrate stakng into spot products as soon as possible, and the potential for the SEC to produce data justifying a sufficient disconnect between regulated futures prices and spot prices).

We do tend to think the risk of outright rejection in particular has now swung around to being generally overstated; unless we are willing to engage in justifications that verge on the conspiratorial (e.g. Gensler trying to block an ETH ETP until after the election because…why, exactly?, or there actually being serious attempts to challenge ETH’s status as a security because of staking), we can’t see a world in which the ETPs are outright rejected and where the SEC are willing or able to go through the sort of rigamarole that they had to in order to continually block the BTC ETPs. What we will note is that a) the BlackRock final deadline is in fact in August, not May, and b) as happened to the majority of the field in the BTC case, there can always be tacit agreements to refile on ETFs in order to not force or enable outright rejection.

Hence, our default scenario right now tends towards ETH ETP approval in early-to-mid July; with that in mind, we would tend to expect a refiling on the VanEck fund sometime in the next month or so.

BTC and ETH ETNs

Finally, something that we don’t think will have much impact on anything, but that we know that will be enquired on heavily and hence demands a footnote. The London Stock Exchange issued a notice on Monday indicating a timeframe on the listing of crypto ETNs on the exchange: applications will be allowed from April 8th, with first listings potentially coming on May 28th.

This may seem like a significant move at face value, but the key thing here is that this doesn’t directly do anything to reverse the existing retail ban – for those unfamiliar, the FCA banned retail investors from buying crypto ETNs (and derivatives) in 2020, a move which was somewhat justifiable with respects to derivatives (albeit the consumer protection here was basically illusory given where retail investors were trading derivatives in the first place) but was ridiculous with respects to ETNs (the move in practice basically only targeted products like the popular CoinShares BTC and ETH ETPs – products that were as efficient and ‘vanilla’ as it is possible to find, and were arguably better than even direct spot holdings for most of the said clients that were purported to be ‘protected’ by them).

The products themselves are unlikely to be interesting; the LSE is simply not a sector-agnostically important venue anymore, and we would be surprised to see any significant demand here. The hope would be that this is a precursor to lifting the broader retail ban on spot crypto ETPs in the UK, but even with this development, that currently seems a long way off.