-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

BTC: September seasonality and the regulatory spectre

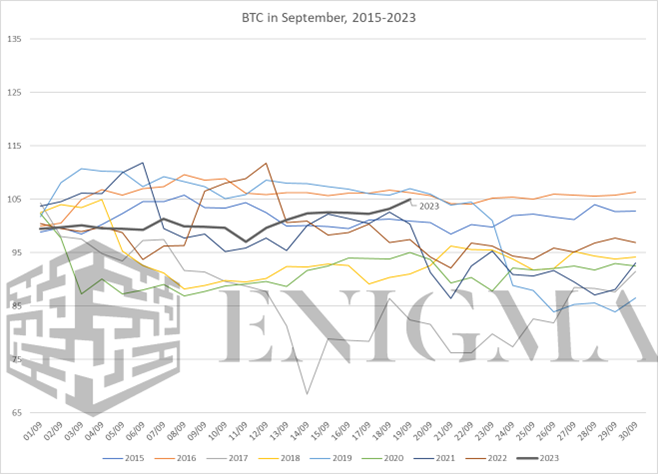

There tends to be something of a feeling of dread for crypto coming into late September every year for crypto markets for the very simple reason of said dread being empirically justified. Despite having returned tens of thousands of percent in gains since 2015, BTC has outright returned negatively on average in September, finishing in the red in every year since 2017 to between 3% and 14%:

Executive Summary

-

We relay the history of Bitcoin's negative seasonality in September and the regulatory fears stoking it

-

On examination, these fears mostly come back to one data point (2019) which looks less relevant going forward over time

-

While we remain bearish in the short- and medium-term for the most part, a rally within range through month's end seems possible

There tends to be something of a feeling of dread for crypto coming into late September every year for crypto markets for the very simple reason of said dread being empirically justified. Despite having returned tens of thousands of percent in gains since 2015, BTC has outright returned negatively on average in September, finishing in the red in every year since 2017 to between 3% and 14%:

Why? There are several factors that weigh on the overall seasonality thing, but the key point of focus over the last couple of years in particular has been regulatory enforcement. US regulators, as a rule, have a tendency to backload enforcement cases towards the end of the year. A short study by Columbia Law scholars Dain Donelson, Matthew Kubic, and Sara Toynbee published last March noted that 17% of all SEC case filings (i.e. double what one would expect for a normal distribution) come in September.

This glut is generally accepted to be an artefact of the US fiscal year, which starts in October; the short version is that, particularly for cases ending in a financial settlement, it tends to work out better for all involved parties to bring cases over the line before the start of the next fiscal year – for the companies with regards to settling cleanly, and more importantly, for the agency with regards to ‘wins’ (fiscal and otherwise) for the budget. The aforementioned study notes that there is an increased tendency for defendant cooperation and filing as settled charges in September, and that the penalties themselves tend to be lower.

We could talk for hours about such a regulatory season being a concern for crypto; nonetheless, it is what it is. The anchor point for fears and uncertainties here is, undoubtably, what happened in 2019; on 30th September of that year, the SEC announced a case and settlement with EOS’s block.one, fining the company $24 million for the EOS ICO (at that time still probably the most highly-regarded non-Ethereum layer-1) in 2017, stoking up fears of further actions to come. The context here was that while the ICO era of 2016-8 had seen a large number of resultant cases in late 2018 and through 2019, most had targeted promoters and outright fraudulent ICOs (e.g. six-digit penalties levied on Floyd Mayweather Jr. and DJ Khaled for promoting the Centra Tech ICO in 2017).

The block.one case was targeting an ICO with a ‘legitimate’ end product and targeting the holding company itself, and hence was seen as an opening or re-opening of the door on potential litigation against distributions and base assets that had taken place years prior. There are significant similarities here in fact with the concerns around the Binance and Coinbase cases this June – the worry was not so much for the targets but for the ‘sins of the fathers’ implications for everything up to and including Ethereum (which was itself distributed via an unregistered ICO back in 2014).

While it needs to be stressed that the block.one news did not in itself obviously crash the markets – the downturn seen that September was largely realised in a single move on 24th September, several days before the settlement broke – it did set the stage for an extended rout through Q4, with a -14% return overall (after -23% in Q3) and, more importantly, a very pronounced and consistent downtrend throughout.

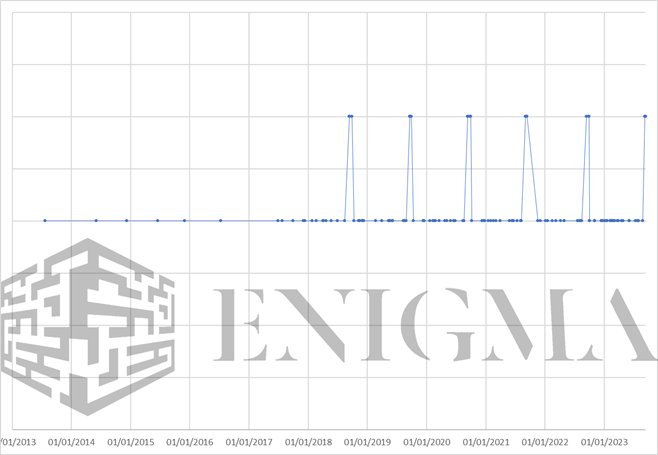

Since block.one, there has hence been a fear around September. The question is: how far is this really warranted? We plotted out all 134 SEC enforcement announcements as of 20th September that have been labelled directly as relating primarily to crypto assets; of these, 19 (14%) were in September.

There are a few things to note here. SEC enforcement only really begins in earnest on crypto asset cases in 2018, and the 2018 drop itself had very little to do with said regulatory action; but we can also see how it was probably a factor in 2019, especially given the quiet from the SEC for much of the second half of the year up until that point. A similar effect can be seen in 2020 and to some extent 2022, though not 2021 or 2023.

Despite the reputation, most September cases have been relative small fry since block.one. 2020 saw a few minor ICO settlements. 2020 saw a second action filed against BitConnect (a fairly straightforward Ponzi scheme whose crypto trappings were secondary) but absolutely nothing in the second half of the month. 2022 again saw several small cases (serial ICO promoter Ian Balina and Sparkster’s settlement probably being the most notable) but nothing of real note.

This lines up with the Columbia Law study and hypothesis. Essentially all cases filed in September, with the exception of BitConnect (on September 1st), have had no implications outsides of themselves, generally consisting of nice fat disgorgements and six-figure civil penalties for the SEC on assets that everyone by then had forgotten about anyway. That is not to say that concerns around the period are totally unfounded here. You may note a decent number of cases that were filed in Q4 and early Q1 each year; in 2020, for instance, these included the John McAfee case on October 5th, the Ripple case on 22nd December of the same year, and (not listed on the graph because it was a CFTC case) the BitMEX case on October 1st.

However, on examination, it does seem that the September fears are perhaps to the point of overstatement in crypto markets as it stands. Notice the glut of cases from November 2022 through to May 2023. When the September effect became received wisdom in 2019 and 2020, it was because we suddenly saw regulatory cases spring out from nowhere, in the manner of a movie character assessing that the predator tracking them had probably lost the trail, seconds before being devoured off-screen. For better or worse – realistically, almost certainly for worse – we are not in that environment anymore.

The SEC has opened cases in just the last year against Binance, Coinbase, Bittrex, Celsius, FTX (multiple times over), Do Kwon and Terraform, Justin Sun, Genesis, Gemini, and Kraken, to name a mere dozen or so. The majority of said cases remain open. There are technically entities left to charge (e.g. DeFi protocols and layer-1s with significant US operations), so we will not be as glib as to suggest that there isn’t, but it is beyond clear that nothing is settled and that the industry is under regulatory assault right now. Nothing that can come from the SEC or other regulators in terms of charges can really change perceptions for the negative in the manner that block.one did four years ago.

That is essentially the point to make here. At the risk of looking very foolish in the next ten days or so: it seems that we’re at the stage where anything that comes out of the regulators is more likely to be positive (i.e. closing out a case, accepting a settlement, and therefore putting a price on said actions in a way) than negative (charges against a new entity, charges that are a substantial escalation on those existing). There are certainly clouds on the horizon still, particularly with how things are swirling around Binance; but it’s hard to see what breaks the dam in the extreme short-term.

As of yesterday’s close, price action is at its strongest since 2019 at +4.9% on the month; markets remain locked in a tight range, and we still see the trend as structurally negative going into Q4, but it would not be a shock to see it hold out at or above current levels through month’s end as the received wisdom of September regulatory bombshells possibly ends up denied.