-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

BTC ETPs latest: assessing the field

We will speak more on inflows by product in the next section, but in terms of the general trend: the last couple of weeks have been indicating towards something very different to where we were at the end of January. We do need to make the point here that while the initial inflows were described as “disappointing” in some quarters, this was always something of a misinterpretation; they were if anything above median expectations for that first week or so, and it was always likely that we would see a big rush on the first day and reduced momentum over the course of that first month.

In-flows

We will speak more on inflows by product in the next section, but in terms of the general trend: the last couple of weeks have been indicating towards something very different to where we were at the end of January. We do need to make the point here that while the initial inflows were described as “disappointing” in some quarters, this was always something of a misinterpretation; they were if anything above median expectations for that first week or so, and it was always likely that we would see a big rush on the first day and reduced momentum over the course of that first month.

The turning point here was on February 8th; as markets moved up (and beyond the technical levels that suggested that said move up was still mostly a retrace), flows started to stack up. Why? As it stands, we don’t exactly know, but it seems very, very likely to have something to do Coinbase and its battles with federal regulators (e.g. the lawsuit brought against it by the SEC). On that date, Paul Grewal (Coinbase’s CLO) took to social media hinting towards a significant win for the exchange (“We regularly have to deliver tough messages; depriving us of the first shot to share news when it’s good is discourteous at best…a word of advice to outside counsel: don’t front-run your in-house counsel in sharing good news with their business partners. Let them have that moment); since then, both price and inflows have been up-only.

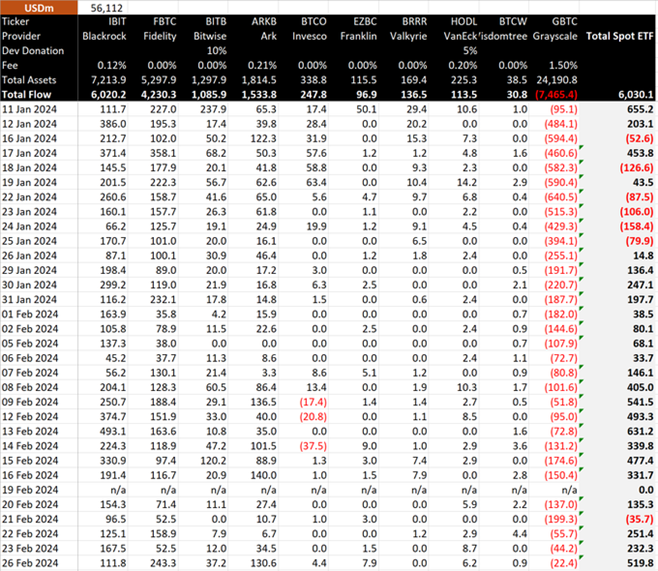

Via Bitmex Research:

This slowed down over the course of last week, before another large print (over $500m, albeit with lower than usual Grayscale negative flows offsetting) on Monday. It will be interesting to see how this ends up playing out over the next couple of weeks should markets start to slow down again, and in particular after whatever news being alluded to by Coinbase eventually comes out (i.e. we don’t think these creations are responses to customer demand so much as larger entities thinking that they have an edge on a headline trade of some description).

‘The field’

When we last wrote extensively about the ETFs, the situation was as such: IBIT and FBTC dominating early inflows, BITB and HODL as the strongest potential challengers, the other five major products as afterthoughts, and Grayscale in terminal decline (but the speed of that decline was being overestimated in the moment). The one big difference so far compared to then is that has been that Ark Invest’s ARKB has picked up steam significantly; while it enjoyed healthy flows in its first few days (including a $122m inflow on the first Monday of trading that outshot everyone except IBIT), it really started to move with the beginning of the overall market rally on the 9th February, adding $136m on the day and $752m total from the 9th to the 28th (a distant third to IBIT/FBTC but also far ahead of BITB, which unsurprisingly has fallen back in a market where retail remains in an oddly uninterested spot).

Much is being made as we write this of Fidelity recommending an allocation as part of a conventional portfolio. To clarify what’s going on there: Fidelity’s Canadian subsidiary appears to have added a small crypto allocation (between 1% and 3%) to its synthetic ‘all-in-one’ ETFs, and indeed FBTC saw its highest daily inflows since 17th January yesterday, far outstripping IBIT for once. This is an indication in the direction that Fidelity are likely to go with regards to pushing the FBTC product into portfolios; the announcement itself isn’t all that significant in the short term beyond what we’ve already seen today.

The only other major thing to note is GBTC, which – predictably – has ended up slowing down in terms of massive early outflows, albeit still seeing consistent redemptions. As we noted back in January, both the size of the backlog of redemptions and in general how much of GBTC AUM was ‘mercenary’ was overstated in the days following the ETF launch (and in the context of the initial poor price action); the reality is that while there were a few billions’ worth of shares that were likely to be redeemed as quickly as capacity allowed (predominantly having been bought post-premium inversion rather than being 3+-year holdovers), large amounts of GBTC were either held by retail or otherwise by entities in no hurry to incur a taxable event by selling or redeeming. Grayscale’s entire business strategy has been to not lower rates, hold onto that AUM and associated fees (at a quick calc, fees times AUM today on Grayscale equals around $363m against $129m for the rest of the market combined – there are a dozen different qualifiers to this but the picture is paints isn’t wrong), and hope GBTC bleeds as slowly as possible as it develops new products. Grayscale could conceivably shrink to less than 20% of AUM (43% today) and still outearn the entire rest of the market combined; this needs to be borne in mind when looking at its flows and AUM going forward.

One other note to make here: when retail turns up, expect it to show up in the BITB (and maybe ARKB) in a far bigger way than it has now. We have been very wrong on low time frames over the last month or so in terms of misjudging the potential for short-term appreciation without stronger retail participation; we have to admit to that. However, we have to reinforce here that retail participation IS low, at least in terms of the sort of interest and associated flows that propelled markets in 2017 and 2021 (there are similarities here to Q3/Q4 2020 re: retail not really involved until markets break all-time highs). It could end up being the case that we don’t get that mania again and that we don’t end up needing it for all-time highs; however, it’s probably safer to assume that we do, and those sorts of inflows may end up being an interesting heat check for that more manic interest down the line.

Volumes

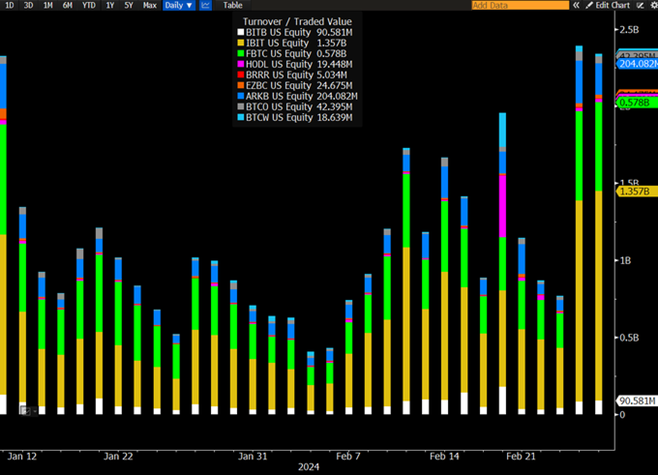

Via Eric Balchunas at Bloomberg:

Something slightly unexpected with the ETFs has been the volumes that they have attracted on secondary markets. Why was this unexpected? The answer mostly comes down to “because GBTC volumes were never particularly high”; its peak daily volume was $19m on January 29th, 2021, and indeed the entire reason that the GBTC trade fell apart was because the firms conducting the trade massively overestimated the potential capacity for the trade with regards to attracting buyers at the premium price in said market cycle. Furthermore, while naturally ETFs are designed to be traded (the clue being in the name), the entire narrative behind the Bitcoin ETFs was almost the opposite – that these were instruments that allowed investors easier access to the underlying assets, and would hence probably be bought-and-held in a similar manner to e.g. gold ETFs.

BTC ETFs passed $2bn in daily volume on the first day, fell quickly back, but started building again in February and got back above that $2bn mark again on Friday and Monday. We will note here that at least some of this volume is probably being driven by all of these ETFs being relatively new and hence opportunities for arbitrage on extreme low time frames cropping up; the biggest feather in the cap of that theory was HODL, which remains tiny, seeing several hundred million in volume after the long weekend on 20th February before falling off the face of the Earth again.

We think the IBIT figure in particular is worth keeping an eye on going forward. With respect to Fidelity, the BlackRock product has ended up being the early leader, especially with regards to non-advisor flows; if volumes remain high or continue to grow, it could be an indication of the rally broadening and hence of some more short-term upside to come.

Gold ETFs

One small note to end on here: the comparison always made when talking about the BTC ETFs is with the gold ETFs. We aren’t going to rehash the “look what the gold ETFs did for the underlying” story again, but we will note that the two products end up being very comparable – and, because they now exist at the same time, they may end up being competitors to each other. This means that, longer-range, the accumulation of AUM into the BTC ETFs needs to be compared against the reduction of AUM on the gold ETFs. While it’s too early to draw a hard comparison, we will note that while BTC flows since launch total to about $6bn net in, gold has seen around $3bn of outflows, concentrated on the SPDR GLD product (notably operated by a firm sitting out the BTC ETF race itself in the form of State Street); this may raise some indications about potential and total capacity for BTC ETFs down the line.