-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

BTC, ETFs, and the rally: 2020 redux?

As we write this, BTC is trading at its highest level in nearly 18 months. Tuesday’s high print just above $35,000 and close at $34,000 both mark a return to a level not seen since the open at May 9th, 2022 – for those tracking timelines carefully, that was the day on which UST started to seriously lose its peg (having dipped a couple cents off over the weekend) and would rapidly transition into complete collapse, bringing BTC down 12% on the day after several days prior of bleed.

Executive Summary

-

Crypto markets in general have rallied significantly over the last two weeks.

-

Said rally has hinged on BTC (which leads over almost all alts).

-

Our view: more likely at a local top than in the middle of a larger move.

As we write this, BTC is trading at its highest level in nearly 18 months. Tuesday’s high print just above $35,000 and close at $34,000 both mark a return to a level not seen since the open at May 9th, 2022 – for those tracking timelines carefully, that was the day on which UST started to seriously lose its peg (having dipped a couple cents off over the weekend) and would rapidly transition into complete collapse, bringing BTC down 12% on the day after several days prior of bleed.

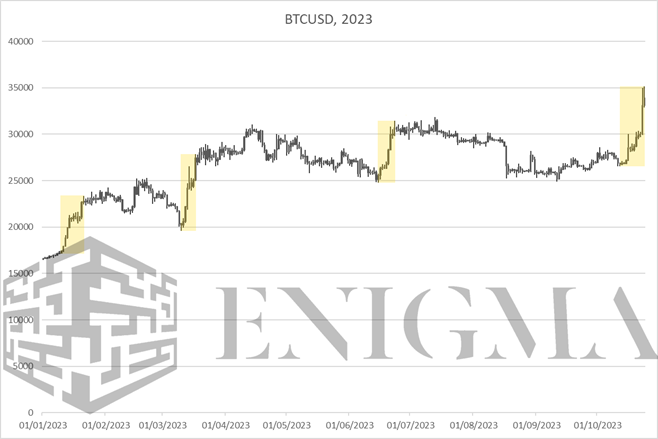

In pure percentage terms, this isn’t the biggest rally we’ve seen this year, or even the second-biggest; while these things always tend to depend on where exactly you draw the line, a reasonable reading (from the intraday low on 12th October to the intraday high yesterday) puts it at around 32% in 12 days; March’s rally saw 48% in the same time, and January 36% (and closer to 50% across the full month).

In terms of levels and potential market structure, it may nonetheless be the most significant. Why? To put it as simply as possible, note that aforementioned date: May 9th, 2022. We are now trading and challenging the levels that almost perfectly match those seen at the moment that crypto started getting hit by earthquake after earthquake with respects to collapses of major structures within the industry, starting with Terra and then moving onto Celsius, 3AC, Voyager, BlockFi, Alameda, FTX, and so on.

It is very, very easy to forget this given how everything would end up playing out, but a lot of air was already out of the bubble by May 2022. BTC was down around 60% from its November 2021 high. ETH was at -50%, SOL was at -70%, and even LUNA was -30% after hitting all-time highs the previous month. Hence, there is a structural and psychological significance towards markets trading at or above these levels, in terms of marking a return to a normalcy of sort. This is something that has, in fact, come up previously in research, explicitly on at least a couple of occasions; the $32,000-$33,000 level on BTC, and comparable on other assets, is where we have long expected to see market structure start to potentially shift.

To start off here, we have to throw in some qualifiers, with the first big one being this: in spite of intraday action and even daily closes, we do not think market structure is shifting just yet. We have said since the start of the month that our expectation was for a rally some time in October towards the top of the range that BTC has traded in since March (between $25,000 and $32,000) due to a slight easing of regulatory concerns and moves towards spot ETFs that nonetheless would not mark the immediate realisation of said spot ETFs.

Our view is that the action over the last week or so has basically reflected that. Last Monday’s jump that would ultimately be the first leg up of a longer rally was explicitly because of the spot ETF, as was much of this week’s action (while more substantially upheld, Monday’s intraday move and pullback was once again based on spot ETF news that was positive but was read as more positive than it initially was re: CUSIP update and filing language on seeding of BlackRock ETF). Additionally, we have seen rumours start to proliferate around a potential Binance DoJ settlement – while we have to strenuously emphasised that said rumours are not confirmed or even substantially backed by anything as of yet, as we said in September, a settlement with Binance (even if punitive) is an important and necessary bullish catalyst going forward due to the simple uncertainty that it ends up removing up and down the industry.

A strictly technical approach would imply probable upside given the last couple of closes on BTC to $38,000; we tend to lean more bearish than that even, and think that we will start seeing a bleed downwards before getting there. Why? While there has been a more substantial uptick in volumes and sentiment than in previous rallies this year, retail participation in the market appears to remain on the low side overall. The move here overall seems to be driven by mid-level money, looking to frontrun the ETF and other developments, positioning in a manner where they can be confident of being on-side in the medium to long-term albeit willingly or otherwise being set up to take some losses in the short term.

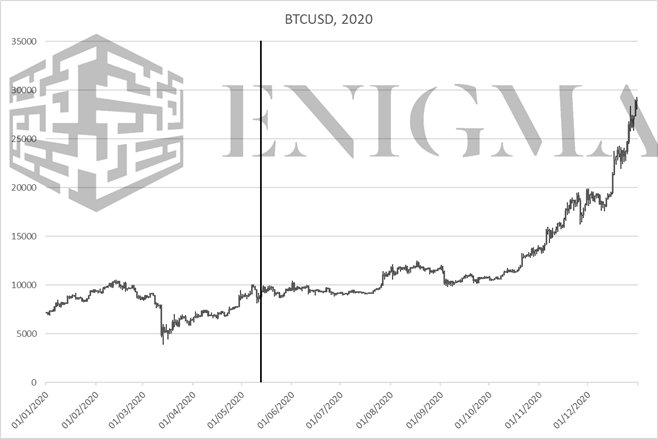

When have we seen this before? The answer is 2020.

Sentiment and volumes bottomed in December 2019, and after rebounding quickly (as all risk assets did) from the Covid crash in March 2020, a lot of focus from the likes of family offices, high net-worth individuals, small hedge funds, and various other entities that could be described as ‘mid-level money’, went onto the May 2020 halving (the contraction in Bitcoin’s supply rate that occurs once every four years).

The halving was portrayed almost messianically in some circles, and there was validity to the idea that it was going to matter for price going forward (albeit the focus on stock-to-flow and similar absolutely over-quantified that to the point of ridicule). The halving came and went in May with much fanfare, but in the short term, very little price impact. A rally in July (which was a lot more to do with Ethereum and ‘DeFi summer’ was fully retracted at the start of September, and crucially we wouldn’t see a breakout above $13,000 – the 2019 high – until October, at which point the dam broke and we saw $60,000 within months.

Movements within a structure in crypto are driven by speculation, but movements that break those structures are driven by participation. The speculators can read the present and future well, and put themselves onsides for what is to come, but they are ultimately at the mercy of participants.

The issue here is that, like in 2020, we think the discourse around these narratives (that are still undoubtedly positive) is getting somewhat misleading, and that there will be a price to be paid for that. In particular, this is about the spot ETFs. Yes, spot ETFs are going to be absolutely transformative for BTC (and ETH) in the medium to long-term; but as we wait and wait, the narrative is turning from it being a long-term catalyst to a short-term one, that there are billions of dollars of money ready to be invested day-one once the ETFs broaden market access overnight.

We do not see it playing out like this. There may or may not be significant first-day inflows (note that there haven’t been on e.g. VanEck’s various recent futures ETF launches), but the reality is that as much as market access may have diminished in some ways over the last couple of years (no FTX, Binance moving out of several jurisdictions, Grayscale’s funds trading at a massive discount to NAV, etc.)…to put it as simply as possible, if someone has a lump sum of cash to throw at crypto, it has been a long time since that was genuinely difficult to do, even in the US context. Market access is important, and yes, spot ETFs are the holy grail for long-term market access – but they matter because of their ability to capture ongoing and passive flows, not active ones.

Again, looking back a few years, a decent comparison here is the Bakkt launc in September 2019, where the advent of an US-based physical Bitcoin futures contract was heralded as a huge step forward. Lo and behold, early volumes were dire (and never really picked up), and BTC recorded its second-biggest one-day drop of the year the day after at -12% on Tuesday 24th (one day after the launch on Monday 23rd).

We tend to think that markets will drop significantly in the weeks after approval of the spot ETFs (currently estimated for December or January, with March being the final deadline as it stands), and that any true structure-breaking rally (i.e. the next bull market) is likely to only come into play in the months following that. These timelines are why we would tend to suggest that this is far, far more likely to mark a local top than the start of a further breakout to the upside for markets.