-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

BlackRock, gold, and Grayscale: ETF latest

This week saw BlackRock filing for a spot Bitcoin ETF; we will not go through the whole story here, but in brief, the ETF would trade on major US markets, uses Coinbase as custodian without specifying purchase mechanisms in our reading, and the current deadline for a decision on the SEC’s end is in February 2024.

Executive Summary

-

BlackRock have filed for a spot ETF in the United States.

-

BlackRock have a near-perfect record on ETF approval, and the move is being taken as a green light for the SEC relenting and approving spot ETFs in the US.

-

The move is also being seen as a powerful positive catalyst for BTC price.

This week saw BlackRock filing for a spot Bitcoin ETF; we will not go through the whole story here, but in brief, the ETF would trade on major US markets, uses Coinbase as custodian without specifying purchase mechanisms in our reading, and the current deadline for a decision on the SEC’s end is in February 2024.

Instead of rehashing all the public discourse on it, we have instead chosen to focus on two particular aspects; first, the comparisons to the introduction of gold ETFs in 2004 and the effect on that market, and second, what this means in relation to the Grayscale trusts and the discount situations there.

Comparisons to gold

One of the more common refrains heard in the aftermath of the BlackRock announcement was comparing Bitcoin to gold. It should be said that this narrative is not new; it is something that we recall writing extensively about in 2019 and 2020, in fact. To explain in brief, physical gold ETFs/ETPs are a relatively new product; a few have claim to technically being the first, but the first significant one in terms of market access was State Street’s SPDR Gold Shares (GLD), which started trading in November 2004.

Gold was essentially in a consistent uptrend from the launch of GLD until mid-2011, peaking in August at $177 a share in GLD and around $1900/oz, before registering a 45% drawdown over the proceeding five years and only recently (late 2020) re-achieving those aforementioned highs. To put the argument briefly, more market access – and a more transparent market – meant more buyers, which caused an explosion in price for an extended period.

We are very familiar with this argument, mainly because it’s an argument that we were, as mentioned, making over and over in 2019 and 2020. Market access ultimately does dictate the ceiling on any investment, and a Bitcoin ETF on a public US market is close to an endgame for total market access for the asset because of what it means for exposure to the largest institutional bodies, and to instruments such as 401ks. (Arguably, the EDX Markets news may end up being the more significant initiative announced this week in the long term, but that’s another question).

However, we have to spoil the party a little here. Direct comparisons of GLD to the BlackRock ETF are asinine, because while GBTC is an OTC product, it has enjoyed market access in general in the US that utterly dwarves anything that existed for gold beyond 2004 in those vital retail sectors and instruments. You are not starting at the bottom of the curve, with gold stuck for a while at around $400 an ounce – and even in that regard, it does need to be pointed out here that gold started moving up from around late 2001 onwards at a very similar momentum to its post-2004 trajectory, as we can see easily on a log-scale chart:

We do not see the BlackRock ETF as a short-term structural catalyst. With that being said, we would instead frame its potential positive impact in two ways. It could still ultimately be a short to medium-term sentiment catalyst – the digital gold narrative seems to be finding its feet again as inflation remains stubbornly high outside of the US itself, and as BTC approaches medium-term resistance at around $32,000 again, its reaction at those levels (and a potential weakening of the relationship for now between BTC and other assets within crypto) will be important to watch.

In the long term, we tend to think it is structurally positive. The ETF announcement has been met with a lot of scepticism from those within the Bitcoin community, because – among other things – the reputation of BlackRock and similar firms for market manipulation within commodities markets (including gold/silver), some of which is decently founded even if some of it is not, and the fact that said manipulation is said to reduce market volatility and upside through e.g. short-long trading and the ‘paper gold’ market in general.

Scepticism here is understandable, especially from an ideological perspective, but we still see it as a positive because there’s nowhere left to go in terms of mass market access. After a battering over the last two years, Bitcoin sits at a nominal market cap of between $500bn and $600bn. Gold, in its entirety, in terms of above-ground holdings of all sorts, is estimated to be at around $12tn, with around $5-6tn of that in fungible forms.

Does anyone out there at this point really think that Bitcoin will eclipse the entirety of physical gold in the next 5 years? Well, yes, they do, and we are sure they will make sure that we know all about it after this note goes out; but discounting apocalyptic circumstances, it seems unlikely. In our view, the most reasonable ballpark estimates one could make for a Bitcoin ceiling in this decade (again, assuming no hyperinflation or anything of the kind) probably places it at a peak of anywhere between $4tn and $8tn adjusting for inflation.

Those are big numbers – along the lines of a $200k to $500k price per BTC. Bear in mind here, however, that even $500k would represent around an 8x return on the peak in 2021. BTC returned around 20x from the 2018 and 2020 lows this time, and around 100x from 2015 to 2017. We may see – we will see, in fact – 100x returns in another bull market, but they won’t be on BTC.

There becomes a point at which it’s no longer a case of reducing friction on soft investment and you instead need to unlock the levers to those harder forms of investment to continue expansion. We think BTC largely went past that point quietly some time in 2021. As a commodity, BTC needs the BlackRock ETF, because it needs access to the money that basically only advisors and asset managers can deliver to it – that the VanEcks, State Streets, and yes, BlackRocks of the world can do for it.

Grayscale impact

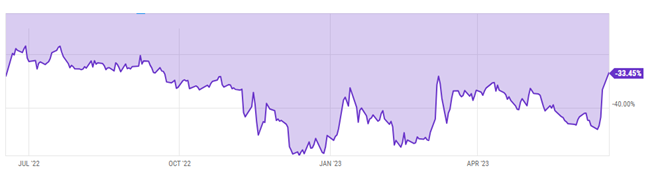

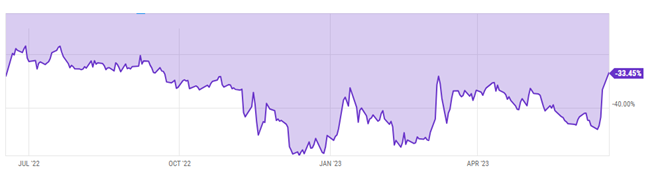

Unsurprisingly, the Blackrock ETF rumours and then announcement have helped to significantly swing the GBTC discount back towards par, trading at -33% as of Tuesday’s close after being at -44% a week prior. Looking at recent months, we can see that this is significant, but not entirely without precedent:

GBTC discount remained in the -15% to -30% for the most part pre-FTX collapse even in the context of an overall depressed market, but excluding that, we see similar peaks to the current ones in mid-January and March. Both of these moves came in relation to Grayscale moving forward with litigation against the SEC; the former with the filing of its brief in its SEC suit, the latter after oral arguments that experts generally saw as a win overall for Grayscale.

Note that, in both cases, the premium tended to slip down again over the coming weeks. Will this time be different? There has tended to be a relationship between overall discount level and BTC price over the last 12 months, but we can see that this hasn’t really led to sustained compression this year in either event, with discount deepening again even as BTC markets were holding up relatively well:

In theory, ETF approval from BlackRock would make it hard to justify a block on conversion for Grayscale at some point in the relatively near future, given that the disagreement between the SEC and Grayscale (and other would-be ETF providers) has always centred on spot. The problem is that, as we said back in March, the Grayscale discount in general terms should be understood to some degree as pricing in the downside risk on the underlying when redemption finally happens. As price increases, that downside risk in our view increases with it; very recent gains asides, we still have not seen sufficient momentum to suggest a sustained breakout to the upside this year.

With that being said, we would say that there is probably further room for compression here, even with the ruling on the Grayscale SEC case being uncertain in terms of both date (CEO Michael Sonneshein had moved projections back to the end of Q3 in April) and contents (we tend to think that Grayscale will win the case, but that the SEC will likely be given grounds for denying conversion on the grounds of other reasoning). A compression to around -21% seems very possible over the next few weeks; further compression about that level would probably require imminent approval, and in general we would expect discount to range from -20% to -35% given that it would take an extraordinarily positive ruling for the timeframe to come down to this year for redemptions being enabled.

As for the longer-range future of GBTC and Grayscale: to put it simply, it’s hard to see a reason for GBTC to be used or even exist in a world with BlackRock (and other) ETFs enjoying full market access, and hence the fortunes of Grayscale remain unclear. We are tending to see short-term dissolution as less and less likely, but a lot will likely depend on how much traction Grayscale are able to get with their Ethereum and altcoin trusts going forward; if there’s a future for the manager, it would seem to be in being able to present as expert providers for frontier assets and even Ethereum itself given the new-found regulatory uncertainty for even major layer-1s and the like in the US. We will note that while Grayscale has provenance in these funds, many currently sit at low-7 digit and even 6-digit AUMs, which may not be sustainable if there’s a serious pivot into them (though the Ethereum trust has over $5bn).