-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

After the spot ETFs: outlook for BTC

For regular readers of the weekly, this is going to feel like a broken record moment, but we do have to repeat it at least one last time: the ETF approval for BTC was always going to be a hard sell-the-news event. The only thing that was really up for debate in our view was whether the post-ETF sell-off would take place on the day, or whether we would see a brief stabilisation through the first two days before selling off, and it of course turned out to be the former. The 1-hour high for the year to date on Coinbase was set in the same hour that the ETFs started trading; we don’t think it gets any clearer than that.

Executive Summary

-

We look at price action following the spot ETF launch and at what comes next.

-

Short-term: prices to remain depressed, stabilisation into grind down through Q1.

-

Medium and long-term: lows marked mid-year, strong Q4, very strong 2025.

For regular readers of the weekly, this is going to feel like a broken record moment, but we do have to repeat it at least one last time: the ETF approval for BTC was always going to be a hard sell-the-news event. The only thing that was really up for debate in our view was whether the post-ETF sell-off would take place on the day, or whether we would see a brief stabilisation through the first two days before selling off, and it of course turned out to be the former. The 1-hour high for the year to date on Coinbase was set in the same hour that the ETFs started trading; we don’t think it gets any clearer than that.

To delve a little more deeply here, in our view, everything still comes back to a fundamental misapprehension by market participants with respects to what the ETFs represent – that being, short-term market access for retail and institutional clients alike. The narrative for years has been that spot ETFs represent essentially the final frontier for market access for crypto – once they’re achieved, there is essentially no money that is theoretically off limits with regards to being able to invest in crypto, other internal controls on said money notwithstanding.

There is a sort of reverse-Bell curve with how true this is over time. During the first great bull market in 2017, an immediate spot ETF would probably have indeed created an even greater rush of money into crypto than happened at the time (and created a bubble that would genuinely put everything seen before to shame and made the comparisons to tulips or what have you slightly less trite and hackneyed) because of how genuinely difficult it was to onboard into crypto without using extremely disreputable and poor provenance venues. Five years from now, the spot ETFs will aggregate to likely hundreds of billions in in-flows and bring BTC to its summit (i.e. ‘digital gold’ realised).

Right now, however, the impact of that market access is not that significant. The situation with respects to both exchanges and custody at all levels for on-shore clients is light-years ahead in 2024 of where it was in 2017; simply put, anybody with a shred of real will to invest in crypto assets in the moment has been able and comfortable in doing so for several years now. The flows that the ETFs will unlock in the longer-term, coming as they do from 401ks and the like and in general being advisor-driven, will be very real, but there will be a ramp-up period measures in years rather than weeks or months, as there always is with said products.

This reality is completely and totally reflected in what we’ve seen in terms of ETF inflows and outflows so far. Inflows were decent and technically record-breaking at $4.5bn in the first 7 days (with much of that having been frontloaded), but when GBTC redemptions are factored out, only represent about $1bn net – definitely good, but far from indicative of big tickets being written to only now get into BTC, especially given that these figures don’t include various outflows on non-US ETFs and other more obscure products.

Volumes arguably print a slightly better picture here at $6bn in the first 7 days ex-GBC ($14bn including it), but the crux of the ETF argument wasn’t that the ETFs would or wouldn’t quickly become strong and tradeable assets, but rather that they would be a gateway to short-term net inflows, and they haven’t lived up to bull case expectations here.

There has been a tendency here to ascribe all woes to GBTC, and specifically to firms stuck in the long-GBTC short-BTC ‘widowmaker trade’ from 2020. We think this is being overstated. As a refresher here, said trade involved larger firms borrowing spot BTC to create GBTC and therefore profit off the premium when they were able to sell the unlocked GBTC. The logic hence goes that redemptions are coming from parties who have been stuck long GBTC for the past 3 years, and are hence redeeming shares as fast as they can, with Grayscale forced to liquidate BTC every time to pay them back (since they can only be redeemed in cash).

We largely don’t think that this holds up. The idea that the initiators of said trade are largely still in the market is ludicrous; most exited (at a loss) in 2021 and 2022. There certainly were firms who bought discounted GBTC in anticipation of redemption over the last year (even unhedged), and we would expect to see consistent outflows via GBTC for a while yet as people cash in on said trade, but given that we’re still seeing net inflows overall, we don’t buy that GBTC alone is causing ETFs to drag massive net money out of the market. In any case, with APs seemingly able to process around $500m a day and Grayscale AUM having started at $29 billion, any influence here should only last for a month or so; at that point, discount on GBTC should go to zero (it was still at -1.18% on Friday 12th but is down to just 10-20 bps now) and redemptions should largely cease.

With that in mind, here are our general views over the coming weeks and months on BTC:

Short-term

As bearish as we have consistently been coming through and out of ETF approval, we do tend to think that there is a degree of relief coming in the next few days, precisely because of our view on what happened coming into it; this fundamentally feels like a demand-size shortage rather than a supply-side one, and as much as we felt the rally in December extended far beyond where it might be expected to in the median case, the conditions probably aren’t there for a sudden breakdown from current levels.

We have noted in the past that there has been a tendency for price to pivot off options expiry in either direction; with monthly expiry coming up on Friday, and with the tendency of the sort of money that was chasing ETF approval as a buy event to load up heavily on monthly options, we think that price action through Friday will probably be very telling of the month ahead. Our default case here is that we see a degree of stabilisation and possibly a small uptick over the weekend and into early next week. We should stress here that even if this does come through, we are talking about relatively limited upside potential (i.e. maybe to 43-44k on BTC and some overperformance on ETH) before we start to grind down again.

Medium-term

We would be very, very surprised if the levels over the weekend (high 38ks on BTC) ended up marking quarterly or annual lows. We will point out here that we did underestimate the overall strength of the market in November and December, and we expected said levels to end up marking basically the Q1 high rather than (for now) its low; regardless, a -20% drawdown would be getting off lightly in historical terms, and we do think that we will see a deeper albeit very slow drawdown that ultimately lands closer to the 31-33k level than anything else over the next two to three months.

When will markets start trending up again? We think there are two catalysts worth keeping an eye out for here. Bitcoin is again near another halving, due for some time in May; for those unfamiliar, BTC’s new issuance essentially works on a Zeno’s paradox level, wherein issuance rate is halved every four years so that it gets infinitely closer to the 21 million cap without ever reaching it. (In practice, this means new issuance goes to effectively 0 for all intents and purposes within a few more halvings, but that is a discussion for another time)

BTC price has generally rallied 6-12 months after halvings. In the early years, there is an argument to be made that the two may have been causally linked to some degree (i.e. a contraction of new supply coming onto the market from miners etc.); this has weakened somewhat as markets around BTC (especially non-spot) have evolved, and we will note that there were similarly between the 2020 halving and the ETF approval re: enthusiasm and anticipation in certain quarters, those in said quarters getting long in expectation of it being a catalysing event, and it ultimately disappointing in the short-term and price only moving significantly a couple of quarters down the line.

That is to say: we don’t think the halving is structurally significant for the market, but it can’t be ruled out entirely as an event that may grab attention and therefore inflows.

The other thing to watch for is conversion and approval of Ethereum spot ETFs. Grayscale have filed to convert their ETHE trust into a spot ETF, and several of the firms (including Blackrock) who filed successfully for spot BTC ETFs have done the same for ETH. Dates on this are still relatively murky, but estimates for potential approval here range from May to August (the latter being Blackrock’s final deadline on their current filing), though we will note that these aren’t hard deadlines due to the possibility of re-filing.

It is difficult to see how regulators in the US will be able to reject spot ETH ETFs after approving spot BTC ETFs given that almost everything is identical in terms of the exchanges and custodians servicing them, the availability of commodity ETH futures, and so on. That being said, there are possible lines of attack with regards to the size of ETH DeFi markets (being a vital part of the asset’s structure and being explicitly decentralised and unregulated), ETH’s proof-of-stake system meaning it can be claimed as a security or at least non-commodity (BTC’s proof-of-work has inured it against that), and so on; these would almost certainly not hold up in any lawsuit against the SEC, and we tend to think that the SEC will try to avoid a repeat on the embarassment that was the GBTC lawsuit, but it does need to be mentioned.

Anyway: conversely to both our BTC ETF call and the consensus we’ve seen among people who made similar calls, we think that ETH probably rallies on spot ETF approval (with BTC likely going along). Why? Firstly, insofar as GBTC has been a drag, we don’t think ETHE profiles out the same; the timeframes on the GBTC trade (i.e. starts to ramp up for creation in Q2 2020, first gains realised Q4 2020, firms repeat the trade in Q4 and get trapped in 2021) meant very few firms were willing or able to conduct basis-style ETHE trades (low timeframe before premiums started inverting and difficulty of finding ETH borrows). Additionally, while ETHE premium was much higher than GBTC, discount generally pegged quite closely to the much more liquid GBTC, and that combined with ETH’s underperformance over the last year or two should have prevented most naked or late discount trades. There will be outflows (especially if ETHE sticks at 150bps fees – we don’t think this is certain but it’s likely) but compared to the relative scale of the token markets it will be fewer per market cap than on GBTC.

Second, expectations matter. Enough people with enough money thought that the BTC ETFs would be catalysing, were long into it, and when that didn’t come to pass it basically necessitated a sell-off. We expect few to be long ETH going into a potential ETF as a result of that, and for early expectations for the success of said ETFs to be set so low that the actual results will be surprisingly positive on that basis near-regardless of what happens.

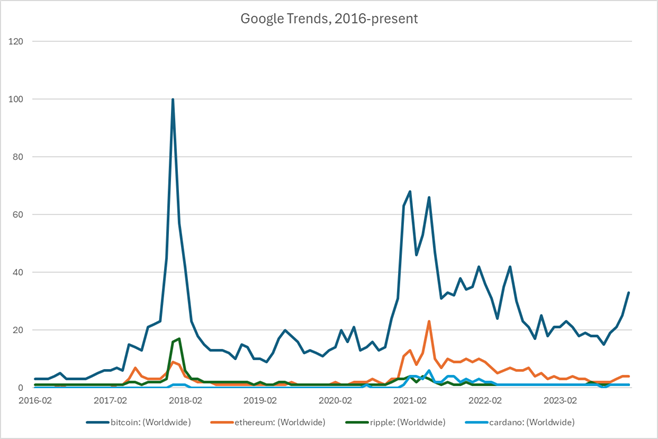

Third, mindshare. While BTC and ETH may be comparable in terms of market structure, exchange, custody, liquidity, and all of that, they are not comparable in terms of provenance or brand recognition. Bitcoin has been part of the cultural zeitgeist in most Western companies since probably 2013 or so; Ethereum has not, and if we take Google search data as a proxy for interest, we see that outside of a very brief moment in Q2 2021, it has barely made up any ground even in relative terms:

It is not the market access itself that matters here, but the publicity that ETF approval may bring to Ethereum as an asset. Our base case here for now would be modestly positive price action coming both in and out of the ETF, with ETH outperforming and BTC following during that; this would in turn set the stage for a stronger uptrend into Q4 for the market as a whole.

Our long-term view remains the same as ever: net positive in 2024, signs of a strong rally late in the year, breakthroughs on all-time highs on BTC and ETH in 2025, strongest beta in general on layer-2s and a handful of layer-1s that are particualrly successful in attaching themselves to ZK and scaling narratives (Solana, Monad, Sui, Worldcoin being the strongest candidates as it stands), and ultimately said rally probably being the last truly exponential one due to the lack of new worlds left to conquer for BTC in the long-term and ETH in the medium-term.