-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Where are We?

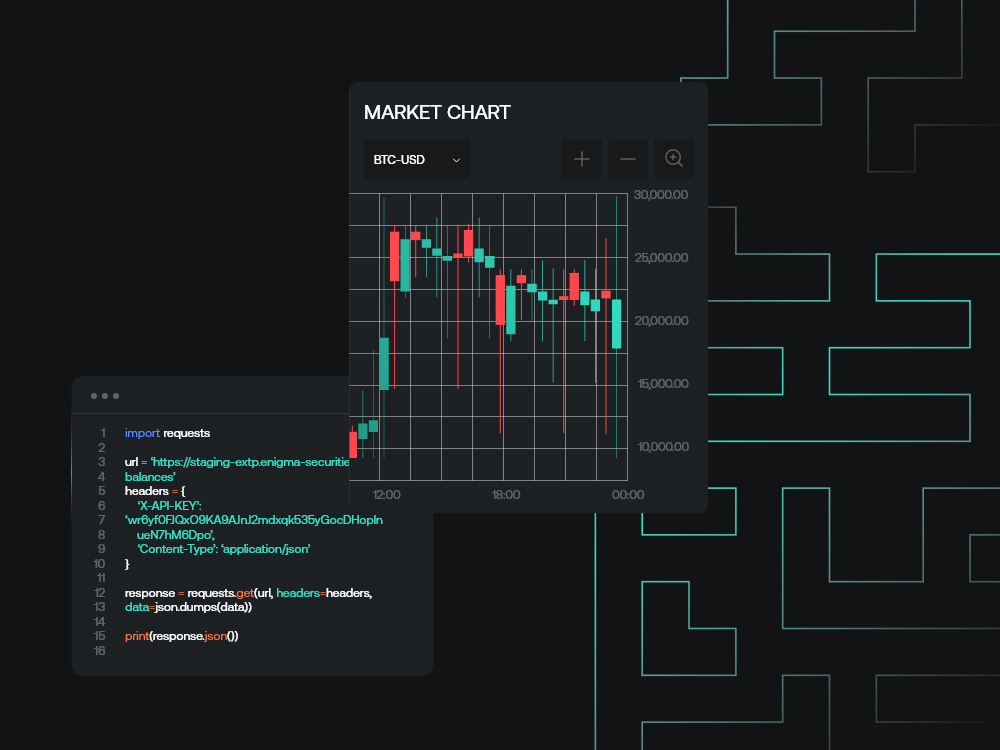

Though BTC prices support last week’s view that digital asset markets remain in a downward trending regime, macro and fundamentals suggest changes are in the wind. Sunday marked the lowest close in two years at $16.3k BTC. Though it ended the free-fall, last week continued a negative trend for BTC price.

Though BTC prices support last week’s view that digital asset markets remain in a downward trending regime, macro and fundamentals suggest changes are in the wind. Sunday marked the lowest close in two years at $16.3k BTC. Though it ended the free-fall, last week continued a negative trend for BTC price. Short term return trends moved up but remain below the long-term trend. Though prices could go marginally lower, we expect returns to incrementally climb in the short-term. Though prices support our view from last week that better entries lie ahead, returns suggest waiting has low utility.

Macro Catalysts

The US Fed released November FOMC minutes today to a second consecutive positive day for risk markets. The minutes listed signs of domestic and international economic weakness. Consumer and business spending growth decreased in October while energy costs rose across the world. They expected these conditions to put near-term GDP growth below trend and weaken inflation by balancing aggregate demand with supply.

The committee conveyed confidence that monetary and interest rate policies would be effective to reduce inflation. Jay Powell’s message from the meetings press conference echoed these sentiments with emphasis on the commitment to lower inflation.

Continuing and initial jobless claims today exceeded consensus expectations and the previous month’s levels to confirm slower US growth. Tighter financial conditions are slowing hiring, as designed. While equity returns caused concern over market expectations out of sync with the economy, merely stable inflation would be enough to ease recession expectations and stabilize growth expectations. Recognition that a soft landing could materialize may be enough to encourage risk-taking after last quarter’s sell-off. The macro picture is supportive for risk and digital assets.

Industry Catalysts

Genesis flirting with bankruptcy would shock markets again. However, every day they can resolve their liquidity and solvency issues out of court is positive for digital assets.

Fear of the Grayscale BTC holdings getting re-hypothecated, sold, or even Grayscale’s opacity have subsided. The FTX collapse proved no firm is beyond scrutiny. However, Coinbase is a publicly-traded firm with an audit and multiple SEC filings each year. They are as secure a custodian can be.

Fundamentals

Bitcoin 30D hash rate stalled at 262 PH/s today. From here, lower hash rate would be the final stage of miner capitulation and consolidation. Miners are likely to sell BTC holdings before machines to raise cash. The worst-performing miners sold BTC all summer as energy prices increased.

Stable hash rate would indicate consolidation and support long-term BTC mining growth. However, liquidated machines will not get turned on unless BTC price exceeds energy cost to mine it. The most efficient miners are profitable above $10k BTC, and potentially lower. One and two generation old machines are nearing breakeven at $15k BTC. After unprofitable miners closed operations this year, we expect miners to consolidate and build over the long term.