-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

SEC-Ripple: the good, the bad, and the ugly

The most important takeaway from the summary judgement was the ruling that XRP sales on-exchange – or, to use the term heard around the world, ‘programmatic sales’ – do not represent the sale of an investment contract.

This is crucial, because by now, the Ripple case isn’t really about XRP or Ripple anymore – the stakes have widened to the bulk of crypto assets overall – and the strictest bear case possible for the outcome here would have been essentially that XRP remains a security to this day, a decade on from its original sale, because of features of its genesis story.

Executive Summary

-

A court ruling on the SEC case against Ripple last week has generally been seen as a win for the industry.

-

The ruling states that XRP transactions through programmatic sales and airdrops did not constitute securities offerings, though institutional sales did.

-

While positive, we think the ruling opens up far more questions than answers.

The good: XRP is not a security

The most important takeaway from the summary judgement was the ruling that XRP sales on-exchange – or, to use the term heard around the world, ‘programmatic sales’ – do not represent the sale of an investment contract.

This is crucial, because by now, the Ripple case isn’t really about XRP or Ripple anymore – the stakes have widened to the bulk of crypto assets overall – and the strictest bear case possible for the outcome here would have been essentially that XRP remains a security to this day, a decade on from its original sale, because of features of its genesis story.

The reverberations throughout the space would have been severe there, because if we were to assign this sort of original sin to developed, mature assets in the space, very few would come out spotless. BTC and a few other fair launch PoW assets (LTC, BCH, and ironically, DOGE) would be above reproach, but even ETH – which did have a public ICO (in 2014) – would, by that logic, find themselves vulnerable to scrutiny.

Why does this matter? A year ago, it didn’t; but the approach of the Gensler administartion at the SEC has been so aggressive as to potentially bring what were widely assumed to be solved questions back into the grey. As we have written about a couple of times recently, the SEC cases against Coinbase and Binance among others have cast such a wide net for what may potentially be a security in crypto that it has given an odd sort of rebirth to anxieties last seen in 2018 or so.

XRP escaping its original sin is hence very good news for the industry in general – and, of course, it does matter just a little for XRP itself. In general, exchanges are loathe to delist anything that still has any sort of market for obvious reasons; when the XRP case came down in 2020, it was enough to force almost every onshore exchange in the United States to delist it near-immediately.

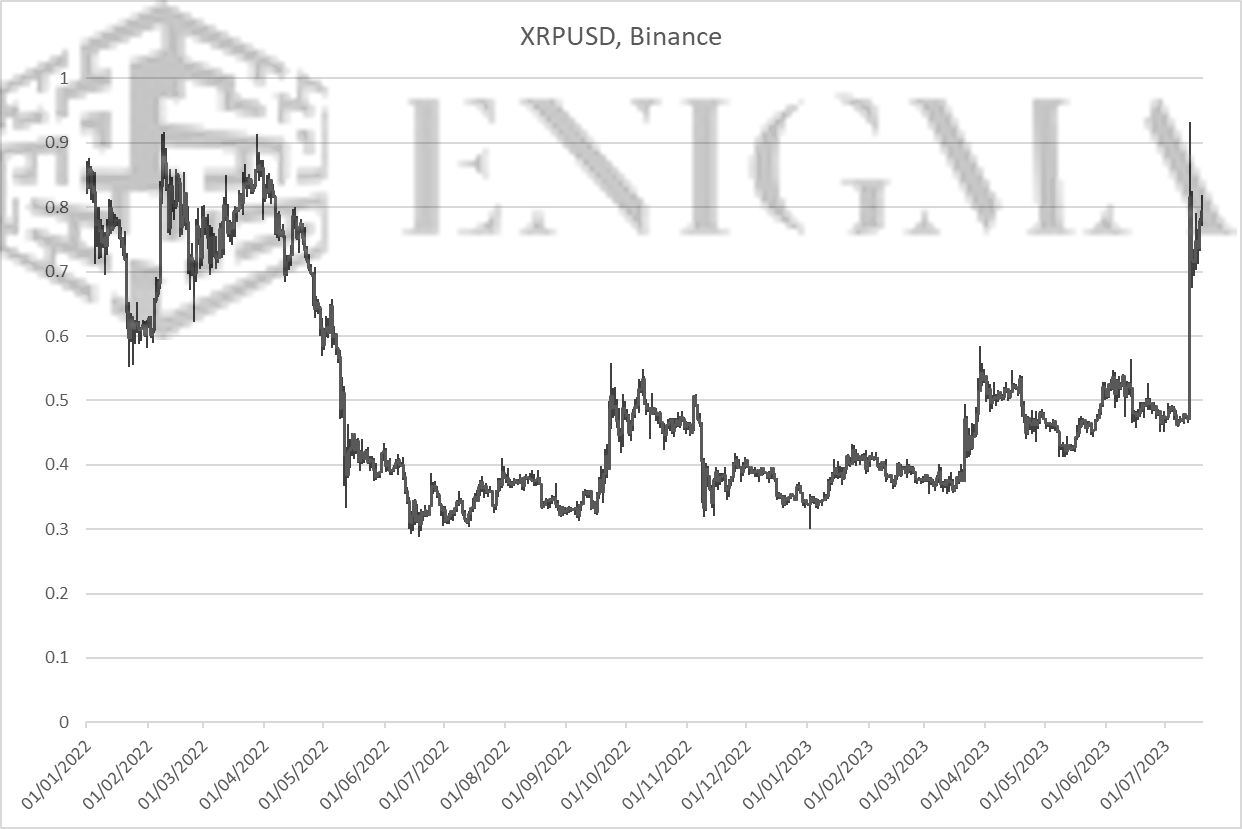

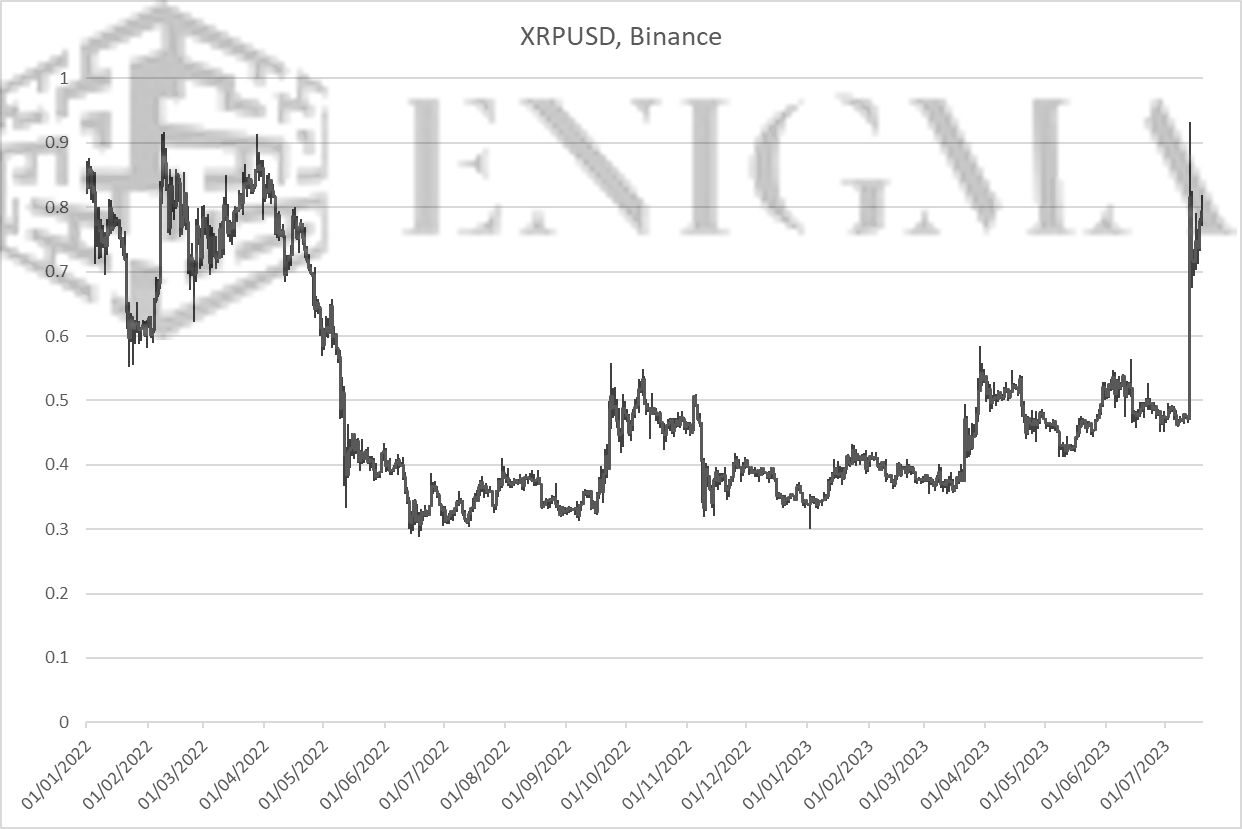

XRP has now been relisted on all three exchanges. XRP itself of course spiked significantly immediately after the news, and after some initial mean reversion has held steady at its highest levels since March 2022. While the long-term future of the asset remains murky for more fundamental reasons (utility, the need to pivot away from its payments/bank transfer model in the longer run, Flare Network’s weak launch and abysmal price and usage performance over first 6 months), XRP at least finds itself back in the top tier of assets with regards to broader market access.

The bad: XRP sales were a security

While the judgement held that programmatic sales (and airdrops) did not necessarily constitute sales of securities, it did hold that Ripple’s institutional sales were a security. For those unfamiliar with Ripple and XRP’s general business model: Ripple was as much of a success, and was as well-capitalised, as it was in the early days of the industry because it took a very aggressive approach towards selling large batches of premined tokens to larger firms, masking any investment intent with references to operations and utility (XRP having been marketed and intended as an international payments layer first and foremost at the time).

Ripple’s defense here was that these tokens were sold without any expectations or obligations of profit after the fact, and hence did not constitute a securities offering. While the court was willing to look past all the public and private statements that would seem to very clearly imply said expectations with regards to programmatic sales, the same was not held for those institutional sales, in essence because there was no real room for doubt over whether said statements were known to, and hence could have influenced, the buyers in question.

Ripple’s defense failing on this front was not particularly surprising; the precedent set in the Telegram Open Network (TON) case a few years ago made it very unlikely that they would ultimately be left off the hook on that, and in turn, this does unfortunately extend the story once again. The court’s decision here does seem to leave the door open for further SEC action against Ripple, and does not fully rule out potential avenues of attack against at least a handful of prominent mid- and large-cap assets in the ecosystem.

The ugly: This solves very little

The unfortunate truth here is that, while the kneejerk reaction to the Ripple case was extremely positive, this provides very little in the way of certainty going forward – perhaps one of the reasons why markets have generally stalled out over the last week after the initial wave of euphoria.

Yes, the departure of the grand sword of Damocles over 99% of the industry is good news. However, this doesn’t solve, or even particularly change precedent, with respects to the most acute threats to major assets. The likes of ETH and ADA have ultimately come back into the crosshairs on the basis of their proof-of-stake model and the ongoing securities implications of staking as a retail service (facilitated by exchanges or otherwise) – there were maybe four or five people on the planet decrying the original Ethereum ICO and any promises made in that period as the problem, and Gary Gensler was not one of them.

Even in the case of said ICOs, opinions are mixed over how much of a green light has ultimately been given by the judgement. There have been corners of the crypto internet that have fixated on the rebirth of the ICO with this judgement because of the element of programmatic sales not necessarily having the same standards applied with respects to assumed investor knowledge and disclosures, but this seems tenuous at best.

It is generally accurate to describe the judgement here as a win for crypto (and especially for exchanges; yes, the staking question remains unresolved, but the programmatic sales precedent is vital for protecting against regulatory attacks that increasingly seek to undermine all spot business). It is, in the net, certainly a positive, albeit already somewhat in line with expectations already set in-market (which raises some questions for another time over how dramatic the SEC-Grayscale judgement may end up being in terms of market structure), but while it may not quite create more questions than answers, it ends up not being far off. It will be interesting to see whether any new developments now occur in the general September/October annual glut period for regulary enforcement actions in the US.