-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Ethereum and the Shapella upgrade

We have to start here with something of an anti-climax: the Ethereum Shapella hard fork tonight is unlikely to either be a major short-term event or a significant medium-term catalyst for the asset in either direction.

Executive Summary

-

The Ethereum Shapella upgrade will take place on the evening of 12th April at epoch 194,048.

-

The upgrade will include EIP-4895, which will enable unstaking of the 18.1 million ETH currently committed to the Beacon Chain.

-

On the one hand, this will allow for essentially locked supply to be unlocked and sold; on the other hand, the ability to unstake as an option is crucial for broader adoption.

-

Our view: this likely plays out similarly to previous similar supply-side events. Minimal impact in the short-term, and that impact tilted negative; bullish for the medium and long-term.

We have to start here with something of an anti-climax: the Ethereum Shapella hard fork tonight is unlikely to either be a major short-term event or a significant medium-term catalyst for the asset in either direction. There is always a tendency with crypto to put too much emphasis on network events as heralding a new dawn or dusk for whatever asset is involved, and in practical terms, it’s rare that such prophecies pan out fully.

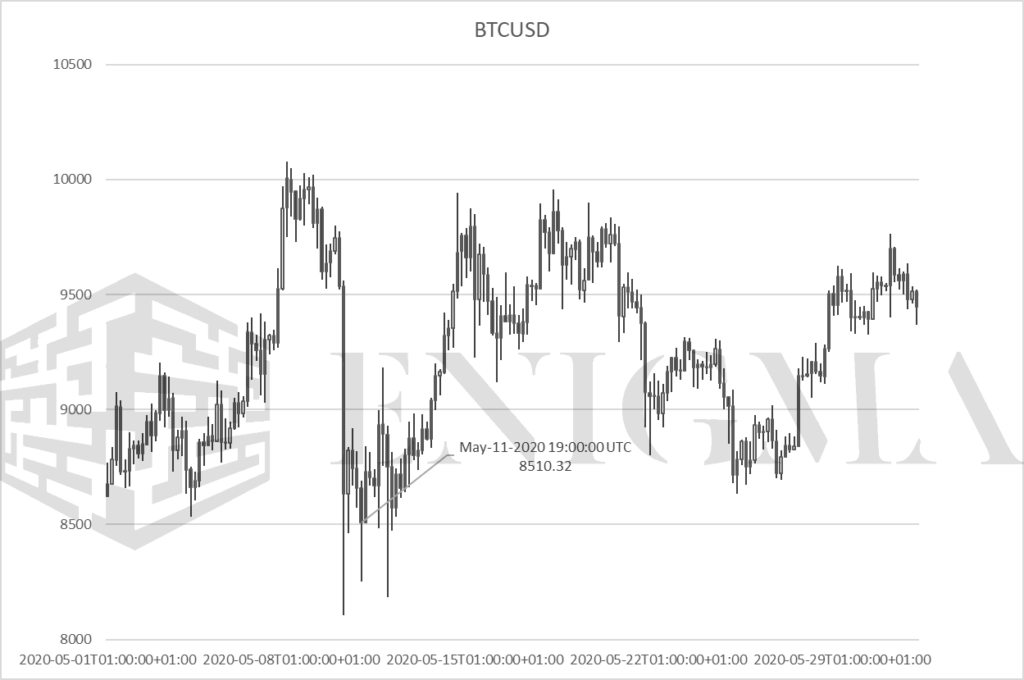

Two examples come to mind here. The first is Bitcoin’s halvings. As has been noted ad nauseam by now, there has seemingly been a cyclical correlation between the 4-year period between halvings and Bitcoin entering a period of exponential growth, most recently with BTC putting in lows in late 2018 and early 2019 at around the $3000 mark, entering the halving at a still-far-off-highs $10,000, and then rallying upwards to highs of $65,000 in 2021.

However, in spite of this, price action coming in and out of the halving was ultimately largely disappointing:

In fact, beyond May, we saw one of the most stagnant periods ever on BTC, even as ‘DeFi summer’ began to spark up in earnest in July. It has to be noted here that this was arguably the most scrutinised halving ever; it was the first where crypto had established itself beyond most reasonable doubts as an at least non-transient asset, and models like stock-to-flow (which modelled the effect of new supply on scarcity and price in similar terms to the likes of gold and silver) had put it very much in the view of larger players. There was a not-insignificant flow of calls from family offices and similar small asset managers coming into the event, calls which overwhelmingly would end up expiring worthless.

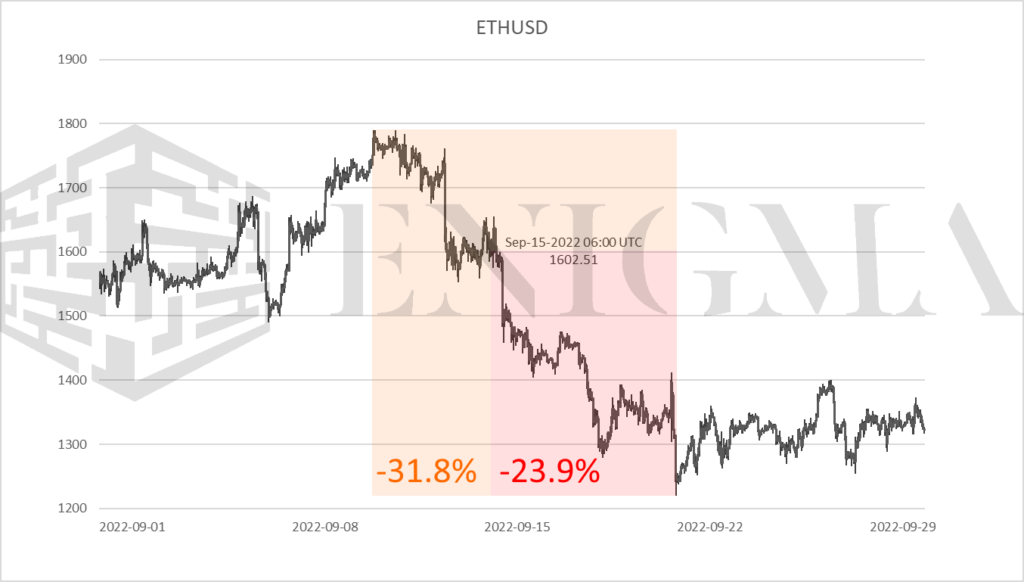

We saw similarly muted price action in the autumn with the implementation of the Ethereum Paris upgrade that moved the network over to proof-of-stake; while perhaps not as heralded as a short-term catalyst (the popular stock-to-flow models have very rapidly transitioned into becoming a laughing stock because of their $100,000+ projection for the current halving cycle), there was still some excitement around the event, and in the end price would actually see a small decline coming out of it.

The Shapella upgrade here is not quite the same beast, of course. Halvings and Paris both represent significant, fundamental shifts in the supply dynamic of the assets in question. There is a supply dimension to Shapella, but in most readings, it is a shorter-term one.

In the very early stages of consideration, the upgrade evokes a feeling of dread. Validators being able to unstake ETH, after all, means a potential release, and potential sale, of ETH that has effectively been kept out of circulation since the introduction of the beacon chain; and, while ETH may be significantly off its local lows of the last couple of years, most estimates have the average ‘buy-in’ (i.e. the price of the ETH when sent to beacon) at a higher price than now.

This has largely shifted away from being the consensus view, however. While liquid staking protocols have perhaps provided a measure of encouragement, ETH stakers for the most part are either true believers or in any case mid-term optimists on ETH as an asset; few on the fence would be willing to undergo the lockup involved, after all, which is part of the reason that (even with a proliferation of LSPs) staking rates for ETH remain barely in the double digits (compared to the 50-90% common on other PoS networks).

Ergo: there is no queue to get out of the door, and unlikely to be a glut of redemptions immediately after the upgrade. Indeed, in the medium-term, the ability to get out is more likely to tend to being structurally bullish than anything else, since it will likely lead to slightly more conservative money being tempted in. We tend to see this view as broadly correct; however, with that being said, we do think the pendulum has shifted a little too far the other way with respects to there being no short-term supply impact or shock. There will likely be some measure of selling over the next few weeks, and that combined with a broader outlook on crypto that leans unfavourable – lack of retail presence, markets consolidating underneath resistance levels, and more to come in the US with regards to regulatory hostility – leads us to think that things may play out similarly to Shapella with respects to at least a modest short-term drop-off. However, the longer-term outlook looks better, and the arrival of the upgrade much earlier than many expected may end up moving up timelines for a broader market resurgence earlier into Q4 of this year.