-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

On Ethereum supply and correlation

Bitcoin-Ethereum correlation has recently dropped to some of its lowest marks in several years. While that drop has been overrepresented, it does bring up an important discussion about Ethereum in particular in the ‘ultrasound money’ era.

Executive Summary

-

Bitcoin-Ethereum correlation has recently dropped to some of its lowest marks in several years.

-

While that drop has been overrepresented, it does bring up an important discussion about Ethereum in particular in the ‘ultrasound money’ era.

-

Ethereum supply since the merge in September has been deflationary, with that rate steepening due to increased fees in the last couple of months.

-

The proliferation of supply-side Ethereum narratives could be an important signal going forward for the start of any future bull market.

Every bear market tends to be defined, above all else, by grasping at straws. Any partnership, any on-chain activity (total addresses can never actually go down!), any potential speck of light is jumped upon as an example of how things are about to make a rapid change for the better.

One of the more amusing recent narratives we saw to that end was on BTC-ETH correlation. To quote Coindesk: “[The historical] positive relationship has weakened this year, signaling an impending regime change in the market.” Jubilation just around the corner! Bread and roses for everyone! The arguments made in the Coindesk piece and elsewhere mainly focus on the divergent supply regime of the two assets; Bitcoin has stuck with proof-of-work and continues to march Zeno’s paradox-like to 21 million total supply, while Ethereum’s move to proof-of-stake and the ‘ultrasound money’ regime promises something very different.

The headline is bunkum, but there are a few notes that feel worth making on supply and correlation at the current moment. Firstly, on Ethereum’s new monetary regime. It does have to be said that the supply situation post-PoS has been evolving in a little bit of an unexpected way. The aforementioned ‘ultrasound money’ was a memetic point conceived by Ethereum advocates as a contrast with Bitcoin’s ‘sound money’, and the argument went like this: yes, Bitcoin has a fixed supply and fixed inflation, but Ethereum post-PoS, while having a technically unbounded maximum supply, would in fact be a deflationary currency overall.

At the time, this seemed unlikely. To cut a long story about how issuance and burning works post-PoS, you need to maintain a relatively low staking rate and a very high fees regime for Ethereum to actually become deflationary; at the time of the burn merge, staked ETH was a low proportion of supply (around 12%), but fees were extremely low compared to recent history.

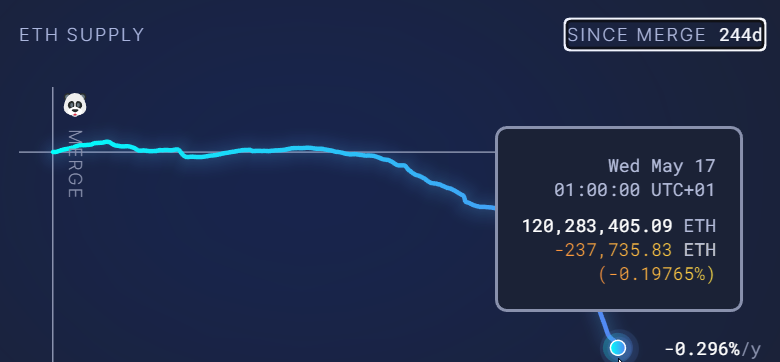

Fast forward a few months, and staked ETH has only increased modestly (to around 15%), and fees are extremely high. This has led to a situation where ETH has technically been actively and consistently deflationary since January, with a marked increase in that reduction over the last month or so:

Via ultrasound.money.

Now, this graph is a little misleading; ETH supply increased by around 2.7% in the year leading up to the merge, and is down -0.2% in the nine months since, so we are talking in practical terms here about something closer to a levelling out of supply; and, as mentioned, this is taking place in what is still likely to ultimately be an elevated fees environment compared to the mean or median, with the proliferation of coins like PEPE being the major driving force behind the fees surge over the last couple of months. (While new follies spring eternal, specific ones always do tend to have a short life overall).

Still – this sort of supply situation tends to get tongues wagging among institutional investors. We can peg a large part of Bitcoin’s rise in 2020 and 2021 to the success of the ‘digital gold’ narrative, and the proliferation in distinguished circles of models like stock-to-flow (even if that model looks like it at best grossly overreached).

It’s very possible that Ethereum is not as far off as one might think from a spell of overperformance, and that it could catalyse the next bull market ultimately. However, there are three key points to make here. The first is that the first demon that Ethereum will have to slay is its quietly uneasy position with US regulators; in particular, the attacks on retail staking platforms will be a major deterrent to the asset truly taking off, just as Bitcoin had to gain commodity status beyond all shadows of a shadow of a doubt in 2018-9.

The second is that it would be wiser this time around to understand the supply narrative is just that – a narrative, not a serious modellable question of fundamentals. We would say that it makes less sense to try to model for Ethereum’s supply than it did with Bitcoin back in the last cycle, which at least had a simple on-chain model and a relatively straightforward universe of sellers and buyers in practice. Crucially, even with liquid staking solutions enabling withdrawals and the advent of unstaking in general, the proliferation of DeFi and yield on-chain in Ethereum significantly softens how the supply dynamic works because even for speculators, it isn’t just a question of ‘buy’ or ‘sell’ in the same way.

Will headline deflation be good for ETH? Most likely, yes, but it will be good because it will provide an excuse for family office and frontier asset manager juniors to convince their seniors that it might be worth allocating here, in combination with the base layer yield, the more advanced yield strategies available, and so on. It won’t suddenly start driving price up any more than Bitcoin’s halvings ever have done in the overnight sense.

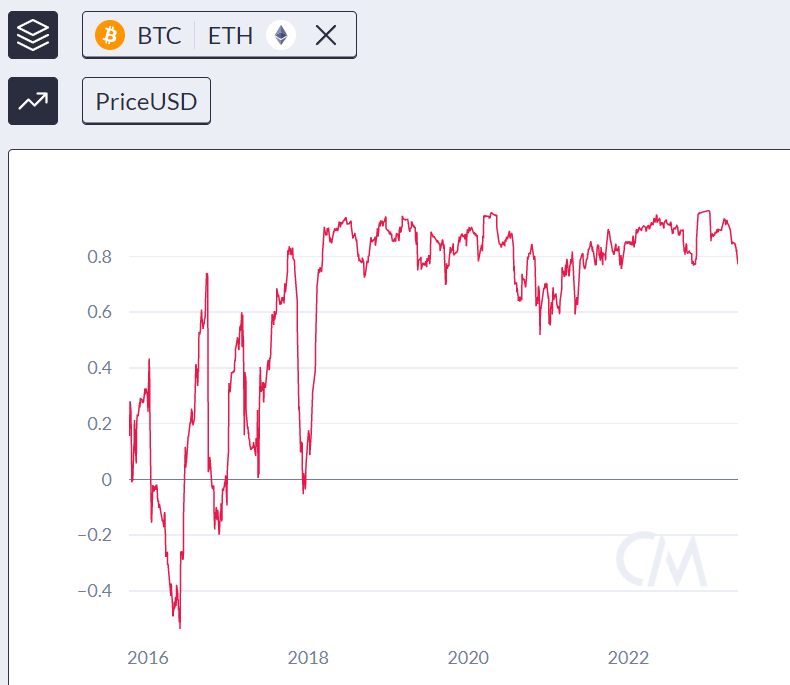

The third and final thing to note is that, despite the headlines, we have not seen anything really resembling decorrelation yet; not even close to it. ETHBTC remains glued to the lower end of the range it has occupied since June 2021 (at 0.067 at the time of writing). 30-day correlation data between the two does show a slight drop in correlation, but when we make sure to look at pre-2020 data, the fall-off is laughable:

Via Coinmetrics.

ETH may very well lead the next bull market, but it is hard to see a world in which BTC doesn’t follow closely behind, and the same will likely be true of all assets. Crypto is likely to remain undiversified within itself. This isn’t even a mark against it per se; it in a sense proves that it’s doing something right, with the industry as a whole still representing a futurist vision, and ultimately all assets being marked in terms of their future growth potential rather than their current cash flows or what-have-you. It is nonetheless important to go in, and stay in, with eyes open to that.