-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Ethena and the yield race

You know that a bull market is coming when you start seeing products pushed with increasingly obtuse financial engineering. This, we think, is a fair characterisation of the latest pseudo-stable in the form of Ethena’s USDe. Off the bat: we don’t think USDe is a particularly good product, and we don’t think it’s particularly likely to end well; nonetheless, we are going to talk about it because it has captured a significant amount of mindshare, and it is definitely at a level of complexity where it does need some explanation.

You know that a bull market is coming when you start seeing products pushed with increasingly obtuse financial engineering. This, we think, is a fair characterisation of the latest pseudo-stable in the form of Ethena’s USDe. Off the bat: we don’t think USDe is a particularly good product, and we don’t think it’s particularly likely to end well; nonetheless, we are going to talk about it because it has captured a significant amount of mindshare, and it is definitely at a level of complexity where it does need some explanation.

eUSD starts from the base point that users deposit stETH (i.e. a representation of ETH staked – and hence earning yield – by liquid staking provider Lido) and receive eUSD back. That stETH is then transferred to what Ethena calls a “Off Exchange Settlement provider” (this means a custodian – Ethena mentions three in its documentation currently), who are then partnered with exchanges in order to allow them to use that stETH as collateral for a short position on said exchanges on those assets. That short position is supposed to be a 1:1 for the value of the stETH staked.

What does this sum up to? Essentially, this ends up being a carry trade. Perpetuals markets funding tends to be positive (perpetual buyers more likely to express a positive view -> perps prices tend slightly higher -> funding rate is positive to fill the gap, longs pay shorts), therefore a short position on perps will tend to have positive carry.

Now: perpetuals funding (and indeed the existence of perpetuals as a hedging tool), and the ability to make use of that funding (and perpetuals in general), has seemed underutilised for a long time. Why? Numerous reasons, but we will focus on three. The first two are custody and counterparty risk. As much as there has always been clear distinction within the ranks of the offshore exchanges, trading on even the cleanest of them has always been a problem for an entity of any size. Ethena have reduced custody risk at least on the assets themselves (by holding the base assets through custodians that are permitted by the exchanges to keep collateral off-exchange – something, we will note, that has only started to take off outside of a small handful of venues in the last year); on paper, they have at least diversified counterparty risk across multiple venues, but if e.g. an exchange that they hold these perpetual contracts on tomorrow suddenly disappears, it would still represent potential material losses to the protocol (assuming that the short position was at a net positive).

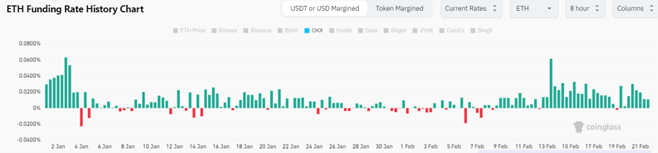

The third is that funding rate is not guaranteed and can go actively negative. This is not particularly common on CEXes, particularly on major assets on large venues, but it does happen; for instance, per Coinglass data, BTC funding on OKX has been negative on 25 windows so far this year, accounting for about 15% of all windows:

Ethena claims to have an insurance fund to pay those shortfalls, and in truth, we wouldn’t be particularly concerned about the possibility of persistent negative funding or anything along those lines. What we will note, however, is that this ends up summing to a far, far lower expected yield than Ethena advertises; 27% is the figure currently being given. A quick calculation would suggest that the ‘real’ yield should be around 14% – stETH is just over 3% and continues dropping (more ETH being staked = lower aggregate yields), and if we take the optimistic assumption that funding rates stick at the default for large-caps on the majority of unregulated major venues (Binance, BitMEX, Bybit all run as such), that would imply APYs of 1.0001^1095 = (1)11.6%. Of course, this could easily go lower, because if Ethena operated at enough scale, it would likely serve to persistently drive down funding rates on said venues.

We have seen analysis on Ethena so far fall into two basic camps. The first is to basically say “don’t worry about it, it’s a real structure and it’s not Terra”. The second is to compare it to Terra and write it off as the next great harbinger of ruin in the crypto space.

On the first: yes, this isn’t Terra. The grift with Terra was that Anchor’s 20% yield was being completely magicked out of thin air as a marketing tool, which is what made it vulnerable to the totalising collapse that ended up playing out. eUSD is far more in the functional, digitally-native DeFi playbook: we can see where the yield is coming from and the collateral structure behind it is reasonably transparent.

The potential problems with eUSD are far more in the vein of the traditional DeFi problems – a complex financial product sold as a simple one, yields that aren’t guaranteed and that are being drastically overstated coming out of the gate, unknown or obscure counterparties, and so on. We think Terra comparisons are simultaneously wrong, and more right than wrong for whoever is making them, in the sense that dismissing Ethena as something that may fail (and in dramatic fashion) is far more likely to end up being right than wrong at some point, should it end up taking off enough for anyone to remember that you said it in the first place. To put it basically, eUSD is unikely to fail catastrophically, but if something went wrong, it could easily fail with material losses (e.g. if a major counterparty went under with Ethena holding significant positive exposure on a short perp for instance, it would immediately become undercollateralised, even assuming that there was no hold on any of the funds that had been initially used as collateral for said short perp).

That, then, is Ethena and eUSD. The interesting thing for us about Ethena is not so much what it is, but what it represents – that being, an emblem of the desperate rush going on right now to make digital assets yield-bearing. We would argue that this largely started at the bottom of the bear with the focus on RWAs and the various attempts to steer risk-free yields into stablecoins and similar instruments, but there has been a pronounced swing back towards doing it on digitally native assets with projects like Ethena directly, and slightly more indirectly in terms of the riders on projects like Blast (the upcoming ETH L2 with rebasing stablecoin USDB) and Canto (working along similar lines with its native NOTE unit of account and with its push into RWAs after the fuel ran out on its initial more traditional DeFi/NFT push).

The interesting thing is that the experience of 2020 and 2021 tells us that, depending on one’s timing, projects built around these yields will tend to be both the greatest boons and greatest traps of the entire cycle. The ability to offer yields in a way that’s at least semi-transparent and semi-sustainable has capability greater than anything else to create market leaders in its own right. The problem is that when it goes bad, it goes bad in a way that’s harder to swallow compared to simpler trending assets, particularly as lockups become longer and longer and it becomes easier to have capital trapped at some level.

It’s possible that RWAs, and access to real-world yields in general, may help to break that cycle somewhat, particularly with how low these digitally-native yields have gotten; after all, if yield and interest is indeed an expression of risk on the underlying, 14% for counterparty risk on at least six exchanges and at least three custodians seems low, and seems particularly low if crypto’s RFR and lower-risk instruments are being driven upwards. We await with interest how both Ethena and Blast end up playing out over the next couple of months or so.