-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Bitcoin spot ETFs and fake news

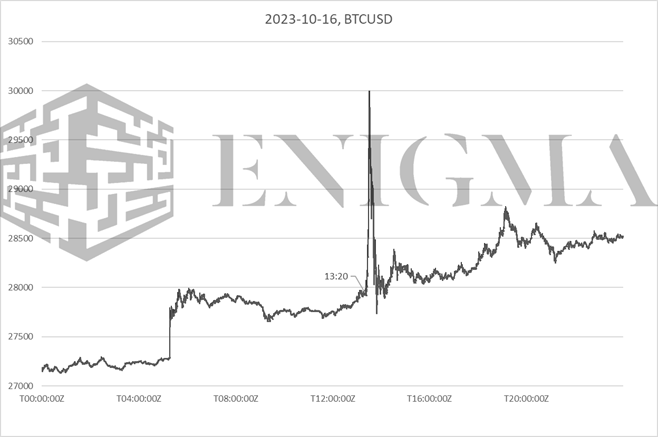

A fond farewell to the 2023 bullmarket, 16th October 2023-2023, 14:30 to 14:45 UTC. Markets ripped upwards briefly at the aforementioned point a couple of days ago on a very simple headline: “BREAKING: SEC APPROVES ISHARES SPOT BITCOIN ETF”.

In the wake of the news, BTC jumped into a double-digit gain on the day – but, while still ending the day positive, the euphoria was brief:

Executive Summary

-

Markets surged and then fell back on Monday on fake headlines about a Bitcoin spot ETF.

-

There has been extreme focus on the likelihood of approval of said ETFs over the last few months.

-

Our view: a regrettable incident that nonetheless shows how much importance the market is putting on the event.

A fond farewell to the 2023 bullmarket, 16th October 2023-2023, 13:30 to 13:45 UTC. Markets ripped upwards briefly at the aforementioned point a couple of days ago on a very simple headline: “BREAKING: SEC APPROVES ISHARES SPOT BITCOIN ETF”.

In the wake of the news, BTC jumped into a double-digit gain on the day – but, while still ending the day positive, the euphoria was brief:

We have written extensively about the spot ETF question over the last few months, but it seems a good opportunity here to present something of a primer on the topic as a whole – the background, the event, and the significance in the present and going forward.

What is it, and why does it matter?

Bitcoin spot ETFs are just as they sound – a exchange-traded fund/product (ETP is the more accurate term, but the two are used interchangeably), built on physical holdings of Bitcoin (hence the ‘spot’), and available on major US venues. The last part tends to be what trips people up the most; spot ETFs for Bitcoin exist in most major jurisdictions at this point outside of the US, and exist on OTC markets in the US (e.g. Grayscale’s trust funds), but not on the biggest venues.

The general thesis here is a comparison to gold. Gold is perceived as a store-of-value asset (the narrative on Bitcoin since 2017 having shifted along very similar lines), but saw only muted appeciation (and mostly lagged deflation) for most of the 30 years after the end of Bretton Woods; however, the launch of gold ETFs, and specifically the integration that allowed with the massive pools of capital available via US pensions and 401ks, allowed gold to start appreciating rapidly from around 2006 through 2012 (helped by the fallout of the 2008 GFC, but having recorded gains consistently throughout differing economic conditions with the exception of the apex of the crisis itself).

An US spot ETF for Bitcoin hence represents something of a final barrier in terms of market access for the asset. However, US regulators have always blocked said ETF on the grounds that acquiring the underlying instrument would require interfacing with unregulated venues that are vulnerable to exploitation, and that even regulated venues were ultimately at the whim of the aforementioned.

This had a shred of validity in 2017, but does not anymore; regulated venues have grown in terms of size and influence, and at this point are no more susceptible to price manipulation than oil markets are by the fact that rogue states can still find ways to sell their own produce. Additionally, the SEC has approved Bitcoin futures ETFs – that is, ETFs based on holding and rolling over monthly futures products – and even multi-strategy and Ethereum futures ETFs.

Said approvals have essentially stripped out any reasonable person’s capability to give validity to the SEC case, and earlier in the year, the SEC lost a lawsuit filed against it by Grayscale. Grayscale, as mentioned, offers spot trusts on the open market; however, because of the trust structure, it is unable to offer redemptions, and the Bitcoin trust has traded at a discount to NAV for around two years now because of that.

Grayscale have stated a desire to convert to an ETF with redemptions; the SEC have been blocking it on the grounds that it would constitute incorporation of a spot ETP by the back door. The court judgement essentially threw out the aforementioned ‘market manipulation’ blanket reasoning that the SEC has used to deny all spot ETF filings for Bitcoin, and while not directly opening the door for conversion, requires them at least to go back and find a different blanket line of reasoning – which seems unlikely to be possible given the futures ETF – or to deny all individual cases for individual reasons – which seems unlikely as an approach given what it would demand on an ongoing basis of the regulator.

The general thesis since arguments in the Grayscale scale were heard in the spring (in the course of which it became clear very quickly that the SEC’s blanket justification was being frowned upon) is that the regulators are likely to accept that they can no longer block spot ETFs, and are looking for an opportunity to make a tactical retreat on the question. BlackRock’s submission for a spot ETF initially filed in June – has been seen by most as the likely such point.

Why? Firstly, BlackRock specifically has only ever seen one ETF rejected, that being an attempt to create an actively-managed ETF a few years ago. Secondly, a clear concern of the regulator in both the spot ETF case and in general has been to avoid giving any one firm a first mover advantage. Immediate conversion would potentially do that for Grayscale despite the fund’s woes over the last couple of years. Instead, the general prediction has been that multiple ETFs will be approved essentially simultaneously. In line with that, almost every firm filing for a spot ETF re-filed in order to line up with BlackRock’s own deadlines.

It seems overwhelmingly likely at this point that a spot ETF will be approved; the only question is when. The current deadline for BlackRock and associated applications is, for final extension, March 2024, but could be moved up (early December being commonly cited as a possible range of dates).

Monday’s events

The news on Monday came after a development on Friday that was not particularly significant or unexpected, but did move the needle a little at least – the SEC decided not to appeal against the court judgement in the Grayscale case. While this neither guarantees conversion nor shuts the door to the SEC blocking Grayscale’s application (and other ETFs) on other grounds, it represents in essence a final defeat for the ‘spot markets are manipulatable’ argument as a blanket ban.

BTC was trending relatively positively throughout the weekend and into Monday, with a big hourly move at 4am UTC on Monday (i.e. at around midday Asian time) attracting some attention. This, it has to be said, probably did contribute to how the following events then played out.

At 13:21 UTC on Monday, crypto news outlet Cointelegraph sent out the following on social channels:

This immediately prompted something of a mad scramble to check the validity. Note that the message was formatted in a very similar manner to a Bloomberg terminal alert; it’s unclear if the message appeared on the terminal at some point (news wire services like Benzinga did pick it up a few minutes afterwards), but we do know that it did not originate from there.

After around 15 minutes, it was almost completely clear that the headline was backed by precisely nothing. Two sources were important here: first, the Bloomberg ETP team and in particular senior analyst Eric Balchunas, who have been very reliable on the beats of the spot ETP story over the last couple of years, quickly noted that it was unconfirmed and then unconfirmable. The second was Fox Business reporter Eleanor Terrett, who contacted and passed on a denial from the SEC at 13:41. Markets settled down by the end of the hour, largely giving up the spike itself but not the gains earlier in the day.

There is a natural knee jerk here to look at this and bring out the usual barrage of complaints about crypto. This seems unfair. False headlines and hyper-volatility happen all the time in all facets of global markets; crypto’s sin, if any, is just that its markets are large and liquid enough that everyone notices when it happens.

This isn’t unique to crypto markets. That being said, it of course isn’t the first time that this has happened in crypto markets – the most prominent case comes to mind was the September 2021 Walmart-Litecoin incident, where an unknown individual was able to get a news wire service to issue a press release under Walmart’s name, claiming to have integrated Litecoin as a form of payment at the megastore giant. The incident there swung LTC up and then down 30% in about the same time as BTC went up and then down 7% this time; maybe there is some solace to be had there with respects to Monday’s events.

As with the Litecoin example, figuring out the legitimacy here came down to figuring out sourcing. In the Litecoin case, the tell was that the press release was coming from a different wire firm than Walmart regularly use and with different contacts. In this case, it was the absence of any sourcing by Cointelegraph, and the immediate scepticism of those like Balchunas who have proven to be ahead of the curve consistently over the last few months.

It is not worth digging too much into the post-mortem of the event because a lot is still unclear, and there are better things for everyone to do with their mortal lifespans than listen to Cointelegraph’s terrible attempts at apologia, but the one part we will note here is that the source for this on Cointelegraph’s end was apparently a single user on a random Telegram channel who posted the headline a hour or so before as a joke. The most generous thing we can do here is to not attribute to malice what can be attributed to stupidity.

Why it happened and what’s next?

This does raise the question: if crypto has such a history with these things anyway, why did anyone buy the rumour here?

There are a few components to this. Price action on the day did support the possibility that there may be something being front-run, and while the Friday announcement again was unlikely to mean much, it did open the door theoretically to a sudden move like this. In addition, Cointelegraph (in spite of some extremely dubious connections) was not seen as a wholly unreliable source, being entrenched firmly in the second tier of native media outlets; this unfortunately contributed to something of an echo chamber effect where so many second- and lower-tier media sources picked it up that it then got onto more respectable newswire services before it had a chance to be nipped in the bud.

However, the biggest reason that it was able to happen – and move markets as it did – comes back to what we said to Reuters regarding the whole saga:

Crypto markets have been awaiting news on several pending spot bitcoin ETF applications, which, if approved, are widely expected to drive investment in the sector. The SEC has denied all spot bitcoin ETF applications on the grounds applicants have not shown they can protect investors from market manipulation.

“The move does show how monomaniacally obsessed the bitcoin market is with the coming spot ETFs,” said Joseph Edwards, head of research at London crypto firm Enigma Securities.

The reality is that the spot ETF is just about the only positive catalyst anywhere visible on the table for BTC in particular; we can argue differently for broader crypto markets, but for BTC, it’s just the spot ETF. Its importance cannot be understated, and as the price action here indicated, there is a lot of dry powder waiting to buy into it.

To be clear here: we don’t see said developments in quite the same way, and urge caution around the event itself (we tend to think that markets will spike significantly on the news but could easily then slip an indeterminate enough afterwards – the market access benefits here play out over 5 years, not 5 minutes or days).

Nonetheless, as we’ve been saying for months: the spot ETF is close to the only thing that matters for BTC in terms of positive catalysts, and remains important to stay aware of, particularly given that after all of this, the next headline that slips through is far more likely to be the real deal.