-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Roundup, August 2023

A weak month across the board, with both BTC and ETH returning negatively at -11%, and the month as a whole defined by just two days. The first was the 18th, which saw a plunge of -7% on both with lower wicks; this was confusing on the face of things because it came without any clear impetus, but as we have consistently said over the last few months, price has been tracking higher than sentiment or flows would suggest that it should, and some degree of correction was overdue.

Weekly Spotlights and Updates

Market outlook latest: structural stagnancy, August 9th

Discussed in our markets section.

CRV, Aave, and collateralisation, August 23rd

CRV hit a local top at 0.50 on August 29th, but has been down since, and currently trades at around 0.44. The nature of the buyers and the potential social ramifications means that it seems unlikely that we’d see panic selling or anything of the like below the OTC price of 0.40, and a bad debt cascade looks progressively less likely at this point short of CRV totally collapsing. We tend to expect some relative overperformance on certain oversold connected assets in the short-term, but this is still in the context of a weak market overall.

Grayscale verdict: what it means, and what’s next, August 30th

BTC price fell off quickly after the initial impulse, with markets in general following. Grayscale continue to push in all corridors possible for allowing a quick conversion as expected, but expectation here continues to be that no conversion will be forthcoming prior to a more generalised acceptance of spot ETFs. Extended deadlines continue to sit in March 2024 for the most part; we did see the early/provisional deadlines (which were due to expire in August) delayed only until October 16th-19th on most standing applications, but those dates are generally unlikely to be significant and expectations are that they will give way to further delays.

Markets

Bitcoin and Ethereum

A weak month across the board, with both BTC and ETH returning negatively at -11%, and the month as a whole defined by just two days. The first was the 18th, which saw a plunge of -7% on both with lower wicks; this was confusing on the face of things because it came without any clear impetus, but as we have consistently said over the last few months, price has been tracking higher than sentiment or flows would suggest that it should, and some degree of correction was overdue.

It specifically happening on the 18th did come with a reason, or rather a lack thereof – the 15th had been hyped up as a potential date for resolution on the long-running Grayscale-SEC lawsuit. This did not happen, but did in the end come through on the 29th, vacating the SEC’s denial and bringing the case back to review.

Markets jumped in the wake of the news, but quickly corrected, and at the time of writing are threatening new lows once again. It bears reiterating here that Grayscale achieving conversion (which they are still a long way off) is not the important thing here (and, on its own, could be argued to not necessarily even be bullish).

The question here is whether, given Grayscale’s success, regulators accept that they are fighting a losing battle over the spot-future ETP distinction, and allow spot ETPs to exist. In general, the same analysts who were first to bat in upgrading Grayscale’s chances on the lawsuit are touting this as a high-probability outcome.

For that, the dates to watch are the final deadlines on the multiple new ETP applications from non-native providers (particularly BlackRock); if a pivot is coming, expect it some time between December and March 2024.

We mentioned in late Q2 that Grayscale could be catalysing; the reaction to the Ripple win and the general dearth of demand in the market made it clear by the time that the process actually concluded that it wouldn’t play out that way. We should however stress that ETP approval should be a far stronger catalyst than Grayscale could have been, and that our view pivots bullish primarily based on whether and when that decision comes through.

In absence of that, we reiterate our general view that markets will continue to drift down, especially during September (which has always had extremely poor seasonality for both crypto and risk assets in general).

Mid- and small-caps

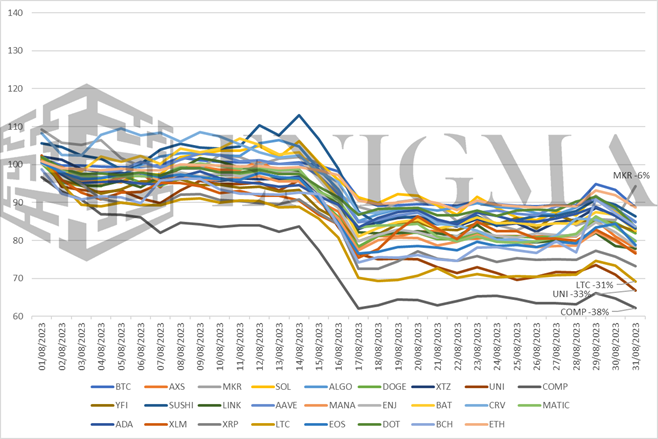

A poor month for mid-caps – as tends to be the case on any down month, essentially the entire field ended up underperforming to the downside, with just a single platform asset (MKR) showing any sort of upside vs. BTC and ETH.

Standouts on the month to the upside:

MKR – Maker saw a boost towards the end of the month with what seems to have been a front-running of a potential strategy shift from MakerDAO with what co-founder Rune Christensen proposed/announced on September 1st. It had already been stated that the intention of MakerDAO, on an indeterminate timeline, would be to build a new chain for “SubDAO tokenomics and MakerDAO governance security” – Christensen proposed that said chain should look to be a Solana fork, a not-particularly-subtle middle finger to Ethereum (with the ‘Ethereum community’ having something of a contentious relationship with MakerDAO as the latter has slowly pivoted away from Ethereum alignment over the last couple of years).

Standouts on the month to the downside:

COMP, UNI, CRV: While Maker has been buoyed, most DeFi bluechips have tracked to the downside, clearly and consequently due to the ongoing CRV saga (see our August 24th research for more details) – some of this comes down to concerns over direct exposure (e.g. AAVE), but most of it has simply represented a lack of confidence in the sector as a whole as TVLs continue to dwindle and regulatory status becomes less certain.

XRP, XLM, LTC: There has been little of note on any of the three mentioned assets over the last month, yet price has dropped more dramatically than for any others. Why? There are some minor specific points (e.g. Litecoin halving event being a pretty good point to get out of the game of mining Litecoin), but for the most part, as we’ve said for most of the summer: all three assets received outsized gains despite no real shifts on the fundamental ends simply because they had wide market access (or in the case of XRP renewed market access) – and as we’ve seen many times, particularly with LTC and BCH, this generally augurs things coming back down to Earth as soon as any air comes out of the market as a whole.