-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

On Worldcoin and odd ducks

24th July saw the much-anticipated mainnet launch of Worldcoin – one of the stranger and more controversial projects in existence even by the standards of the crypto space. Despite its notoriety among crypto natives, its launch revealed a surprising lack of broader recognition, with mainstream media tripping over itself to herald the ‘new’ project. With that in mind, it seems a good time to look at what Worldcoin was and is, and to discuss its status as not only a high-minded crypto project, but as a liquid asset, too.

Executive Summary

-

Worldcoin (WLD) came out of beta and opened trading on public markets on July 24th.

-

Early performance has been respectable, putting the token at a valuation of over $20bn.

-

Our view: short- and long-term bearish, but a strong bull case for the medium term.

24th July saw the much-anticipated mainnet launch of Worldcoin – one of the stranger and more controversial projects in existence even by the standards of the crypto space. Despite its notoriety among crypto natives, its launch revealed a surprising lack of broader recognition, with mainstream media tripping over itself to herald the ‘new’ project. With that in mind, it seems a good time to look at what Worldcoin was and is, and to discuss its status as not only a high-minded crypto project, but as a liquid asset, too.

Almost every report on Worldcoin opens with the OpenAI connection, and so shall we. While there seems to be something of an unspoken assumption that Worldcoin sprung out of OpenAI, or is at least connected to it, this is a misconception. Worldcoin and OpenAI share a founder in the form of Sam Altman, who spent most of the 2010s as a partner at startup accelerator YCombinator; when Altman finally left YC sometime in 2019-20 (after rising to company president), he transitioned into a role as full-time CEO of OpenAI (started as a non-profit in 2015 but had recently gone for-profit) but also held co-founder status with the newly announced, Andreessen Horowitz-backed Worldcoin.

OpenAI and Worldcoin, then, do not have a direct relationship outside of Altman. This is important to note, because the personal connection between the two might encourage one to see Worldcoin as relational or a proxy for AI exposure; there are some esoteric links between the bull cases for both, but for the most part, we tend to think that will not hold.

In any case, Worldcoin was from the start something of an odd duck within crypto. Like most of crypto, Worldcoin took a populist tack in its design and marketing – re-invention of the financial system, banking the unbanked, and all of the usual spin that was fuel for the fire in the 2017 bull market in particular and has persisted as an undercurrent for many to most coins to this day.

However, unlike said coins, Worldcoin took an aggressive, permissioned approach to distribution and operation. The headline pitch of Worldcoin was simple: each human would get the same amount of Worldcoin initially, no matter who they were, for free. While such an approach was always fraught with issues (ask the Russians how voucher privatization went in the 1990s), this in itself was not the issue that those in crypto generally took with what Worldcoin was proposing, particularly given that these proposals were coming out in the aftermath of the ICO boom and would in fact shortly precede an era in which airdrops became arguably one of the most important forms of initial distribution of new tokens.

The problem with Worldcoin was in how they proposed to do distribution. To evenly distribute Worldcoin, the company would need personal data for identity verification. Official documentation would defeat the point of the project, which meant that Worldcoin would have to go down the biometric route. The most non-obtrusive way of doing this, as it turned out, would be retina scans. Hence, the Worldcoin orb, a large but sufficiently mobile device to allow for Worldcoin employees and subcontractors to onboard people even in areas with extremely weak infrastructure, was born.

Reactions to the orb and Worldcoin’s project tended to range somewhere between cynicism and cries of dystopia. Biometric data being given to a for-profit for some tokens is, as the younger among us say, not a good look. The orbs were simultaneously Worldcoin’s greatest marketing tool – being paraded around every crypto conference that would let them in over the last 4 years – and one of its greatest burdens with respects to wider acceptance within the crypto community.

Now, to give a positive note here: there was a great degree of prescience with regards to where crypto was going to go in over the next few years in what Worldcoin was doing. Firstly, in terms of building Worldcoin as an ERC-20 rather than as an independent chain, which went from looking a little unambitious and silly in 2019, to genius in 2020, to a potential major error due to gas fees in 2021-2, and back to genius in 2023 as layer-2s developed (Worldcoin would end up migrating from the base layer to Optimism for its main operations).

Secondly, the issue of ‘proof of personhood’ for airdrops became a real consideration from around 2020 on in a way that had never been true in the past. The term ‘Sybil attack’ dates back to at least 2018, if not earlier, but sybilling as a verb and as an operation came about at some time in 2020, when the large-scale creation of new wallets and fake identities in order to farm potential airdrops became a full-on industry in itself (because the monetary value of said airdrops became significant, and because the increased strength of DeFi in general made them far easier to convert to real money).

There is an entire discussion to be had here over whether a constant focus on better distribution methodology for an asset that has to exist after that distribution is a worthwhile use of anyone’s time, but we will save that long and likely profane diatribe for another time. The biggest thing in Worldcoin’s favour was simply that it was always overwhelmingly likely to make it to launch. Its Series A raised $25m in 2021 with a diverse array of investors (given the timing, this did include both Alameda and Three Arrows Capital, which has been a minor point of contention given what we know now) and that crucial a16z backing, and while the long-term value in its onboarding methodology can be questioned, technically, it had onboarded a reported 2 million people – not a small number, especially by crypto standards.

In any case: Worldcoin is live. What now? We should first talk about valuations. The big headline statement here is that Worldcoin has launched at a FDV of over $20 billion – a huge number that is comparable to OpenAI itself, and one that would make it the 7th-biggest token and 5th-biggest non-stablecoin token by market cap.

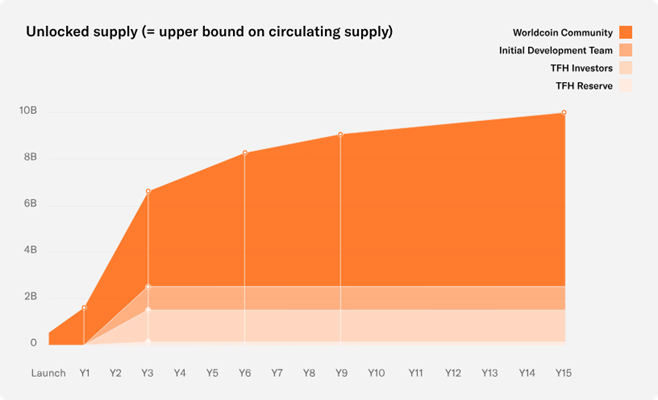

Yet, no trackers list it as such. CoinGecko puts it at around #130 depending on when you check in, with a market cap of around $260m. The Binance-owned CoinMarketCap ranks it a little higher but quotes the same number. Why? The problem here is float. Worldcoin have opted to float a maximum of just 500 million WLD tokens – 5% of supply – at launch, and in fact have stated that the real launch supply is 143 million tokens, with 100 million of that going to market makers and the other 43 million to early registrants.

This is a common approach in crypto. At its more benign, the intent here is to allow for a gradual distribution of tokens to discourage quick sales and to keep attention and interest in the project.

The problem is that the real logic behind such floats are rarely benign. If one has dabbled at any point in pink-sheet equities, then they will likely be familiar with the basic way in which these things play out – an extremely limited supply means limited liquidity, which inflates price and diluted valuation far beyond what would normally be expected – great for all involved in the short term, but almost always ending messily when significant supply and therefore selling pressure comes onto the market. In crypto, these extreme low-floats are heavily associated with the Solana ecosystem, and by extension Alameda and FTX.

This, then, is at least a yellow flag with regards to Worldcoin’s long-term prospects at its current valuation (particularly with no yield accumulation methodology planned). It is not quite a red flag, because the size and nature of crypto markets have actually meant that they have over the last few years been less susceptible to full-on sell waves than some more traditional instruments. Notably, Alameda’s approach with the aforementioned Solana tokens (which now tend to be down 95+%, but with that having come after and because of FTX’s collapse rather) was purported to be that they would hold the principal and sell the yield because markets would not support them selling the principal; it was, in fact, even more esoteric than that, with the firm instead taking out loan after loan with future tokens to be vested used as collateral. It seems unlikely that, even if they wanted to, Worldcoin could repeat the same with ‘locked’ WLD here because of their methodology.

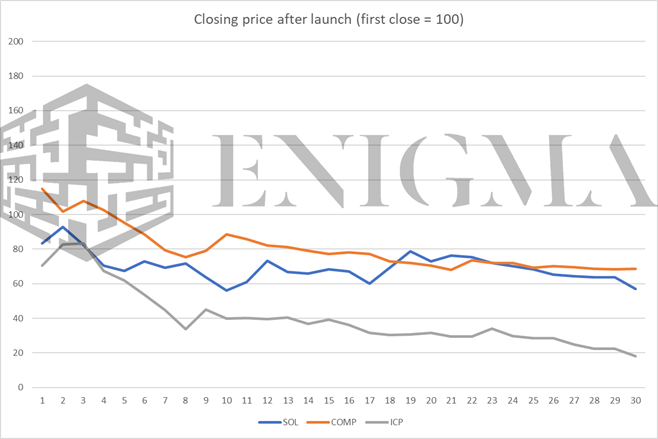

In the short-term, the first fortnight or so is important. Ignoring the nominal first-hour prints, WLD has held up decently in the first couple of days, opening at $2.70 on Monday, hitting lows of $1.90 overnight on Tuesday, and currently printing at around $2.40 at the time of writing. The experience we have tended to see in the past with regards to new or major listings is that the vast majority of new tokens will draw down in the first week or so, stabilise, and then move from there. To show three examples of how things can play out from there, here are SOL (April 2020), COMP (June 2020), and ICP (May 2021):

Most ‘serious’ tokens trail off from their open significantly over their first few weeks even if they end up being relatively successful in price terms down the line; few register quick and explosive growth throughout that time. We actually think that a quick break to the upside would paradoxically be one of the more bearish things for WLD’s medium-term prospects, because the precedent for long-term success following that sort of activity is extremely thin, and it would set a FDV figure so inflated that WLD would likely never be able to get out from under the stigma associated from it, no matter how slow its inflationary schedule could be adjusted to. An extreme contraction would also be a problem (sub-$1.30), but our base case here is that WLD draws down from current levels and then survives into medium-term and long-term price discovery.

We tend to think that WLD will be relatively successful in that said medium-term period (between around 3 and 9 months from launch); it hits the right notes in terms of narratives and personalities, and we tend to expect some fleshing-out of its UBI narrative in coming months which will drive further interest. A FDV of anywhere between $50bn and $90bn would seem a very attainable peak given available circulating supply and liquidity.

However, in the longer term, we do take a negative view. First, recall that distribution schedule; investors and developer tokens vest linearly over the course of the second and third year, and what we’ve seen in the past has been that even if said investors and developers don’t sell (possible and even likely with large swathes of both in this case – like AI, these are projects that tend to attract true believers even on the VC side), those who had accumulated prior to that point will be ready and willing to front-run them just in case.

The response will, of course, be ‘who’s going to sell?’, with reference once again to Worldcoin’s supposedly egalitarian distribution system. The answer, simply, is ‘those who bought’ – either those who bought the coin while live, or those who acquired significant commitments OTC before that. (There is a significant black market for the sale of Worldcoin scans across Asia and Africa, with estimates putting single Worldcoin identities at between $20 and $30). Distribution is not a panacea for accumulation.

The bigger problem is adoption. Worldcoin are pariahs among huge swathes of the crypto industry; the focus on biometrics, and the implications for privacy and anonymity, are too much for most to stomach for either ideological or practical reasons. This is a problem, because WLD is almost the dictionary definition of a token that will live and die by its partnerships – the big selling point of the Worldcoin app is to become a digital-human identity (the ‘proof-of-person’ concept), and this is an extremely partnership-reliant selling point.

The response to this generally centres around creating new mass markets for crypto – the ‘next billion users’ concept initially pioneered in the early 2010s with regards to web services in developing countries in general, and taken and ran with over the last four years or so by crypto advocates in a similar vein. (It is worth noting that Worldcoin is intended to be unavailable in the United States for regulatory reasons)

To us, this seems like a very tall task indeed given the need to battle with weak and localised network effects, the price of onboarding and function relative to wealth in those markets, the arguable failure of crypto to even reach mass adoption on an utility level anywhere in its most developed markets to this point, and so on. While not impossible, it does not seem to be the median case, to put it politely.

Just as the project itself is, WLD is likely to be one of the odder ducks in the market in general over the next few months. We would be tempted to go as far as to saw that it is likely to exhibit the sort of relatively low correlation that XRP and BNB did at points because it stands so far apart from the broader market, though this is tempered somewhat by it being on Ethereum and hence easy to trade and sell. In any case, though, it may be an early beneficiary of the overall positive trend we tend to expect to start towards the end of the year, and should be monitored carefully.