-

Share on Facebook

-

Share on Twitter

-

Share on LinkedIn

-

Copy link

Copied to clipboard

Roundup, May 2023

Work on Ordinals as a protocol has continued to take place – most notably with BRC-721E, a process for (one-way) bridging ERC-721 NFTs on Ethereum over to Bitcoin – and the congestion on May 10th did so far represent the peak of congestion…

Weekly Spotlights and Updates

Bitcoin and the ordinals dilemma, May 10th

Work on Ordinals as a protocol has continued to take place – most notably with BRC-721E, a process for (one-way) bridging ERC-721 NFTs on Ethereum over to Bitcoin – and the congestion on May 10th did so far represent the peak of congestion, but said congestion does remain elevated in historical terms (transactions priced at 12 sats/vB have in general been stuck in the pool for over a month now, which has not happened since roughly March 2021, and before that 2018). Overall enthusiasm for Ordinals is likely past its peak for now, which may not be the best thing with BTC threatening a break to the downside.

On Ethereum supply and correlation, May 17th

30-day correlation has seen a significant upturn over the last few weeks, as it often does; as we said, the notion that the two would become decoupled because of any supply-side feature is mostly bunk, and our point about PoS economic models not necessarily being a point of total benefit because of US regulators now looks regrettably prescient with what’s happened to Coinbase and Binance.

The case for FTX 2.0?, May 24th

Nothing substantially new yet. Regulatory action in the US, oddly, would seem to make the prospects for a FTX 2.0 better rather than worse; it seems that we are rapidly approaching a landscape where there will be no competitors within the region left.

Unlocks, FDV, and cliff-edges, May 31st

OP has outperformed since the unlock, up just under 5% at the time of writing while BTC/ETH are near-flat. SUI fell around 15% in one day on the 5th of June and prospects continue to look grim, now sitting at -19% since publication.

Markets

Bitcoin and Ethereum

A weak month for BTC and ETH, but one roughly in line with expectations; as we said last month, we had just about run up against the limits of the medium-term rally in resistance terms, and we didn’t see significant enough momentum behind the overall move up to justify any real hope of a breakout. The high for the month on BTC was all the way back on May 6th, and while we saw the odd promising day (28th May), on the whole action was flaccid. ETH saw very little independent action on the month, though ETHBTC did edge up somewhat to 0.069 at the close, essentially restoring it to its level prior to the downswing in late April.

A longer-form discussion of the situation re: the SEC cases against Binance and Coinbase is in the works, but the pertinent bullet points for now:

1) The case against Coinbase is much, much weaker than the case against Binance, but the level of cooperation and collaboration between federal and state regulators on the Coinbase case (e.g. 10 state regulators taking action against it immediately) inclines us to think that Coinbase is ultimately the real target here.

2) The avenues of attack on Coinbase with regards to claiming all staking represents a security and with regards to going after all possible tokens makes us think that the intent here is to create an essentially existential threat. There is no room on Coinbase’s end for concession without destroying all future business. Our inclination is that the SEC has overstepped in terms of providing a legally winnable case on the Coinbase side; the outcome of the Ripple case in the next few months will probably influence the decision on Coinbase’s end whether to fight or flight.

3) Losses coming through the indictment were relatively modest. The threats here suppress upwards momentum, but in terms of seeing substantial or new lows, we would need a structural/logistical failure that a lawsuit cannot deliver on its own. Potential catalysts for a downturn would likely centre around one or more tokens newly in the public crossfires of the SEC as a security, e.g. MATIC.

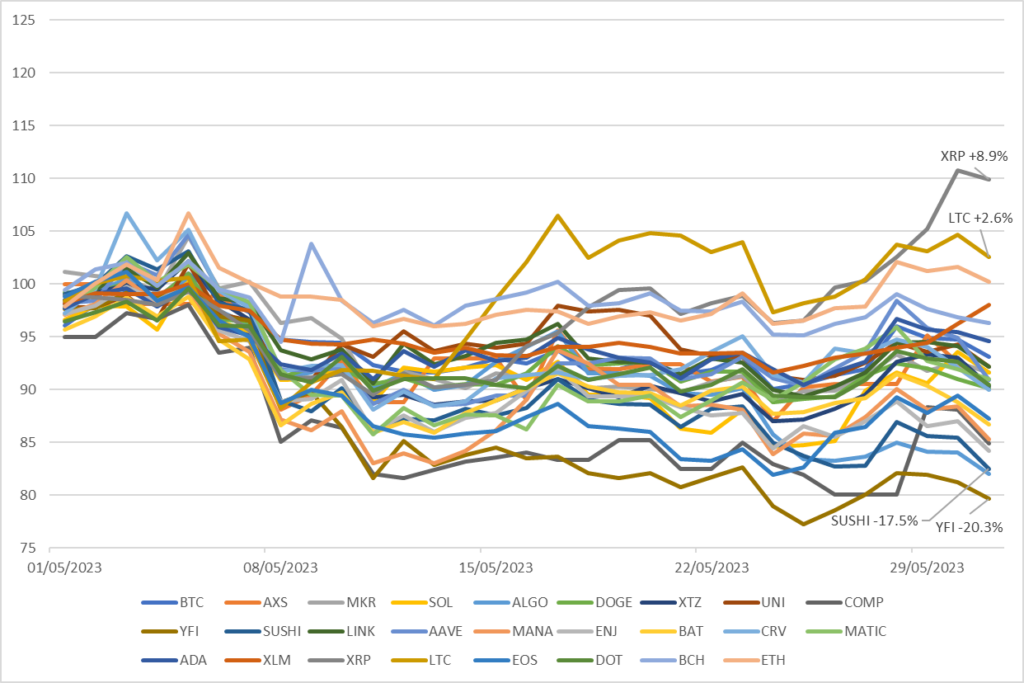

Mid- and small-caps

In general, a fairly weak month for alts, albeit with some unsuual outperformers to the upside; the trend there is worth paying attention to, because we tend to think that it will be a longer-lived one than most alts trends.

Standouts on the month to the upside:

XRP: Up 8% on the month and has extended gains further in early June, primarily due to being one of the few major coins excluded from the SEC’s briefs against Binance and Coinbase. We would caution against reading too far into this – it’s more likely that it’s been excluded because of a mixture of the active court case (regardless of its chances of success) and it not being available on Coinbase anyway – but it still does have a good chance of sustaining that outperformance in July and August after a correction.

LTC, BCH: LTC up 7% on the month; BCH was a slight underperformer vs ETH and a slight overperformer vs BTC at -4%. What unites the two, besides being legacy assets, is that both are proof-of-work; this has arguably been one of the reasons that they have escaped critique so far in the SEC filings, and we tend to think that PoW assets may end up seeing a period of subtle but sustained outperformance with how strong the messaging is against PoS almost as a concept (because of its yield-producing nature).

Standouts on the month to the downside:

ALGO, ADA, SOL: ALGO was at -18% in June and significantly extended losses in the first few days of July. ALGO is unusually weak because of the total destruction of its entire reason to be (staking layer-1 that had done things ‘the right way’ and was as close to Gensler as one could be), but in general alt-L1 losses will probably extend, especially with the threat of the staking tap being turned off – ADA in particular would be the major victim, with its growth over the last 4-5 years heavily driven by consumer staking. SOL will be the interesting one to watch; while we have repeatedly described Solana’s ecosystem as a Potemkin village and cast aspersions on its real usage, said usage is still higher than on its rivals; while grossly overvalued still in the current market context, it is worth keeping a close eye on, particularly if things turn to the worse for Polygon.COMP, MANA, YFI, SUSHI: DeFi blue chips continue their long-term retreat; we are inclined to think of SUSHI in particular as a slightly leading indicator of the market as a whole, given its deteriorating relationship with the SEC and hence that it will probably be a point of first reference with regards to any broader regulatory offensive into DeFi itself (rather than base layer tokens).